Medical Device Coating Market Growth Drivers and Forecast by 2028

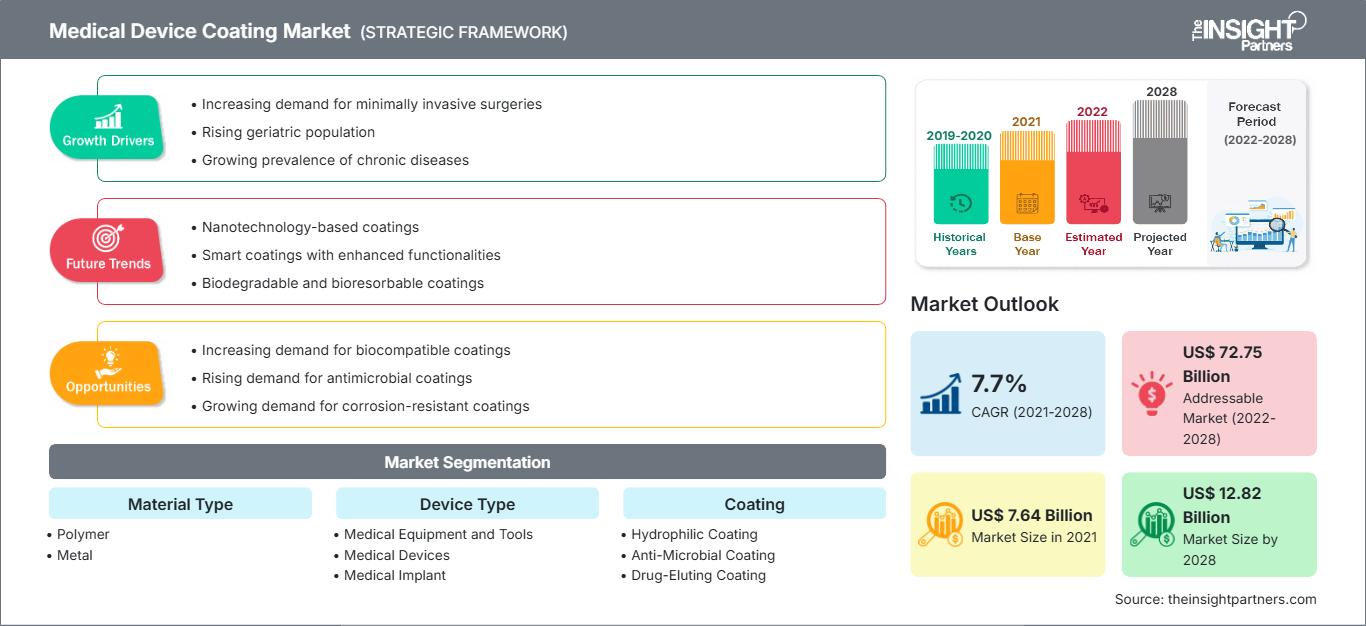

Medical Device Coating Market Forecast to 2028 - Analysis By Material Type (Polymer, Metal, and Others), Device Type (Medical Equipment and Tools, Medical Devices, Medical Implant, and Others), Coating (Hydrophilic Coating, Anti-Microbial Coating, Drug-Eluting Coating, Anti-Thrombogenic Coating, and Others), and Application (Infection Diseases, General Surgery, Orthopedic, Neurology, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Oct 2022

- Report Code : TIPRE00009272

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 280

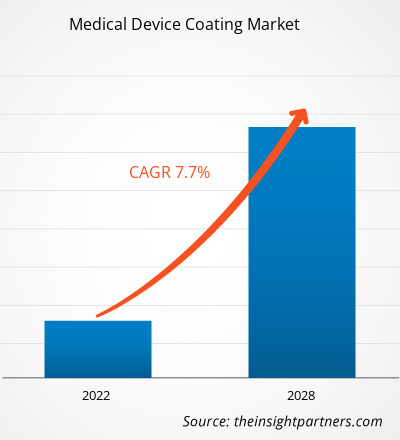

The global medical device coating market was expected to reach US$ 7,644.09 million in 2021 and it is estimated to grow at a CAGR of 7.7% from 2022 to 2028.

Rising demand for coated medical devices intended for surgical and diagnostic procedures drives the medical device coating market growth. Further, rising product launches and product developments would provide lucrative opportunities for the global market during the forecast period.

Medical devices are required for various invasive and minimally invasive surgical and diagnostic procedures including laparoscopy, biopsy, and endoscopy. Laparoscopic ureterolithotomy, a process of removing stones from the ureter, is performed using a laparoscope and catheters. The use of coated medical devices significantly reduces the time taken for cardiac and urinary catheterization. Coatings prevent infections during biopsy, excision, and cryotherapic diagnostic procedures where the contact between medical devices and body is integral. Besides, coated medical devices are significantly cost-effective. According to WHO, an estimated 2 million types of medical devices are categorized into more than 7,000 generic groups.

Disposable medical devices, such as cannulas, blades, anvils, triggers, diagnostic probes, and guide wires, need coatings for anti-infectious procedures and maneuverability improvement. The diagnosis and treatment of abdominal pain, kidney stones, varicose veins, and intestinal infections are increasing, demanding coated medical devices. As per the American Cancer Society, the number of carcinogenic cases is going to hit 27.5 million by 2040 leaping from the previous figure of 17.0 million in 2018. Such rising cases of diseases demanding medical devices for surgical procedures are propelling the growth of the medical device coating market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Device Coating Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The continuous research in medical device development offers new innovative coating varieties. Product innovation and strategic activities by key market players create ample opportunities to step in new application areas. A few product launches and developments in the market are as follows:

- In April 2022, BioInteractions, a UK-based biomaterial company, announced "TridAnt," a coating technology with active and passive components for creating a non-leaching, effective, safe, and durable antimicrobial coating for medical devices and implants.

- In January 2021, LipoCoat launched LipoCoat-enabled contact lenses to develop the first coated catheters in the global market.

- In July 2020, Sahajanand Medical Technologies (SMT) Pvt Ltd signed an agreement with the Italian government for a purchase entity with Consip spa-a society of Economy & Finance Ministry (CONSIP) delivering up to 40,000 biodegradable polymer-coated DES "Supraflex" stents.

- In August 2020, Hydromer partnered with N8 Medical to supply coatings to manufacture CeraShield endotracheal tubes. These tubes play a crucial role in the treatment of COVID-19 patients. This development exhibits the company's active involvement in the medical device coatings market.

- In February 2020, Biocoat launched HYDAK UV. The new version of its original HYDAK coating is designed to be cured using ultraviolet (UV) light. This coating allows for flexible integration with industry-standard UV coating systems.

Thus, the increasing medical device coating product launches and various organic and inorganic developments are expected to provide lucrative opportunities for the medical device coating market growth during the forecast period.

The complications associated with medical device coatings and frequent product recalls limit the overall medical device coating market growth. Medical device coatings are susceptible to peeling, flaking, or shedding, which may be potentially fatal in surgical procedures. According to the Food and Drug Administration (FDA), coating separation, which may include delamination or sloughing off or degradation, may adversely impact clinical performance and result in inflammation at the access site, pulmonary embolization, pulmonary infarct, myocardial embolization, myocardial infarct, embolic stroke, cerebral infarct, tissue necrosis, or death in worst scenarios. Furthermore, various studies published by National Center for Biotechnology Information (NCBI) in 2018, 2020, and 2022 revealed that it is common for the coating material to peel off from medical devices and travel through the bloodstream to areas where plastic particles can cause inflammation or block blood flow to critical organs.

As per FDA safety communication, ~500 medical device reports (MDRs) have listed cases of coatings that peeled, flaked, shed, delaminated, or sloughed off since 2014. Various manufacturers have had major recalls of medical devices due to coating delamination. Covidien (now part of Medtronic) issued a voluntary recall of 650 of its Pipeline embolization devices and Alligator retrieval devices after quality test revealed delamination. In 2019, the US FDA reported that Cook Medical recalled a needle used in heart surgery due to a potentially lethal manufacturing fault reported to be an error related to coatings. Such events highlighting the issues of dislodging and damaging vital organs due to coated devices are hampering the growth of the global medical device coating market.

Regional Overview

China is a well-developed country in Asia Pacific and has a well-established healthcare system. It is one of the leading producers of medical devices in the region. The country has an increasing burden of diseases such as obesity, cardiovascular disorders, and orthopedic disorders owing to the presence of a large geriatric population. As per the Lancet Public Health Journal 2020, China has experienced ~4 million deaths due to cardiovascular disorders. Additionally, the medical device coating market growth is attributed to the presence of a large geriatric population prone to orthopedic conditions and joint replacement procedures, a surge in number of surgical procedures, an increase in healthcare expenditure, and rise in investments in the development of advanced coatings to avoid healthcare-associated infections and surgical site infections.

The healthcare industry in China is proliferating, which subsequently helps in the medical device coatings market growth. According to China’s National Coating Industry Association (NCIA), had proposed and drafted the medical device coating standards that people's health concern has increased significantly, due to which medical device coated products with antiviral and antibacterial properties has gained the popularity among the Chinese population. As a result, the demand for antiviral and antibacterial coatings is expected to increase in the coming years, which would promote the overall growth of the medical device coating market during the forecast period.

Material Type Based Insights

Based on material type, the medical device coating market is segmented into polymer, metal, and others. The polymer segment is estimated to hold the largest market share and register the highest CAGR from 2022 to 2028. Medical devices are made of various biocompatible materials to prevent complications caused due to the material. These devices are further coated with different materials to avoid side effects, which enhances the overall recovery process of the patient. Polymer is one of the highly used biocompatible materials for different coating, which improves the overall efficiency of the medical devices. Polymers exhibit good biocompatibility and enables the drug delivery process that can modify and can be dissolved in the body over time. For instances, Polyelectrolyte multilayers is one of the highly used polymers in medical devices coatings owing to its biocompatible nature with wide applications, which provide numerous possibilities to create various surface coatings. These layers can also be modified as drug releasing coating with balanced pH and many more. Silicon, polyethylene, polystyrene, polyurethane, and polypropylene are a few types of polymer coatings available in the market. Thus, the aforementioned factors are likely to boost the medical device coating market growth for the polymer segment from 2022 to 2028.

Companies operating in the medical device coating market adopt the product innovation strategy to meet the evolving customer demands across the world, which also permits them to maintain their brand name in the market.

Medical Device Coating Market Regional InsightsThe regional trends and factors influencing the Medical Device Coating Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Medical Device Coating Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Medical Device Coating Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.64 Billion |

| Market Size by 2028 | US$ 12.82 Billion |

| Global CAGR (2021 - 2028) | 7.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Device Coating Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Device Coating Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Medical Device Coating Market top key players overview

Medical Device Coating Market – Segmentation

Based on material type, the medical device coating market is segmented into polymer, metal, and others. The polymer segment accounted for the largest market share in 2021 and is expected to register the highest CAGR from 2022 to 2028. Based on devices, the market is segmented into medical equipment and tools, medical implants, medical devices, and others. The medical equipment and tools segment led the market in 2021 and is expected to retain its dominance during the forecast period. Based on coatings, the market is segmented into hydrophilic coatings, antimicrobial coatings, drug-eluting coatings, anti-thrombogenic coatings, and others. The hydrophilic coating segment led the market in 2021 and is expected to retain its dominance during the forecast period. Based on application, the medical device coating market is segmented into infectious diseases, neurology, orthopedics, general surgery, and others. Based on geography, the market is primarily segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Company Profiles

- Koninklijke DSM NV

- Hydromer Inc.

- Surmodics Inc

- Biocoat Inc

- AST Products Inc

- Covalon Technologies Ltd

- Harland Medical Systems Inc

- Precision Coating Company Inc

- Kisco Ltd.

- Formacoat LLC.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For