Monoclonal Antibody Therapeutics (mABs) Market Trends and Analysis by 2031

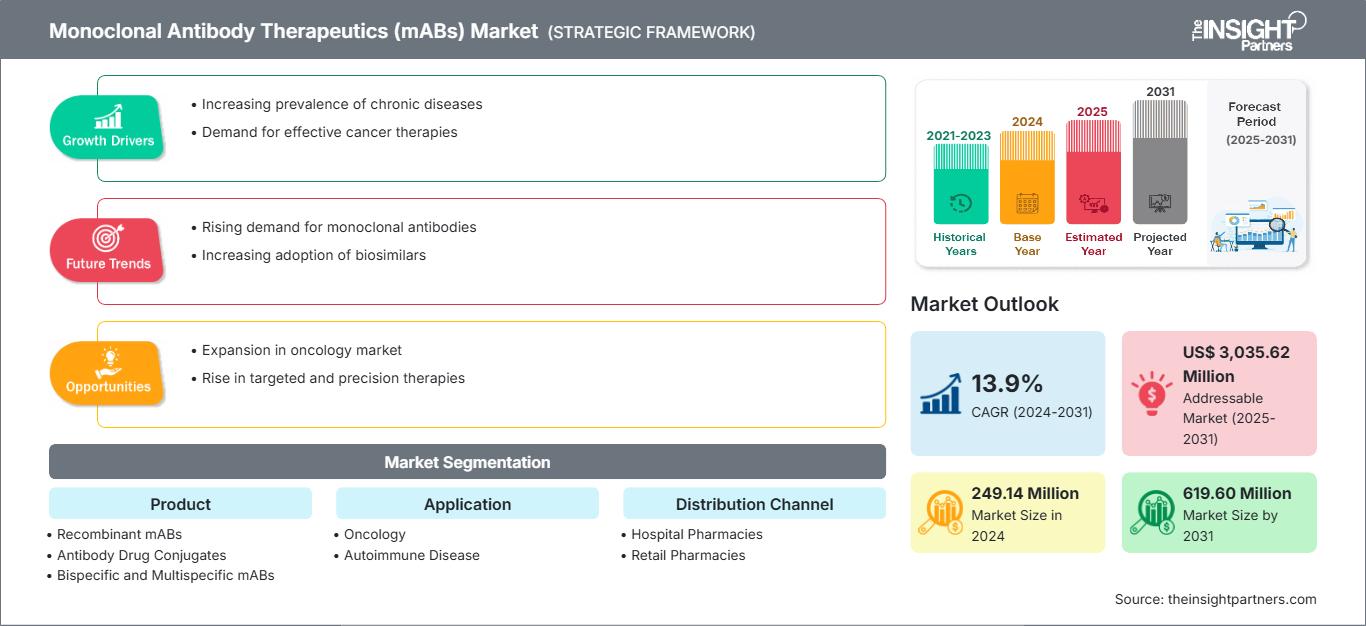

Monoclonal Antibody Therapeutics (mABs) Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Recombinant mABs, Antibody Drug Conjugates, Bispecific and Multispecific mABs, Biosimilars, and Others), Application (Oncology, Autoimmune Disease, and Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2026

- Report Code : TIPRE00003417

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

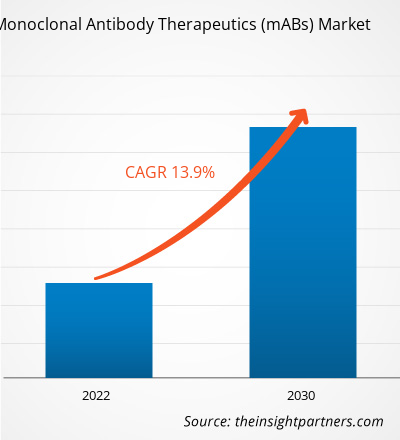

The monoclonal antibody therapeutics (mABs) market size is projected to grow from US$ 249.14 million in 2024 to US$ 619.6 million by 2031; the market is estimated to record a CAGR of 13.9% during 2025–2031.

Market Insights and Analyst View:

Robust research and development and the increasing in prevalence of chronic diseases are likely to have a significant impact on the monoclonal antibody therapeutics (mABs) market forecast in the next few years

A monoclonal antibody (mAbs) drug is a homogenous collection of antibodies having specificity toward selected target antigens. The production process of therapeutic mAbs requires a mammalian expression system offering the cell machinery essential to glycosylate, fold, orient, and covalently bind antibody peptide chains to produce complete and biologically functional molecules. New modality antibodies such as bispecific and trispecific antibodies recognize multiple epitopes on a single antigen, while single-domain antibodies can penetrate tissues with greater ease. Such advanced antibody types can enhance the efficiency of the antibody therapeutics, thereby expanding their application areas. These antibodies can also form antibody–drug conjugates to improve the efficiency of chemotherapy agents in targeting specific cell types. Production of mAB-based drugs to treat several diseases propel the market development. Innovative product launches through strategic developments by the manufacturers act as lucrative market opportunities. Furthermore, combination drugs containing mABs acts as a market trend for mAbs therapeutic market.

Market Driver

Production of mAB-Based Drugs to Treat Several Diseases Drives Market Growth

Monoclonal antibody therapeutics (mABs) are employed to treat a wide range of diseases, including cancer, autoimmune diseases, and metabolic diseases. Such drugs produced by biopharmaceutical companies and scientific research institutes have gained significant attention in the global market due to their high specificity, strong targeting ability, and low toxicity and side effects. Thus, an increase in the production capabilities of mAB therapeutics is anticipated to drive the monoclonal antibody therapeutics (mABs) market growth

Therapeutic mABs Approved in European Union (EU) and US

Products |

Brand Name |

Disease Indication |

Approval Year: EU |

Approval Year: US |

|

Pozelimab |

VEOPOZ |

CHAPLE disease |

NA |

2023 |

|

Elranatamab |

Elrexfio |

Multiple myeloma |

2023 |

2023 |

|

Rozanolixizumab |

RYSTIGGO |

Generalized myasthenia gravis |

2024 |

2023 |

|

Talquetamab |

TALVEY |

Multiple myeloma |

2023 |

2023 |

|

Epcoritamab |

EPKINLY |

Diffuse large B-cell lymphoma |

2023 |

2023 |

|

Mirikizumab |

Omvoh |

Ulcerative colitis |

2023 |

2023 |

Source: Antibody Society

Market Opportunity

Innovative Product Launches Through Strategic Developments by Manufacturers

Organic developments such as product launches by the manufacturers of therapeutic mABs are likely to bolster the monoclonal antibody therapeutics (mABs) market in the coming years. In March 2022, Adagio Therapeutics, Inc. announced the launch of ADG20 (ADINTREVIMAB). The newly launched product is the first monoclonal antibody to meet primary endpoints with statistical significance across pre-and post-exposure prophylaxis and treatment for COVID-19 by seeking US Emergency Use Authorization (EUA).

Further, inorganic developments such as mergers and acquisitions would result in the introduction of new therapeutic mABs. For instance, in July 2023, Elli Lilly announced the acquisition of Versanis, a private clinical-stage biopharmaceutical company intended to treat cardiometabolic diseases. Elli Lilly acquired Versanis to access its core product portfolio, including a monoclonal antibody product named bimagrumab. This product is currently being assessed in the "BELIEVE Phase 2b study" as a standalone molecule. It is also being studied in combination with semaglutide for its combined potential to reduce fat mass, preserve muscle mass, and deliver better patient outcomes in people living with obesity and obesity-related complications. The aforementioned factors are responsible for influential monoclonal antibody therapeutics (mABs) market growth in the coming years.

Monoclonal Antibody Therapeutics (mABs) Market Trends

Combination Drugs Containing Monoclonal Antibodies (mABs)

According to the National Institute of Health (NIH) 2021 report, Roche and Regeneron (pharmaceutical companies) initiated the clinical trial phase 2/3 to evaluate combinational monoclonal antibodies for patients suffering from mild to moderate COVID-19. They are investigating "REGN-COV2," a cocktail drug produced by combining two monoclonal antibodies—casirivimab and imdevimab—for the treatment of COVID-19. These companies expect that the combination of this mAB drug would reduce hospitalization by 70%, and it would be more effective on children above 12 years (having a body weight of more than 40 kg). Researchers are strongly looking for more such therapeutic combinations of monoclonal antibodies. For example, bamlanivimab and etesivimab developed by Elli Lilly have shown positive clinical results for COVID-19 in 2022. Therefore, combination drugs of monoclonal antibodies to treat several diseases would gain significant attention in the coming years, thus emerging as a prominent trend in the monoclonal antibody therapeutics (mABs) market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMonoclonal Antibody Therapeutics (mABs) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The monoclonal antibody therapeutics (mABs) market analysis has been carried out by considering the following segments: product, application, and distribution channel

The market, based on product, is segregated as recombinant mABs, antibody–drug conjugates, bispecific and multispecific mABs, biosimilars, and others. The monoclonal antibody therapeutics (mABs) market, by application, is segmented into oncology, autoimmune diseases, and others. The market for autoimmune diseases is further segmented as rheumatoid arthritis, psoriasis, ulcerative colitis, and others. The monoclonal antibody therapeutics (mABs) market, based on distribution channel, is segmented into hospital pharmacies, retail pharmacies, and others.

In terms of product, the recombinant mABs segment held the largest monoclonal antibody therapeutics (mABs) market share in 2022. The antibody–drug conjugates segment is anticipated to record the fastest CAGR of 18.5% during the forecast period. According to the ACS Publications report, therapeutic recombinant monoclonal antibodies reflect state-of-the-art biomedical research conducted by planning effective strategies to treat a wide range of diseases for which no effective treatment is available. Tocilizumab is an example of a recombinant mAB drug administered to treat arthritis, idiopathic arthritis, and rheumatoid arthritis (RA). Additionally, recombinant mABs can also be used to treat diseases such as autoimmune diseases and cancer. Bevacizumab is an example of a recombinant mAB currently used to treat breast, lung, and colorectal cancer; HIV-1; bacterial toxins infections/reactions, and SARS-CoV-2 and ebola virus infections.

Antibody-drug conjugates (ADC) are a rapidly emerging class of therapeutic agents and a new emerging class of highly potent pharmaceutical drugs exploiting a combination of chemotherapy and immunotherapy. According to a report by the NIH, currently, ADCs are predominantly based on immunoglobulin G (IgG), and till now, 13 ADCs have been approved by the US Food and Drug Administration (FDA). Further, more than 90 ADCs are under clinical development/trials.

Sr. No. |

Product (Approved ADCs) |

Disease Indication |

|

1 |

Mylotarg |

Relapsed acute myelogenous leukemia |

|

2 |

Adcetris |

Relapsed Hodgkin lymphoma and relapsed systemic anaplastic large cell lymphomas |

|

3 |

Kadcyla |

HER2-positive metastatic breast cancer |

|

4 |

Besponsa |

Relapsed or refractory CD22-positive B-cell precursor acute lymphoblastic leukemia |

|

5 |

Lumoxiti |

Relapsed or refractory hairy cell leukemia or HCL |

|

6 |

Polivy |

Relapsed or refractory (R/R) diffuse large B-cell lymphoma or DLBCL |

|

7 |

Padcev |

Metastatic urothelial cancer |

|

8 |

Enhertu |

Metastatic HER2-positive breast cancer |

|

9 |

Trodelvy |

Metastatic triple-negative breast cancer |

|

10 |

Blenrep |

Relapsed or refractory multiple myeloma |

|

11 |

Zynlota |

Large B-cell lymphoma |

|

12 |

Tivdak |

Recurrent or metastatic cervical cancer therapy |

|

13 |

Elahere |

Platinum-resistant ovarian cancer |

Source: Single Use Support Article

Therefore, regulatory approvals of ADCs and ongoing clinical trials for treatment approaches for rare diseases boost the growth of the monoclonal antibody therapeutics (mABs) market for the antibody–drug conjugates segment during the forecast period.

Regional Analysis:

Based on geography, the Monoclonal Antibody Therapeutics (mABs) market report covers North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In 2022, North America accounted for the largest global monoclonal antibody therapeutics (mABs) market share. Asia Pacific is expected to register the highest CAGR during 2022–2030. In North America, the US accounts for the largest market share. Accelerated product approval procedures for mABs therapeutics benefit the market in this country. Until December 2019, 79 therapeutic mABs were approved by the US FDA according to the statistics revealed by a study published in the BioMed Central journal. Among 79 therapeutic mABs, 30 are intended for cancer treatment. In May 2021, the FDA announced authorized EUA for the use of a new therapeutic mAB—Sotrovimab—intended for outpatient applications to treat people suffering from severe COVID-19 condition. In February 2022, the FDA announced the issuing of EUA for bebtelovimab produced by Elli Lilly and Company, an example of mAB intended against the Omicron variant. Further, etesevimab is also an example of therapeutic mABs approved by the US FDA.

Monoclonal Antibody Therapeutics (mABs) Market Regional InsightsThe regional trends and factors influencing the Monoclonal Antibody Therapeutics (mABs) Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Monoclonal Antibody Therapeutics (mABs) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Monoclonal Antibody Therapeutics (mABs) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | 249.14 Million |

| Market Size by 2031 | 619.60 Million |

| Global CAGR (2024 - 2031) | 13.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Monoclonal Antibody Therapeutics (mABs) Market Players Density: Understanding Its Impact on Business Dynamics

The Monoclonal Antibody Therapeutics (mABs) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Monoclonal Antibody Therapeutics (mABs) Market top key players overview

Monoclonal antibody therapeutics (mABs) Industry Developments and Future Opportunities:

Various strategic developments by leading players operating in the monoclonal antibody therapeutics (mABs) market are listed below:

- In January 2023, AstraZeneca received approval for Evusheld in the European Union (EU). Evusheld is a combination of two long-acting antibodies—tixagevimab (AZD8895) and cilgavimab (AZD1061). The US government extended support for the development of this product through federal funds from the Department of Health and Human Services, the Administration for Strategic Preparedness and Response, and the Biomedical Advanced Research and Development Authority.

- In August 2023, Regeneron Pharmaceuticals, Inc. entered into an agreement with the Biomedical Advanced Research and Development Authority (BARDA) to support clinical development, clinical manufacturing, and the regulatory licensure process for next-generation monoclonal antibody therapy against COVID-19. Under this agreement, Regeneron plans to work collaboratively with BARDA to evaluate and further develop and manufacture this therapy, and conduct regulatory activities.

Competitive Landscape and Key Companies:

GlaxoSmithKline, F.Hoffmann-La-Roche, Bayer AG, Amgen, Novartis, AbbVie, Bristol-Myers Squibb, Janssen Pharmaceutical, Merck KgaA, and AstraZeneca are among the prominent companies in the monoclonal antibody therapeutics (mABs) market. The monoclonal antibody therapeutics (mABs) market report includes company positioning and concentration to evaluate the performance of key players in the market.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For