Newborn Screening Market Analysis and Opportunities by 2030

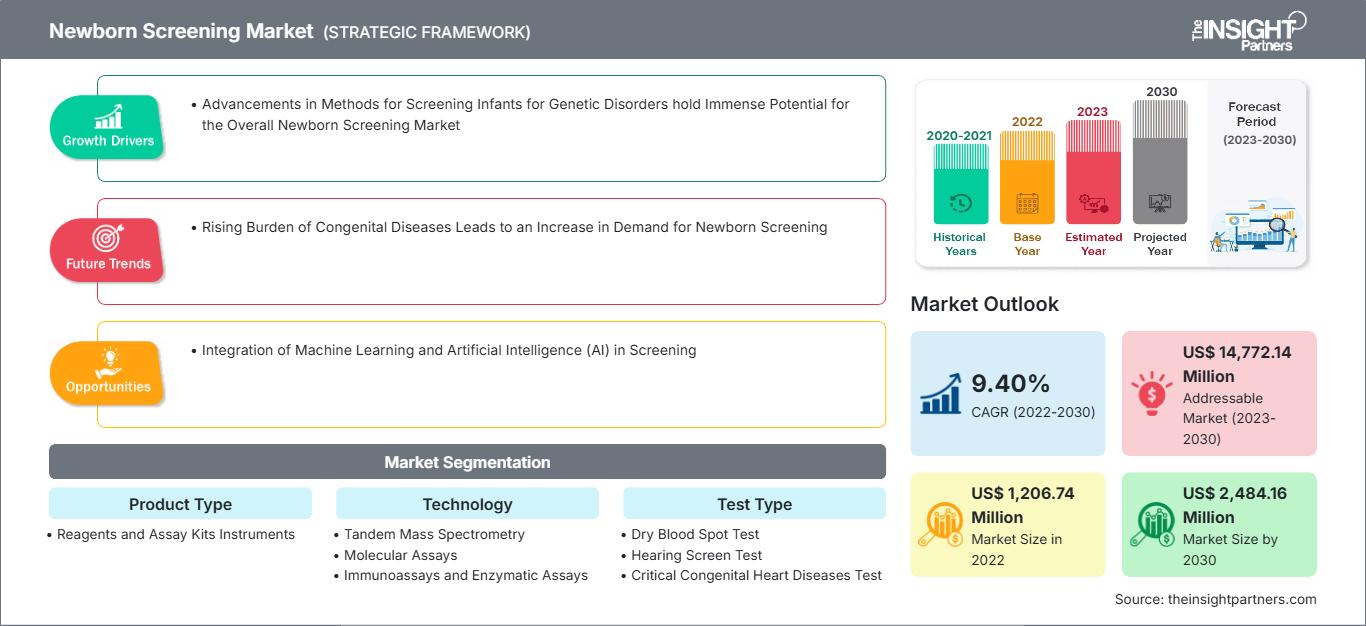

Newborn Screening Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Reagents and Assay Kits, and Instruments), Technology [Tandem Mass Spectrometry (TMS), Molecular Assays, Immunoassays and Enzymatic Assays, Pulse Oximetry Screening Technology, and Others], Test Type [Dry Blood Spot Test, Hearing Screen Test, Critical Congenital Heart Diseases (CCHD) Test, and Others], End User (Hospitals and Clinics, and Diagnostic Laboratories), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPHE100001294

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 226

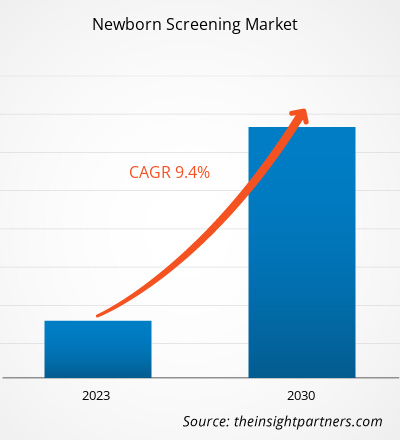

The newborn screening market size is projected to reach US$ 2,484.16 million by 2030 from US$ 1,206.74 million in 2022. The market is expected to register a CAGR of 9.40% during 2022–2030. Integration of machine learning and artificial intelligence (AI) in screening will likely remain a key trend in the market.

Newborn Screening Market Analysis

The market is expected to grow due to increased public and healthcare provider awareness of the value of early diagnosis and intervention for newborn disorders through government and nonprofit educational campaigns. Moreover, the need for newborn screening is boosted by increased birth rates, especially in developing nations. Stakeholders in the newborn screening market can improve early detection and intervention and, eventually, improve the health outcomes of newborns globally by utilizing these drivers and opportunities.

Newborn Screening Market Overview

Governments of different countries are increasingly allocating funds for newborn screening programs. These programs help reduce long-term healthcare costs for children and their parents, as congenital and genetic disorders could result in severe health complications and extensive medical interventions if left undetected. By identifying and addressing health issues in infancy, governments can enhance the health and well-being of their citizens. Thus, newborn screening aligns with broader public health objectives to improve overall population health and reduce the burden on healthcare systems.

Government funding promotes equity in healthcare access, ensuring that newborn screening services are available to all, regardless of socioeconomic status. This inclusivity is essential for early disease detection and intervention, as it prevents disparities in healthcare outcomes among different demographic groups. As governments continue prioritizing newborn screening through increased funding and policy support, the infant screening market has been experiencing sustainable growth worldwide.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNewborn Screening Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Newborn Screening Market Drivers and Opportunities

Rising Burden of Congenital Diseases Leads to an Increase in Demand for Newborn Screening, Favors the Market Growth

Congenital diseases can lead to lifelong health challenges if not detected and managed early. These diseases can contribute to long-term disability, significantly affecting families, individuals, healthcare systems, and societies. The WHO estimates that 240,000 newborns worldwide succumb to death each year within 28 days of birth due to these diseases. An additional 170,000 children die between the ages of 1 month and five years due to congenital diseases. A growing understanding of the genetic basis of many congenital diseases is one of the several factors contributing to the increasing burden of these conditions. Genomics and genetic testing advancements have enabled healthcare providers to identify a broader range of genetic mutations and conditions in newborns. This expanded knowledge has highlighted the importance of early diagnosis through newborn screening to initiate timely interventions and treatments.

Changing demographics such as maternal age, environmental exposures, and altering lifestyle habits increase the risk of congenital conditions in newborns. Moreover, the number of births occurring every day is on the rise due to the burgeoning global population, resulting in an expanding pool of infants that can be at risk of congenital diseases. In addition, healthcare systems and policymakers recognize the long-term benefits of early disease detection. They increasingly incorporate newborn screening into routine healthcare protocols and insurance coverage, further stimulating market growth. The rising burden of congenital diseases is a significant driver behind the development of the newborn screening market.

Advancements in Methods for Screening Infants for Genetic Disorders hold Immense Potential for the Overall Newborn Screening Market

The demand for comprehensive genetic screening of newborns is rising with the deepening knowledge about the genetic causes of medical conditions and advancements in healthcare technologies. As a result, companies in the newborn screening market are developing innovative, cost-effective screening solutions. The US FDA licensed the Kymriah gene therapy in 2017 for use in pediatric patients with a particular kind of acute lymphoblastic leukemia. During this therapy, a new gene that codes for a chimeric antigen receptor is inserted into the patient's T cells, stimulating the altered T cells to go after and destroy the leukemic cells. Yescarta and Zynteglo are two more examples of authorized gene treatments for large B-cell lymphoma and beta-thalassemia. Further, the emergence of technologies conferring an ability to identify genetic predispositions to diseases at birth paved the way for personalized healthcare, aligning with the broader trend of precision medicine.

Screening for genetic diseases during pregnancy also focuses on the early detection of pregnancy-related problems. Next-generation sequencing aids in the prenatal screening of neonates with a sensitivity above 95% for detecting aneuploidies (such as Down syndrome and Trisomy 21) or partial chromosomal abnormalities (duplications or deletions) in all chromosomes. Fluorescence in-situ hybridization (FISH) is employed to detect monogenic illnesses such as sickle cell anemia and aids in an effective preimplantation genetic diagnosis. Recent advancements in genetic tests include non-invasive procedures such as the cell-free fetal DNA approach using maternal plasma. The embryonic DNA can be distinguished from maternal DNA pieces based on size differences. Real-time PCR with fluorescent probes, shotgun sequencing (Solexa or Illumina), or massive targeted parallel sequencing can be used to examine DNA associated with fetal medical conditions. This will allow doctors to provide early molecular interventions with specific pharmacological therapies (pharmacogenetics) and transform cells, tissues, and organs physically and chemically if this genetic screening is further researched. Thus, advancements in methods for screening infants for genetic disorders hold immense potential for the overall newborn screening market.

Newborn Screening Market Report Segmentation Analysis

Key segments that contributed to the derivation of the newborn screening market analysis are product type, technology, test type, and end user.

- Based on product type, the newborn screening market is divided into reagents and assay kits, and instruments. The reagents and assay kits segment held the most significant market share in 2022.

- By technology, the market is categorized into tandem mass spectrometry (TMS), molecular assays, immunoassays and enzymatic assays, pulse oximetry screening technology, and others. The pulse oximetry screening technology segment held the largest share of the market in 2022.

- By test type, the market is segmented into dry blood spot test, hearing screen test, critical congenital heart diseases (CCHD) test, and others. The dry blood spot test segment held the largest share of the market in 2022.

- By end user, the market is categorized into hospitals and clinics, and diagnostic laboratories. The hospitals and clinics segment held the largest share of the market in 2022.

Newborn Screening Market Share Analysis by Geography

The geographic scope of the newborn screening market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The newborn screening market in North America has experienced significant growth in recent years. The demand for newborn screening services has increased significantly with the surging awareness among parents and healthcare professionals about the importance of early screening for identifying and managing congenital disorders. Additionally, improvements in medical technology have been crucial in enhancing newborn screening capabilities—laboratory automation has boosted screening accuracy, speed, and cost-effectiveness. This has made it possible for medical professionals to give thorough newborn screening panels that cover a larger spectrum of genetic and metabolic disorders. Favorable legislation and regulatory measures also benefit the newborn screening market in North America. Many states and provinces have implemented mandatory newborn screening programs, ensuring all infants are screened shortly after birth. For instance, every state in the US offers newborn screening as a public health program; yearly, ~4 million babies are screened under this program for illnesses that aren't often present at the time of delivery. The Texas Department of Health and Human Services began screening newborns for Spinal Muscular Atrophy (SMA) in June 2021.

The rising prevalence of genetic abnormalities and congenital problems has highlighted the significance of newborn screening. The National Institutes of Health has given a researcher from the University at Buffalo a highly competitive R01 grant to lead an international project to significantly increase the accuracy of newborn screening for three rare, frequently fatal genetic diseases.

Further, the Eunice Kennedy Shriver National Institute of Child Health and Human Development of the NIH funds the US$ 3.8 million five-year award. Thus, the newborn screening market in North America is increasing with increased awareness, technological advancements, supportive policies, and the growing prevalence of congenital disorders.

Newborn Screening Market Regional Insights

The regional trends and factors influencing the Newborn Screening Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Newborn Screening Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Newborn Screening Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,206.74 Million |

| Market Size by 2030 | US$ 2,484.16 Million |

| Global CAGR (2022 - 2030) | 9.40% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Newborn Screening Market Players Density: Understanding Its Impact on Business Dynamics

The Newborn Screening Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Newborn Screening Market top key players overview

Newborn Screening Market News and Recent Developments

The newborn screening market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the newborn screening market are listed below:

- Rady Children’s Institute for Genomic Medicine (RCIGM) announced a novel program to advance and evaluate the scalability of a diagnostic and precision medicine guidance tool called BeginNGS (pronounced “beginnings”) to screen newborns for approximately 400 genetic diseases that have known treatment options using rapid Whole Genome Sequencing (rWGS). BeginNGS, developed through a research collaboration with Alexion, AstraZeneca’s Rare Disease group; Fabric Genomics; Genomenon; Illumina, Inc.; and TileDB, uses rWGS to diagnose and identify treatment options for genetic conditions before symptoms begin, an advancement over current pediatric uses of rWGS that focus mainly on children who are already critically ill. (Source: Rady Children's Institute for Genomic Medicine, Press Release, June 2022)

Newborn Screening Market Report Coverage and Deliverables

The “Newborn Screening Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Newborn screening market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Newborn screening market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Newborn screening market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the newborn screening market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For