North America Intravenous Immunoglobulin Market Share and Forecast by 2030

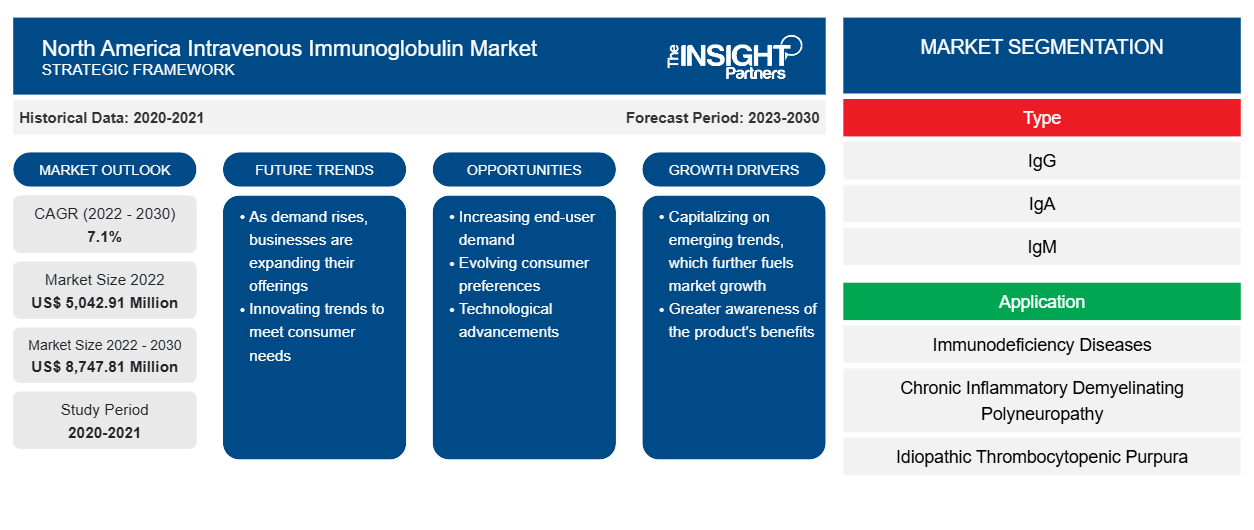

North America Intravenous Immunoglobulin Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (IgG, IgA, IgM, and Others), Application (Immunodeficiency Diseases, Chronic Inflammatory Demyelinating Polyneuropathy, Idiopathic Thrombocytopenic Purpura, Multifocal Motor Neuropathy, Hypogammaglobulinemia, Guillain-Barre Syndrome, Specific Antibody Deficiency, Inflammatory Myopathies, Myasthenia Gravis, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Others), End User (Hospitals, Specialty Clinics, and Others), and Country (US, Canada, and Mexico)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPRE00030117

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 107

The North America intravenous immunoglobulin market was valued at US$ 5,042.91 million in 2022 and is projected to reach US$ 8,747.81 million by 2030. It is estimated to register a CAGR of 7.1% during 2022–2030.

Market Insights and Analyst View:

Patients with autoimmune diseases are treated with intravenous immunoglobulins. Autoimmune diseases are conditions wherein the immune system accidentally attacks its own tissues or cells. Chronic inflammation, and organ and system damage result from this aberrant immune reaction against healthy cells. Fatigue, joint pain, muscle weakness, skin rashes, and neurological disturbances are a few of the typical signs and symptoms of autoimmune diseases. Symptoms of autoimmune diseases such as Guillain-Barré syndrome (GBS), myasthenia gravis (MS), rheumatoid arthritis (RA), systemic lupus erythematosus (LE), and immune thrombocytopenia (ITP) can be alleviated with the IVIG therapy. Benefits of this therapy include the rapid relief of symptoms and long-lasting effects, leading to improved quality of life among patients.

According to the Intermountain Healthcare, autoimmune and immune-mediated diseases and conditions affect 23.5–50 million Americans. According to the Centers for Disease Control and Prevention, rheumatoid arthritis (RA) is the most prevalent type of autoimmune arthritis, and 1 in 4 adults in the US has arthritis. As per the Myasthenia Gravis Foundation of America, Inc., the prevalence of myasthenia gravis (MG) is estimated at 14–20 per 100,000 of the US population. In Canada, the incidence of MG is estimated to be 23 per 1 million person-years, with a prevalence of 263 per 1 million people, and the numbers have been stable over the past few decades.

With a decrease in the body's capacity to produce T- or B-cells, aging impairs a person's ability to fight off infections and cancerous cells. Immunosenescence, i.e., a weakening of the immune system, is the term used to describe the aging-related changes to the immune system. The elderly population is more prone to immunodeficiency diseases because of immunosenescence. Elderly patients with these diseases are prescribed IVIG therapies. Thus, an upsurge in the geriatric population and the rising prevalence of immunodeficiency disorders propel the growth of the North America intravenous immunoglobulin market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Intravenous Immunoglobulin Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers and Challenges:

Plasma-derived immunoglobulins are used for treating autoimmune and inflammatory disorders, among others. In addition to autoimmune and acute inflammatory conditions, primary immune deficiency disease (PIDD), chronic inflammatory demyelinating polyneuropathy (CIDP), and multifocal motor neuropathy (MMN) are the chronic and acute conditions that are treated with immunoglobulins. Immunoglobulins are also increasingly used to manage infectious diseases, dermatological conditions, rheumatological/nephrological conditions, and heart disease. Thus, the demand for intravenous immunoglobulins is on the rise with the surging use of these antibodies for treating various conditions.

In recent years, various developments have been in the intravenous immunoglobulin market in North America. Market players have been launching new products and seeking regulatory approvals for their offerings. In April 2023, Takeda Pharmaceutical Company Limited, an R&D-driven biopharmaceutical leader, received a supplemental Biologics License Application (sBLA) approval from the US Food and Drug Administration (FDA) to expand the use of HYQVIA to treat primary immunodeficiencies (PI) in children belonging to the age group of 2–16 years. Only HYQVIA's subcutaneous immune globulin (ScIG) infusion allows for monthly administration. In 2022, Health Canada approved HyQvia, a new Immunoglobulin (IG) treatment for Canadians with immune deficiencies. In February 2021, Pfizer Inc. received an sBLA approval for PANZYGA (10% liquid intravenous immunoglobulin preparation) to treat chronic inflammatory demyelinating polyneuropathy (CIDP).

Immunoglobulins are manufactured for infusion so that the finished goods have higher purity levels. Therefore, the cost of producing and purifying intravenous immunoglobulins is high. The total cost of this treatment also varies based on factors like the treatment's length, the disease's diagnosis, and the patient's body weight. For instance, a single IVIG infusion procedure may cost between US$ 100–350 or more. The reported average cost of IVIG therapy in the US is nearly US$ 9,720. If patients receive 4–5 infusions per month, the cost would reach ~US$ 41,796. Thus, the elevated cost of therapy hinders the North America intravenous immunoglobulin market growth

Report Segmentation and Scope:

The North America intravenous immunoglobulin market is divided on the basis of type, application, distribution channel, and end user. Based on type, the North America intravenous immunoglobulin market is segmented into IgG, IgA, IgM, and others. In terms of application, the North America intravenous immunoglobulin marketis segmented into immunodeficiency diseases, chronic inflammatory demyelinating polyneuropathy, idiopathic thrombocytopenic purpura, multifocal motor neuropathy, hypogammaglobulinemia, Guillain-Barre syndrome, specific antibody deficiency, inflammatory myopathies, myasthenia gravis, and others. The North America intravenous immunoglobulin market , by distribution channel, is classified into hospital pharmacy, retail pharmacy, and others. Based on end user, the North America intravenous immunoglobulin marketis divided into specialty clinics, hospitals, and others. Based on country, the North America intravenous immunoglobulin market is divided into the US, Canada, and Mexico.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

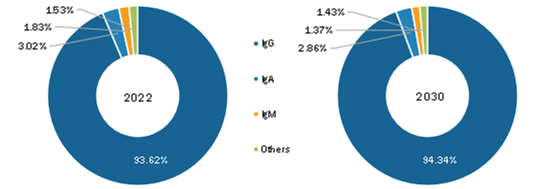

Based on type, the intravenous immunoglobulin market is segmented into IgG, IgA, IgM, and others. IgG (i.e., immunoglobulin G) is the most abundant antibody found in blood, lymph fluid, cerebrospinal fluid, and peritoneal fluid, and it plays a vital role in the humoral immune response. IgG constitutes approximately 75% of total serum antibodies and is equally distributed between intravascular and extravascular serum pools. IgG is the only class of immunoglobulins that can reach fetal circulation by crossing the placental barrier. Human IgG can be divided into four subclasses—IgG1, IgG2, IgG3, and IgG4—based on unique antigenic determinants on their heavy chain constant-region domains and associated biologic functions. Moreover, intravenous immunoglobulin (IVIg) is a replacement therapy and treatment for patients with antibody deficiencies or who suffer from immunodeficiency disorders. For instance, in primary or secondary hypogammaglobulinemia, IVIg replacement therapy protects against infections by providing IgGs in adequate quantities in the blood. IVIg is a blood product prepared from the serum of 1,000-15,000 donors per batch where only the IgG is purified from plasma. IVIg solutions used for treatments contain 95–98% pure IgGs and small amounts of other plasma proteins, including IgAs and IgMs. Thus, the wide application of IgG in treating several categories of disorders will likely complement the growth of the IgG segment during the forecast period.

Intravenous Immunoglobulin Market, by Type – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on the application, the intravenous immunoglobulin market is classified into immunodeficiency diseases, chronic inflammatory demyelinating polyneuropathy, idiopathic thrombocytopenic purpura, multifocal motor neuropathy, hypogammaglobulinemia, Guillain-Barre syndrome, specific antibody deficiency, inflammatory myopathies, myasthenia gravis, and others. In 2022, the immunodeficiency diseases segment held the largest share of the market and is expected to register the highest CAGR during 2022–2030. Immunodeficiency diseases are categorized as primary (congenital) and secondary (acquired) immunodeficiency diseases. Among both, primary immunodeficiency diseases (PIDDs) can be characterized into 400 different types. According to the Journal of Allergy and Clinical Immunology, the prevalence of PIDD in the US is estimated at 1 in 2,000 individuals. Moreover, researchers targeting PIDDs are making great strides toward improving treatment options and enhancing customers' quality of life. IVIg administration is the apparent treatment of choice for humoral primary immunodeficiencies, as these patients cannot mount an effective immune response against pathogens. The US Food and Drug Administration (FDA) approved Privigen, a 10% IVIg liquid, as a replacement therapy against primary immunodeficiency disease (PIDD). In March 2022, ADMA Biologics received FDA approval for its ASCENIV and BIVIgAM immunoglobulin drug products to extend their expiration dates from 24 months to 36 months when stored at 2–8°C. Thus, such regulatory approvals for IVIg products to treat immunodeficiency disorders contribute to the progress of the US intravenous immunoglobulin market for the PIDD segment.

In terms of distribution channels, the intravenous immunoglobulin market is classified into hospital pharmacy, retail pharmacy, and others. In 2022, the hospital pharmacy segment held the largest share of the market, and it is expected to register the highest CAGR during 2022–2030. Hospital pharmacies are among the essential parts of any country's healthcare system. They receive a huge footfall of patients suffering from some type of indication, requiring IVIg replacement therapy. Additionally, all patients need to visit hospitals to receive the scheduled doses of IVIg, which results in the demand for these products in hospital pharmacies. Thus, the hospital pharmacy segment contributes significantly to the intravenous immunoglobulin market.

Based on end user, the intravenous immunoglobulin market is classified into hospitals, specialty clinics, and others. In 2022, the hospitals segment held the largest market share, and it is expected to register the highest CAGR during 2022–2030. Hospitals are complex organizations providing healthcare services with the help of modernized equipment. An increasing number of hospital admissions, coupled with the rising prevalence of immunodeficiency disorders, is projected to drive the growth of the hospital segment in the US intravenous immunoglobulin market during the forecast period. Moreover, a vast demand for advanced hospital settings is experienced in emerging nations for managing a huge patient pool and rising public health concerns.

Hospitals in partnership with companies conduct studies to observe the doses and adverse events related to the therapy and monitor the product's clinical outcomes. Hospitals serve as primary centers for providing immunoglobulin replacement therapies. The perceived advantages of receiving IgRTs in hospitals include greater safety and closer monitoring of patients, and better support from health professionals and experts. Moreover, proper patient-centric care, availability of reimbursement facilities, and other similar benefits provided by hospitals are expected to fuel the US intravenous immunoglobulin market growth for the hospitals segment during the forecast period.

Regional Analysis:

Based on geography, the intravenous immunoglobulin market is divided into the US, Canada, and Mexico. The US is the largest contributor to the market growth in this region, and Canada is expected to record the fastest CAGR during 2022–2030. The rising number of immunodeficiencies and autoimmune diseases in the US is likely to increase the demand for intravenous immunoglobulins. As per the National Institutes of Health, ~23.5 million Americans (over 7% of the population) suffer from an autoimmune disease. Additionally, the US has North America's largest and most commercial pharmaceutical market. It alone holds over 45% of the global pharmaceutical market. Most top global drug manufacturing companies active in biomedical research are headquartered in the US.

In July 2021, the US Food & Drug Administration (FDA) approved Octapharma’s Octagam 10% to treat patients with dermatomyositis, a rare chronic systemic autoimmune disease with a peculiar skin rash and progressive proximal muscle weakness. Further, the FDA approved the investigational new drug (IND) application of Octapharma USA for phase III clinical trial on the efficacy and safety of Octagam 10% [Immune Globulin Intravenous (Human)] therapy in COVID-19 patients with severe disease progression.

Thus, the increasing cases of immunodeficiencies and autoimmune diseases, the flourishing pharmaceutical sector, and surging product approvals are anticipated to boost the US intravenous immunoglobulin market during the forecast period.

Competitive Landscape and Key Companies:

Takeda Pharmaceutical Co Ltd; Grifols SA; Pfizer Inc.; ADMA Biologics, Inc.; Bio Products Laboratory Ltd; Octapharma AG; Kedrion SpA.; CSL Ltd.; LFB Group; and Prothya Biosolutions B.V are a few prominent players operating in the intravenous immunoglobulin market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

North America Intravenous Immunoglobulin Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,042.91 Million |

| Market Size by 2030 | US$ 8,747.81 Million |

| CAGR (2022 - 2030) | 7.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For