Demerara Sugar Market Size, Trends & Growth by 2034

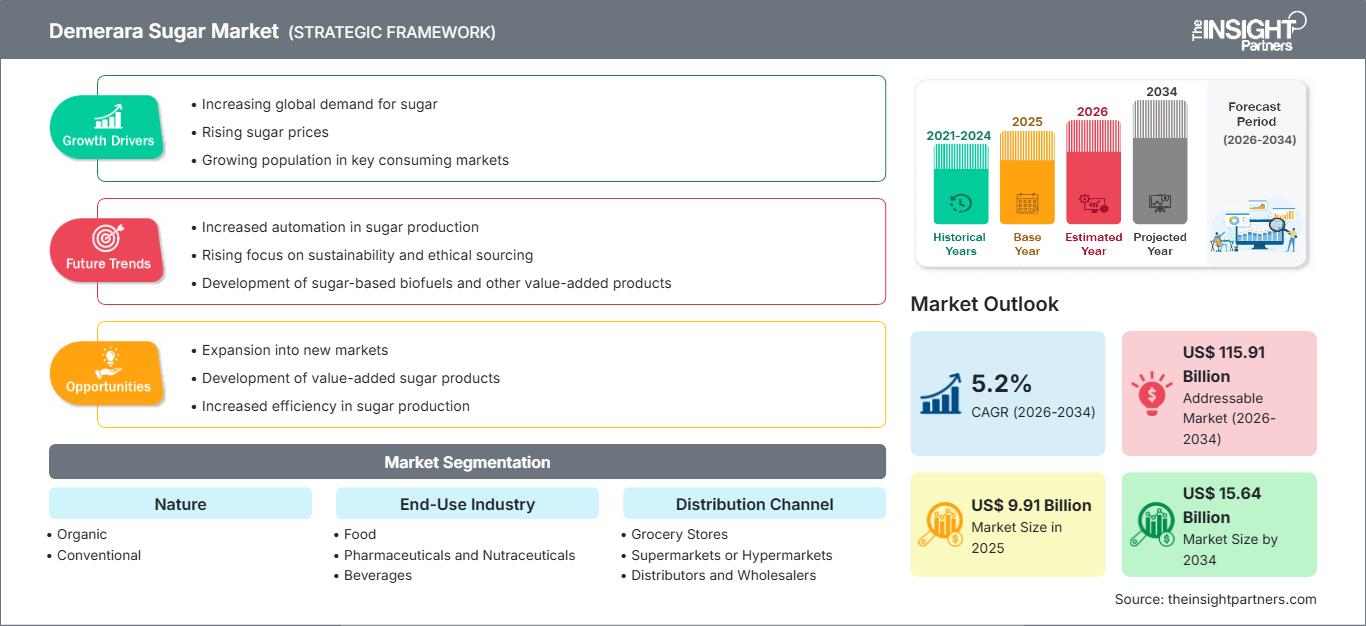

Demerara Sugar Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Nature (Organic and Conventional), End-Use Industry (Food, Pharmaceuticals and Nutraceuticals, Beverages, and Others), and Distribution Channel (Grocery Stores, Supermarkets or Hypermarkets, Distributors and Wholesalers, Online Retailers, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00015933

- Category : Food and Beverages

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

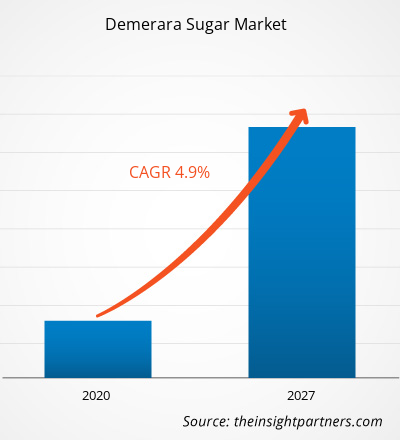

The global Demerara Sugar market size is projected to reach US$ 15.64 billion by 2034 from US$ 9.91 billion in 2025. The market is anticipated to register a CAGR of 5.2% during the forecast period 2026–2034. Key market dynamics include an escalating consumer shift toward unrefined and minimally processed sweeteners, a rising preference for natural flavor enhancers in the culinary sector, and the expanding popularity of specialty and artisanal food products. Additionally, the market is expected to benefit from the growing demand for clean-label ingredients, the expansion of premium bakery and confectionery segments, and the increasing inclusion of demerara sugar in high-end beverage applications, such as craft cocktails and specialty coffees.

Demerara Sugar Market Analysis

The demerara sugar market analysis indicates a significant transition toward premiumization and functional application as consumers increasingly scrutinize refined sugar consumption. Strategic opportunities are emerging in the gourmet and hospitality sectors, where the unique flavor profile and coarse texture of demerara sugar offer a distinct competitive advantage over conventional white sugar. Procurement trends highlight a growing demand for ethically sourced and Fair Trade-certified products, reflecting broader global sustainability initiatives. The analysis further suggests that market participants can achieve differentiation by targeting the "better-for-you" snack segment and developing innovative packaging solutions that emphasize the product's mineral-rich profile. Competitive positioning is currently being shaped by transparency in the supply chain—particularly from traditional production hubs like Guyana and Mauritius—leveraging historical branding to command premium pricing in developed markets.

Demerara Sugar Market Overview

Demerara sugar is evolving from a niche baking ingredient into a mainstream premium commodity. Characterized by its large, crunchy crystals and natural molasses content, demerara sugar has gained traction among health-conscious demographics seeking alternatives to highly processed sugars. The market is supported by a robust supply chain originating from sugarcane-rich regions, where traditional refining methods are preserved to maintain the sugar's inherent nutritional value. While historically a staple in European tea and coffee cultures, the product is seeing rapid adoption in North America and Asia-Pacific due to the rise of home-baking trends and the diversification of retail product portfolios. Large-scale processors and small-scale organic producers alike are capitalizing on the "naturalness" trend, positioning demerara sugar as a vital component of the modern clean-label pantry. For instance, the market in the US is characterized by a high demand for specialty sweeteners within the artisanal food and beverage sector. Domestic consumers increasingly favor minimally processed ingredients for home baking and gourmet cooking. Retail expansion in high-end grocery chains and the growth of the craft cocktail movement further support market stability.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDemerara Sugar Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Demerara Sugar Market Drivers and Opportunities

Market Drivers:

- Rising Demand for Unrefined Sweeteners: Growing consumer awareness regarding the health implications of highly refined sugars is driving the adoption of demerara sugar as a more "natural" alternative.

- Expansion of the Specialty Coffee and Tea Industry: The global proliferation of premium coffee shops and cafes has sustained high demand for demerara sugar as a preferred sweetener for hot beverages.

- Growth in Artisanal Bakery and Confectionery: Professional bakers and confectioners are increasingly utilizing demerara sugar for its structural properties and flavor depth, particularly in toppings and crusts.

Market Opportunities:

- Development of Organic and Fair Trade Segments: Significant growth potential exists in providing certified organic demerara sugar to meet the demands of environmentally and socially conscious millennials.

- Innovation in Liquid and Syrupy Variants: Creating demerara-based syrups for the mixology and beverage industries offers a lucrative avenue for product diversification.

- Targeting Emerging Economies in APAC: Forming strategic distribution alliances in markets like China and India can facilitate entry into the burgeoning luxury food sector.

Demerara Sugar Market Report Segmentation Analysis

The Demerara Sugar Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Nature:

- Organic: This segment is witnessing significant growth as consumers increasingly prioritize health-conscious and environmentally friendly products. It appeals to high-end retail markets and artisanal producers who emphasize chemical-free cultivation and sustainable farming practices.

- Conventional: As the primary volume driver, conventional demerara sugar benefits from established large-scale agricultural operations and remains the standard choice for industrial food processing and mass-market retail.

By End-Use Industry:

- Food: The largest segment, encompassing the bakery and confectionery sectors, where the sugar's distinct texture and caramel notes are highly valued. It is also used in the production of dairy products and gourmet desserts.

- Pharmaceuticals and Nutraceuticals: Emerging as a niche application, where the mineral content of less-refined sugar is leveraged in specialty supplements and certain medicinal formulations.

- Beverages: A key growth area driven by the craft cocktail movement and the specialty coffee industry, which utilizes demerara sugar for its superior solubility and flavor-enhancing properties in hot and cold drinks.

By Distribution Channel:

- Grocery Stores: Provide local accessibility for everyday consumers and are a vital channel for established regional brands.

- Supermarkets or Hypermarkets: Hold a substantial share of the market by offering a wide variety of domestic and imported specialty sugar brands under one roof, often featuring dedicated organic sections.

- Distributors and Wholesalers: Act as the critical link for B2B transactions, supplying bulk quantities to industrial bakeries, restaurant chains, and large-scale food manufacturers.

- Online Retailers: The fastest-rising channel, enabling direct-to-consumer (D2C) sales and providing smaller artisanal brands with a global platform to reach niche demographics.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Demerara Sugar Market Regional Insights

The regional trends influencing the Demerara Sugar Market have been analyzed across key geographies.

Demerara Sugar Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 9.91 Billion |

| Market Size by 2034 | US$ 15.64 Billion |

| Global CAGR (2026 - 2034) | 5.2% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Nature

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Demerara Sugar Market Players Density: Understanding Its Impact on Business Dynamics

The Demerara Sugar Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Demerara Sugar Market Share Analysis by Geography

Europe currently holds a substantial market share due to longstanding cultural usage, while Asia-Pacific is expected to witness the most rapid growth during the forecast period.

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for premium dairy producers and infant formula manufacturers to expand. The demerara sugar market is undergoing a significant transformation, moving from a traditional British baking staple to a global high-value functional sweetener. Growth is driven by the rising prevalence of refined-sugar health concerns, a surge in "clean-label" demand, and the expansion of the luxury artisanal food sector. Below is a summary of market share and trends by region:

North America

- Market Share: A niche but rapidly expanding segment driven by gourmet retail and the growth of the craft beverage industry.

- Key Drivers:

- Rising consumer preference for minimally processed, mineral-rich sweeteners like demerara

- Mainstreaming of "specialty" ingredients in high-end grocery chains like Whole Foods and specialty delis

- Increased use in the mixology sector for premium syrups and decorative cocktail rims

- Trends: Scaling of retail distribution for organic-certified sugars and the successful adoption of specialty certifications (e.g., Fair Trade, Non-GMO) to appeal to ethically-minded demographics.

Europe

- Market Share: Holds the largest share globally, anchored by deep-seated culinary traditions in the United Kingdom, France, and Germany.

- Key Drivers:

- High domestic consumption in traditional tea and coffee cultures and classic European confectionery

- Established supply chains with longstanding trade relations with traditional producing regions like Mauritius and Guyana

- Robust regulatory frameworks focusing on sustainable sourcing and transparent labeling

- Trends: A strategic shift toward prioritizing organic and Fair Trade demerara to meet the demands of eco-conscious European consumers. There is also an increasing focus on premium "origin-specific" branding to differentiate from standard brown sugars.

Asia-Pacific

- Market Share: The fastest-growing region, with high-end urbanization acting as the primary engine for market penetration, particularly in China and India.

- Key Drivers:

- Massive consumer base in emerging economies seeking westernized "luxury" food experiences and premium baking ingredients

- Rapid expansion of the hospitality and specialty cafe sectors in tier-1 and tier-2 cities

- Rising disposable incomes are leading to a preference for "premium natural" versions of everyday staples.

- Trends: Heavy reliance on e-commerce platforms for D2C sales and B2B contracts for high-end demerara used in the bakery and "beauty-from-within" edible segments (e.g., molasses-based functional snacks).

South and Central America

- Market Share: Dominant production hub with an emerging local artisanal sector in countries like Guyana, Brazil, and Colombia.

- Key Drivers:

- Increasing awareness of the nutritional superiority of demerara compared to highly refined local white sugars

- Modernization of traditional sugar estates into commercial-grade refineries to supply premium global and domestic markets

- Strategic location as a primary producer, allowing for cost-effective "farm-to-table" boutique branding

- Trends: Growth of boutique "estate-branded" sugars and the introduction of demerara-based specialty products, such as artisanal syrups and local confectionery, to differentiate from industrial exports.

Middle East and Africa

- Market Share: Developing market with deep cultural roots in sugarcane cultivation, transitioning toward formalized commercial premium segments.

- Key Drivers:

- Traditional presence of unrefined sugars in regional cuisines and beverages

- High demand for shelf-stable premium sweeteners in expanding urban retail centers

- Strategic investments in modern processing technologies to improve local production quality and export potential

- Trends: Implementation of modern refining and packaging technologies to formalize the artisanal sugar market, coupled with a focus on high-nutrient sweeteners for the growing luxury food segment in the GCC.

High Market Density and Competition

Competition is intensifying due to the presence of established leaders such as Guyana Sugar Corporation (GuySuCo), Associated British Foods plc (Silver Spoon), Tate & Lyle PLC, Tereos Group, Nordzucker AG, Ragus Sugars Manufacturing Limited, Sugar Australia Company Ltd, Alteo Limited, and LOC Industries, which also contribute to a diverse and rapidly expanding market landscape.

The competitive environment is intensifying as established sugar giants and niche producers focus on sustainable sourcing and brand storytelling. Major players are differentiating through:

- Strategic Certifications: Emphasizing non-GMO, Organic, and Fair Trade labels to appeal to ethical consumers.

- Packaging Innovation: Utilizing eco-friendly and resealable packaging to align with sustainability goals and improve consumer convenience.

- B2B Partnerships: Collaborating with multinational beverage and food companies to integrate demerara sugar into mainstream product formulations.

Opportunities and Strategic Moves

- Expansion into the Artisanal Beverage and Mixology Sector: There is a significant opportunity for producers to target the high-growth craft cocktail and specialty coffee markets. By developing liquid demerara syrups and specialized "rimming" sugars with consistent crystal sizes, companies can cater to professional mixologists and baristas seeking high-performing, flavor-rich sweeteners that enhance the multisensory indulgence of premium drinks.

- Strategic Transition Toward Regenerative and Ethical Sourcing: As global scrutiny on supply chain transparency intensifies, manufacturers can differentiate themselves by adopting regenerative agriculture practices and securing certifications such as Bonsucro or Fair Trade. Aligning with these ethical standards allows brands to capture the "clean-label" demographic and secure long-term contracts with multinational food and beverage companies committed to sustainable procurement goals.

Major Companies operating in the Demerara Sugar Market are:

- Guyana Sugar Corporation (GuySuCo)

- Associated British Foods plc (Silver Spoon)

- Tate & Lyle PLC

- Tereos Group

- Nordzucker AG

- Ragus Sugars Manufacturing Limited

- Sugar Australia Company Ltd

- Alteo Limited

- LOC Industries

Disclaimer: The companies listed above are not ranked in any particular order.

Demerara Sugar Market News and Recent Developments

- In January 2026, the Government of Guyana advanced a strategic initiative to modernize the national sugar industry, aiming to position the Guyana Sugar Corporation (GuySuCo) for long-term profitability within the global Demerara Sugar market. The administration budgeted $13.4 billion for 2026 to enhance mechanization, operational efficiency, and value-added production. During the presentation of Budget 2026, Dr. Ashni Singh, Senior Minister in the Office of the President with Responsibility for Finance, emphasized that restoring the financial health of the corporation remained a top priority. These modernization efforts were designed to increase output and revitalize rural economies, securing livelihoods through the expanded production of iconic Demerara Sugar. Over the preceding five years, the administration successfully reopened the Rose Hall Estate. It implemented significant field and factory upgrades at the Albion, Blairmont, and Uitvlugt facilities to bolster the supply chain.

- In September 2025, Tate & Lyle PLC, a global leader in ingredient solutions for healthier food and beverages, launched Tate & Lyle Sensation™, its proprietary precision sensory formulation tool, in Asia Pacific. This innovative tool was introduced to assist food and beverage producers in accelerating product development, particularly within the yogurt category. The launch provided manufacturers with enhanced capabilities to optimize mouthfeel and flavor profiles, enabling the more effective integration of specialty ingredients like Demerara Sugar into premium, health-focused formulations that require a specific balance of texture and natural sweetness.

Demerara Sugar Market Report Coverage and Deliverables

The "Demerara Sugar Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Demerara Sugar Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Demerara Sugar Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Demerara Sugar Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Demerara Sugar Market.

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For