CAR-T Cell Therapy Market Developments and Forecast by 2030

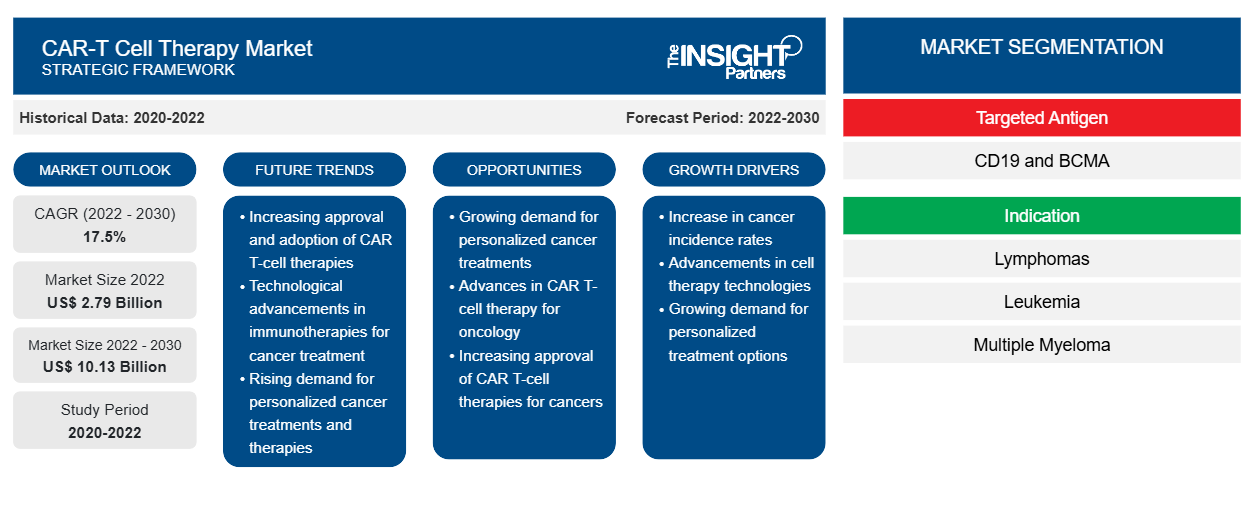

CAR-T Cell Therapy Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Targeted Antigen (CD19 and BCMA), Indication (Lymphomas, Leukemia, and Multiple Myeloma), End User (Hospitals and Specialty Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, and Rest of World)

Historic Data: 2020-2022 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Apr 2026

- Report Code : TIPRE00029935

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

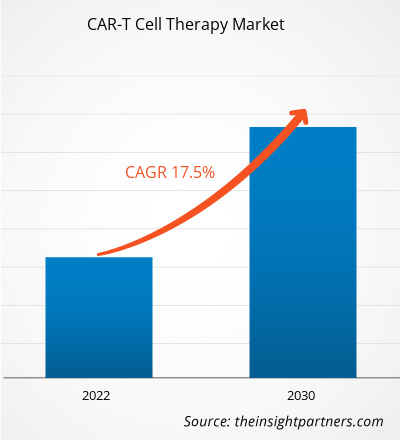

[Research Report] The CAR-T cell therapy market size is projected to reach US$ 10.13billion by 2030 from US$ 2.79 billion in 2022; it is estimated to record a CAGR of 17.5% during 2022–2030.

Market Insights and Analyst View:

One of the most promising methods for treating cancer is chimeric antigen receptor (CAR) T cell therapy, and every year, an enormous number of pre-clinical and clinical trials are conducted to increase its application. After decades of research, CAR-T cell therapy will inevitably expand. In addition to autologous and allogeneic products, new in-vivo CAR-T cell gene therapies and efficacy in indications other than hematologic malignancies will also be investigated in the future of cellular therapies. However, commercializing challenges impede the CAR-T cell therapy market growth.

Growth Drivers:

Rising Prevalence of Cancer Drives CAR-T Cell Therapy Market

CAR-T cell therapy is a new cancer treatment method. T cells are modified in a lab and then returned to the body to target cancer cells. Adult and pediatric leukemia and some types of lymphoma are treated with CAR-T cell therapy. Additionally, it is being researched as a potential treatment for other cancers, such as some solid tumors that develop in the chest.

Genetic predisposition, processed foods, pollution, and altered lifestyles are the factors contributing to the increase in cancer prevalence. According to the American Cancer Society, an estimated 19.3 million new cancer cases were registered globally in 2020. Thus, the increase in the number of patients with cancer is driving the demand for CAR-T cell therapies.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCAR-T Cell Therapy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “CAR-T cell therapy market analysis” has been carried out by considering the following segments: targeted antigen, indication, and end user.

Segmental Analysis:

By targeted antigen, the CAR-T cell therapy market is segmented into CD19 and BCMA. The CD19 segment held a larger CAR-T cell therapy market share in 2022 and is anticipated to register a higher CAGR of 17.9% during the forecast period.

CAR-T cells effectively treat relapsed/refractory diffuse large B cell lymphoma. T cells from patients are genetically modified to produce CD19 CAR T cells. Receptors that bind to the highly expressed CD19 protein found in leukemia and lymphoma cancer cells are expressed by modified T cells.

The availability of CD19 CAR-T cell therapy products is anticipated to drive the segment's growth. Below is the list of products approved by the US Food and Drug Administration and European Union in the US and Europe, respectively:

Manufacturer |

Brand Product |

Target Antigen |

Disease Indication |

Approval Year |

|

|

Novartis |

KYMRIAH |

CD19 |

Leukemia |

2017 |

|

|

Gilead Sciences, Inc |

YESCARTA |

CD19 |

Lymphoma |

2017 |

|

|

Gilead Sciences, Inc |

TECARTUS |

CD19 |

Lymphoma & Leukemia |

2020 |

|

|

Bristol Myers Squibb |

BREYANZI |

CD19 |

Lymphoma |

2021 |

The CAR-T cell therapy market, by indication, is divided into lymphomas, leukemia, and multiple myeloma. The lymphomas segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 18.1% during the forecast period. Hematological malignancies such as acute lymphoblastic leukemia, chronic lymphocytic leukemia, lymphoma, and multiple myeloma have been the main indications for the use of CAR-T cells.

The CAR-T cell therapy market, by end user, is categorized into hospitals and specialty clinics, ambulatory surgical centers, and others. The hospitals and specialty clinics segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 17.9% during the forecast period.

Technological Advancements to Accelerate CAR-T Cell Therapy Market Expansion

The creation and introduction of CAR-T therapy, which uses a patient's white blood cells to combat specific forms of blood cancer cells, is among the greatest medical advances of the past few years. Some cancer patients may find hope in CAR-T cell therapy as a potential cure. Five additional CAR-T cell therapies have been approved by the Food and Drug Administration (FDA) since the first therapy was approved in 2017 to treat particular types of adult and pediatric leukemia, lymphoma, and multiple myeloma. Research is also being done to create comparable treatments for solid tumor cancers.

Allogeneic CAR-T cell therapy has been the subject of hundreds of global pre-clinical and clinical trials. Most of these are used for hematological malignancies, where CD19 is the most commonly used target, along with other traditional targets such as CD20, CD22, and BCMA. Included are also newly developed targets such as CD70, CD7, and CD5. Emerging treatments for solid tumors include mesothelin, GD2, and NKG2DL.

Thus, advancements in cell-based therapeutics will likely bring new CAR-T cell therapy market trends in the coming years.

Regional Analysis:

The scope of the global CAR-T cell therapy market report focuses on North America, Europe, Asia Pacific, South & Central America, and the Rest of the World. In 2022, North America held the largest CAR-T cell therapy market share. The market growth in this region is driven by the increasing number of product launches by key manufacturers and the presence of key market players. In addition, extensive R&D by various pharmaceutical and biotechnology companies and academic & research institutes is expected to stimulate market growth in North America. For instance, in June 2022, Bristol Myers Squibb announced receiving the approval of Breyanzi (lisocabtagene maraleucel), a CD19-directed CAR-T cell therapy from the US Food and Drug Administration (FDA) for the treatment of adult patients with large B-cell lymphoma (LBCL), including diffuse large B-cell lymphoma (DLBCL).

In the US, the CAR-T cell therapy market growth is mainly driven by the growing pharmaceutical and biopharmaceutical sector, characterized by technological advancements and increasing flexibility. Furthermore, increasing R&D investments by US-based pharmaceutical and biotechnology companies to improve outcomes of clinical trials and ensure patient safety stimulate market growth. For instance, in July 2021, a purchase agreement was signed by BioNTech SE and Kite, a Gilead Company, allowing BioNTech to purchase Kite's clinical manufacturing facility in Gaithersburg, MD, as well as its solid tumor neoantigen T cell receptor (TCR) R&D platform. The new Gaithersburg location supplements BioNTech's current cell therapy manufacturing facility in Idar-Oberstein, Germany, and offers manufacturing capacity to strengthen clinical trials in the US. The facility helps advance the company's growing pipeline of innovative cell therapies, which includes product candidates for cancer based on NEOSTIM and CAR-T Cell Amplifying mRNA Vaccine (CARVac) and the recently acquired Individualized Neoantigen TCR program.

Future Opportunities and Research and Developments:

CAR-T cell therapies have shown promising outcomes in cancer treatment; nevertheless, their use is restricted to patients with certain liquid tumors that are relapsed and resistant. In the upcoming years, several CAR-T cell therapies for regenerative medicine in the US and advanced therapy medical goods in Europe are anticipated to receive market authorization. Hundreds of different key players with innovative techniques are being developed for a wide range of indications. In the long run, these treatments may improve patient outcomes by offering substantial, even curative, health advantages from a single dosage.

The future of CAR-T cell treatment is quite promising, given the quantity of ongoing clinical trials and new CAR-T cell products under development for a range of indications. Researchers are motivated to investigate ways to enhance the effectiveness of CAR-T cells due to the complete response rates and progression-free survival observed in patients with relapsed/refractory malignancies who had received a lot of prior treatment.

Researchers are looking into elements like antigen loss that could lead to immune escape and are coming up with ways to deal with them. Creating CAR-T cell treatments that simultaneously target several antigens is one such tactic. New medications are being developed to target antigens, such as CD138 and GPRC5D. In contrast, CAR-T cell treatments for ALL and NHL target the CD19 antigen, and therapies for multiple myeloma target the BCMA antigen.

The CAR-T cell therapy market forecast can help stakeholders in this marketplace plan their growth strategies. A few research and developments by leading players operating in the CAR-T cell therapy market are listed below:

- In November 2023, Vittoria Biotherapeutics declared that it completed a private financing round, raising over US$ 15 million. The funds will be utilized to conduct clinical trials of VIPER-101—an autologous dual population CD5-knockout CAR-T cell treatment for T cell lymphoma.

- In December 2023, AstraZeneca announced the acquisition of Gracell Biotechnologies Inc. to complement AstraZeneca’s existing capabilities and previous investments in cell therapy.

- In December 2021, researchers at the University of California San Diego School of Medicine (US) received a US$ 4.1 million grant to support the advancement of their innovative CAR-T cell therapy. The funding, authorized by the governing board of the California Institute for Regenerative Medicine (US), may enable the group to advance novel cancer treatment from the laboratory to the patient's bed.

CAR-T Cell Therapy

CAR-T Cell Therapy Market Regional InsightsThe regional trends influencing the CAR-T Cell Therapy Market have been analyzed across key geographies.

CAR-T Cell Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.79 Billion |

| Market Size by 2030 | US$ 10.13 Billion |

| Global CAGR (2022 - 2030) | 17.5% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Targeted Antigen

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

CAR-T Cell Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The CAR-T Cell Therapy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

Bristol-Myers Squibb Company; Novartis AG; Gilead Sciences, Inc.; Johnson & Johnson Services, Inc.; CARsgenTherapeutics Co., Ltd; Aurora Biopharma; Legend Biotech; Pfizer Inc.; bluebird bio, Inc.; Mustang Bio; Sorrento Therapeutics, Inc.; and Fate Therapeutics are among the prominent companies profiled in the CAR-T cell therapy market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For