Dental Bone Graft Substitutes and Barrier Membrane Market Growth and Forecast by 2030

Dental Bone Graft Substitutes and Barrier Membrane Market Forecast to 2030 - Industry Analysis by Product [Dental Bone Graft Substitutes (Allograft, Xenograft, Synthetic Bone Graft, Autografts, Alloplasts, Demineralized Bone Matrix (DBM-Allograft, and Others) and Dental Barrier Membrane (Resorbable Membrane and Non-Resorbable Membrane)], Procedure [Guided Bone Regeneration Procedures (GBR), Guided Tissue Regeneration Procedures (GTR), Sinus-Lift Procedures and Ridge-Split Procedures, Alveolar Ridge Preservation (ARP), Block-Graft Procedures, Periodontal Regeneration Procedures, Socket Preservation, and Others], End User (Hospitals, Dental Clinics, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Aug 2023

- Report Code : TIPRE00030006

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 215

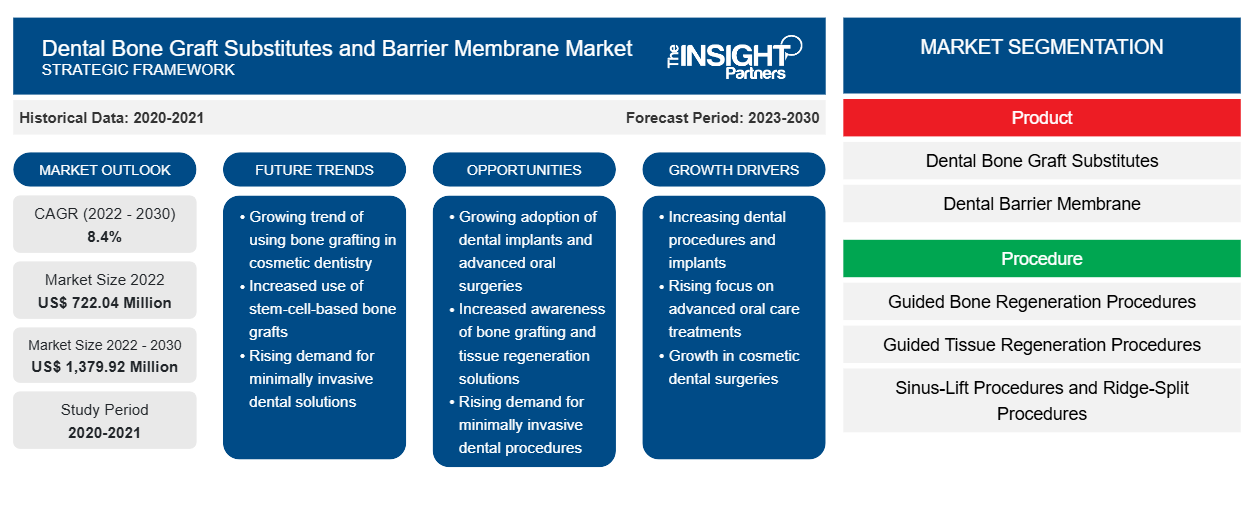

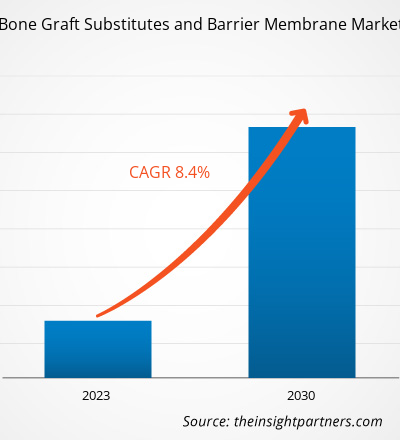

[Research Report] The dental bone graft substitutes and barrier membrane market was valued at US$ 722.04 million in 2022 and is expected to reach US$ 1,379.92 million by 2030; it is estimated to record a CAGR of 8.4% from 2022 to 2030.

Market Insights and Analyst View:

Dental membranes are used for guided tissue regeneration (GTR) and guided bone regeneration (GBR). Different dental membranes are commercially available, and innovative membranes have been developed extensively. Dental barrier membranes are generally required to provide barrier function, biosafety, biocompatibility, and appropriate mechanical properties. In addition, membranes are supposed to be bioactive in nature, promoting tissue regeneration. On the other hand, dental bone graft substitute is a natural or synthetic material, often containing only a mineralized bone matrix with no viable cells. In the near future, alloplastic bone substitutes with safety and standardized quality may be the first choice instead of autologous bone; they may offer new osteoconductive and osteoinductive products with easier handling form and an adequate resorption rate, which can be used with growth factors and/or cell transplantation. Careful selection of alloplastic bone graft products is necessary to achieve favourable outcomes according to each clinical situation. Dental bone graft materials have been commonly used with growth factors and/or barrier membranes in situations such as periodontal regeneration therapies and guided bone regeneration procedures before implant placements. In recent past, these materials have also been applied to bone defects caused by peri-implantitis.

Growth Drivers and Challenges:

According to British Dental Journal, approximately 10–12% of cases of inflammatory maxillary sinus disease are of dental origin. Mostly, these diseases are not only related to pulpal necrosis and periapical disease but also advanced periodontal disease and oro-antral communications following dento-alveolar surgery. Extruded pulp space-filling materials will act as local irritants when displaced into the maxillary sinus, and have predisposed to fungal infections such as aspergillosis. Both autologous bone and various bone substitutes have been studied in the last decades as grafting materials for maxillary sinus floor elevation. Recently, xenogeneic and alloplastic bone substitutes in gel form have been proposed as grafting material for transcrestal sinus floor elevation. These biomaterials are composed of micronized particles (generally up to 300 μm) suspended in an aqueous solution and embedded in a collagen matrix. These biomaterials are easily injectable into the subantral space after performing a crestal access to the sinus cavity through the cortical of the sinus floor. Micronized particles are smooth and do not present sharp or cutting edges, representing a risk factor for sinus membrane tearing during grafting procedures. Additionally, bone substitutes in gel form accidentally dispersed into the sinus cavity could be more easily cleared through the OMC by the ciliary activity due to the pasty consistency and the extremely small dimensions of the particles. Such factors have assisted the growth of the global dental bone graft substitutes and barrier membrane market and is expected to continue to follow a similar trend during the forecast period. Periodontal diseases range from simple gingivitis to serious conditions that cause significant damage to the soft tissues and bones that support teeth; in the worst case, teeth are lost. Periodontal disease is a major public health problem in the US, and many adults in the country currently have some form of this disease. A study published in Cancer Epidemiology, Biomarkers & Prevention, a journal of the American Association for Cancer Research (AACR), showed that periodontal disease is associated with an increased risk of multiple cancers in postmenopausal women. According to the article “The Link between Periodontal Disease and Oral Cancer—A Certainty or a Never-Ending Dilemma” published in the Multidisciplinary Digital Publishing Institute (MDPI), more than 50% population, including 18-year-old adults, in the US has periodontitis, and 75% of the population over 35 has some form of periodontitis. The severity of periodontitis is also variable. According to different studies, 30–50% of these diseases are mild, and 5–15% are severe and generalized.

In the US, a national health interview survey has reported a high prevalence of periodontitis based on oral health assessments; the prevalence of periodontitis among adults older than 30 is estimated at ~47%, rising to 70% in those aged 65 and above. The prevalence of moderate and severe periodontitis, more closely associated with systemic inflammation and the immune response, is significantly high in adults over 65.

Cancer is one of the major public health concerns and the second-leading cause of death in the US. According to the US Department of Health and Human Services, oral cancer accounts for ~3% of cancer cases diagnosed annually in the US. Yearly, ~48,000 people are diagnosed with oral cancer, and ~9,600 succumb to death due to this condition. According to the CDC, mouth and throat cancer cases account for 3% of cancer cases diagnosed annually in the US in 2020. Risk factors for oral cancer include tobacco use, excessive alcohol consumption, and HPV infection. Periodontal disease can lead to resorption and failure of the alveolar bone, loss of periodontal attachment, and loosening and falling of the teeth. Therefore, the treatment of periodontal disease focuses on eliminating the source of infection, stimulating factors, and pays attention to repairing periodontal tissue defects and restoring normal morphology and function. Bone grafting is done for repairing periodontal defects by grafting materials (bone or bone substitutes) to restore the anatomical morphology of the alveolar bone and the function of the periodontal tissue. Therefore, the growing cases of periodontal diseases and oral cancer contribute to the growth of the dental bone graft substitutes and barrier membrane market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDental Bone Graft Substitutes and Barrier Membrane Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global dental bone graft substitutes and barrier membrane market, based on product, is bifurcated into dental bone graft substitutes and dental barrier membrane. Dental bone graft substitutes are segmented into allograft, xenograft, synthetic bone graft, aDental bone graft substitutes are segmented into allograft, xenograft, synthetic bone graft, and others. On the other hand, dental barrier membrane is divided into resorbable membrane and non-resorbable membrane. Based on procedure, the dental bone graft substitutes and barrier membrane market is segmented into guided bone regeneration procedures (GBR), guided tissue regeneration procedures (GTR), sinus-lift procedures and ridge-split procedures, alveolar ridge preservation (ARP), block-graft procedures, periodontal regeneration procedures, socket preservation, and others. Based on end user, the dental bone graft substitutes and barrier membrane market is segmented into hospital, dental clinics, and others. Based on geography, the dental bone graft substitutes and barrier membrane market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The global dental bone graft substitutes and barrier membrane market, based on end user, is segmented into hospitals, dental clinics, and others. In 2022, the dental clinics segment held the largest market share and is expected to register the highest CAGR during the forecast period. In the US, the penetration of dental clinics is more compared to hospitals. Demographically, this may vary slightly in emerging and developing countries, but the penetration or share of dental clinics is more compared to hospitals across the world. According to Express Dentist, in 2021, there were 159,246 dentists licensed for general practice in the US and 10,921 were licensed for orthodontics and dentofacial orthopedics. Rising geriatric population and increasing number of cosmetic dentistry procedures in the US have also assisted the overall market growth and are expected to continue to catalyze the overall dental bone graft substitutes and barrier membrane market during the forecast period.

Regional Analysis:

North America is the dominating region in the dental bone graft substitutes and barrier membrane market. The North America dental bone graft substitutes and barrier membrane market was valued at US$ 293.65 million in 2022 and is projected to reach US$ 552.38 million by 2030; it is expected to register a CAGR of 8.2% during the forecast period. The North America dental bone graft substitutes and barrier membrane market is segmented into the US, Canada, and Mexico. The US captured the largest share in 2022 and is expected to continue with a similar trend during the forecast period. According to the American Dental Association, the demographic of older adults (i.e., 65 years of age and older) is growing and likely will be an increasingly large part of dental practice in the coming years. Dental conditions associated with aging include dry mouth (xerostomia), root and coronal caries, and periodontitis. According to the National Institute of Dental and Craniofacial Research, 30% of adults (i.e., 65 years or older) in the US had total periodontitis, 7.8% with severe periodontitis, and 34.4% with non-severe periodontitis. Such a factor has aided the regional growth of dental bone graft substitutes and barrier membrane market and is expected to continue with a similar trend during the forecast period.

Competitive Landscape and Key Companies:

Dentsply Sirona, Johnson & Johnson, Danaher Corporation, Medtronic, Strauman, Zimmer Dental, Smith & Nephew, Geistlich Pharm, ZimVie Inc., RTI Surgical, and Osteogenics Biomedical are among the leading companies operating in the global dental bone graft substitutes and barrier membrane market.

Among these players, Medtronic and Geistlich Pharm are the top two players owing to the diversified product portfolio offered by them.

Krey Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the dental bone graft substitutes and barrier membrane market. A few recent key market developments are listed below:

- In March 2023, ZimVie Inc. announced the release of its publication 'Comparison of the Effects of Tissue Processing on the Physicochemical Properties of Bone Allografts.' The article was published in The International Journal of Oral & Maxillofacial Implants. The article showed the impact of different tissue processing methods of its products, such as Puros Cancellous Particulate Allograft bone substitute, Creos, OraGraft, and MinerOss.

- In January 2021, Dentsply Sirona announced the acquisition of Datum Dental, Ltd. The acquisition enabled Dentsply Sirona to acquire a strong OSSIX biomaterial portfolio of Datum Dental, Ltd. It has also enabled the acquisition of Datum Dental Ltd's patented technology GLYMATRIX.

The regional trends and factors influencing the Dental Bone Graft Substitutes and Barrier Membrane Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Dental Bone Graft Substitutes and Barrier Membrane Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Dental Bone Graft Substitutes and Barrier Membrane Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 722.04 Million |

| Market Size by 2030 | US$ 1,379.92 Million |

| Global CAGR (2022 - 2030) | 8.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Dental Bone Graft Substitutes and Barrier Membrane Market Players Density: Understanding Its Impact on Business Dynamics

The Dental Bone Graft Substitutes and Barrier Membrane Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Dental Bone Graft Substitutes and Barrier Membrane Market top key players overview

Covid-19 Impact:

The COVID-19 crisis significantly decreased the adoption of dental bone graft substitutes and barrier membranes due to low patient volumes in dental clinics and hospitals. Prominent market participants witnessed a significant drop in their revenues and profit margins during the COVID-19 crisis. The decline in dental visits and delay in elective surgeries directly impacted the bone graft substitutes and dental barrier membrane products market. In short, the demand from end users has declined significantly as key regions and countries imposed social distancing rules and lockdowns to limit the spread of the virus. Thus, the pandemic negatively impacted the market growth of dental bone graft substitutes and barrier membrane. However, the relaxation of regulations in 2022 led to increased admissions in dental hospitals and specialty clinics.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For