Disposable Endoscope Market Share and Forecast by 2031

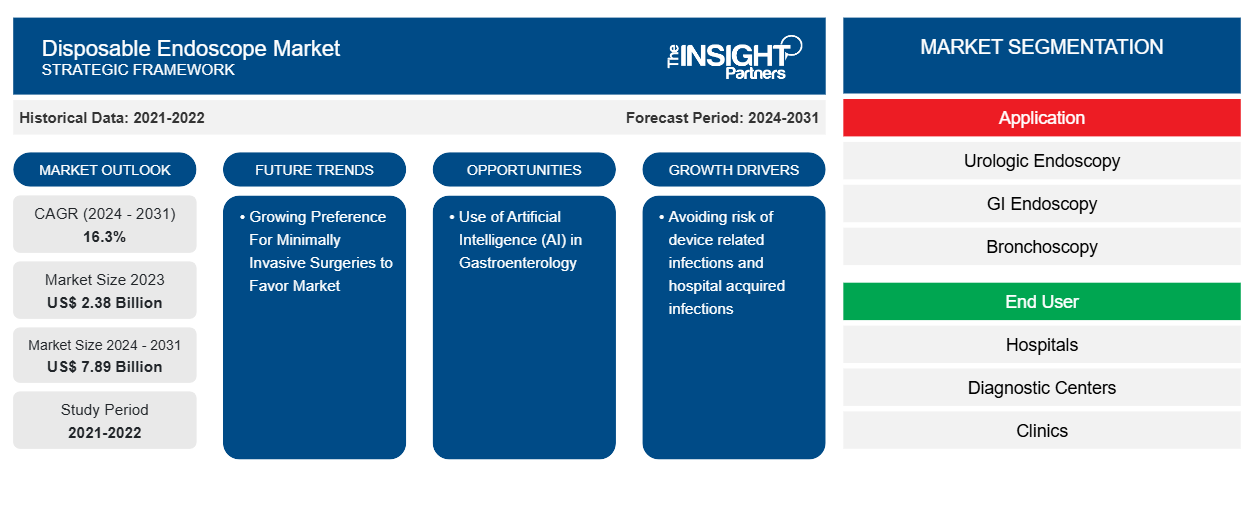

Disposable Endoscope Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Urologic Endoscopy, GI Endoscopy, Bronchoscopy, Arthroscopy, Proctoscopy, and Others), End User (Hospitals, Diagnostic Centers, and Clinics), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Apr 2026

- Report Code : TIPRE00004924

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

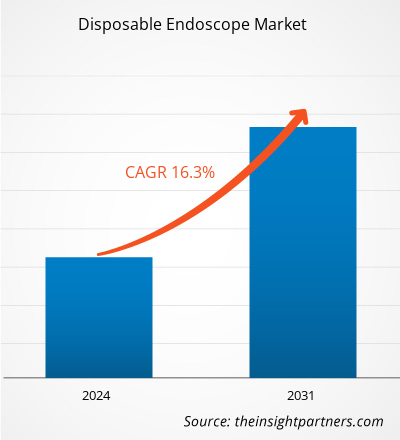

The disposable endoscope market size is projected to reach US$ 7.89 billion by 2031 from US$ 2.38 billion in 2023. The market is expected to register a CAGR of 16.3% during 2024–2031. Avoiding risk of device related infections and hospital acquired infections coupled with favourable government scenario are likely to remain key trends in the market.

Disposable Endoscope Market Analysis

According to a report by the World Health Organization (WHO) on the burden of hospital acquired infections (HAIs) around the world, the rate of HAIs ranges from 3.6 to 12% in high-income countries and from 5.4 to 19.1% in low- and middle-income countries, as of 2022. This led to the use of single- use endospcopic devices in the recent past and is expected to continue a similar trend during the forecast period. Increasing funds and investments by government and other companies is expected to propel the growth of overall disposable endoscope market.

Disposable Endoscope Market Overview

Growing risk of infection transmission with reusable endoscopes has led the growth of disposable endoscope market. According to HHS.gov, as of 2021, about 1 in 31 inpatients have an infection related to hospital care. These infections lead to tens of thousands of deaths and cost the U.S. health care system increased exponentially each year. 6% of hospitalized patients in the 2021 survey had one or more HAI. There were an estimated 887,000 HAIs in U.S. acute care hospitals in 2021. About 90,000 hospital patients with HAIs died during their hospitalizations. Such a factor has resulted in the growth of disposable endoscope market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDisposable Endoscope Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Disposable Endoscope Market Drivers and Opportunities

Growing Preference For Minimally Invasive Surgeries to Favor Market

Minimally Invasive Surgeries (MIS) cause less post-operative pain, so patients receive less painkillers. As minimal cuts or stitches are involved, hospitalization is relatively shorter, and patients need not visit the hospital frequently. People prefer minimally invasive proceduresv to traditional open surgeries involving long incisions made through the muscles. These muscles take a huge amount of time to heal. MIS involves smaller incisions, leading to faster recovery. Also, the body scars involved in MIS are barely noticeable. The main advantage of MIS over conventional open surgeries is the accuracy due to video-assisted equipment, which produces a better and magnified image of the organs or body parts being operated. These surgeries are gaining popularity among the geriatric population due to the relatively shorter recovery time.

According to the article "Anatomic Study of Endoscopic Transnasal Approach to Petrous Apex," published in January 2020, endoscopy systems are commonly used in MIS to find the cause of specific issues and symptoms. Traditionally, most of the space difficult to observe by microscope can be exposed through endoscopic-assisted technology. Endoscopy can flexibly change the angle and observe the surrounding anatomical structure through the natural human foramen. It can provide the surgeon an open visual field and an operation channel without retraction, significantly improving the surgery's quality. Thus, flexible endoscopy systems are mostly preferred by surgeons.

Thus, the major factors leading to the disposable endoscopy market growth are the growing inclination toward minimally invasive surgeries (MIS).

Use of Artificial Intelligence (AI) in Gastroenterology

The application of artificial intelligence (AI) in gastrointestinal (GI) endoscopy is drawing a great amount of attention because it has the potential to improve the quality of endoscopy at all levels, compensating for human errors and limitations by bringing more accuracy, consistency, and higher speed. It will make a breakthrough and a big revolution in the development of GI endoscopy. AI has the advantage of limiting inter-operator variability. It can compensate for the limited experience of novice endoscopists and the errors of even the most experienced endoscopists. Over the past four decades, the incidence of esophageal adenocarcinoma (EAC) has risen rapidly due to the increasingly prevalent excess body weight. AI assistance shows promising results in terms of improving the detection and diagnosis of esophageal adenocarcinoma (EAC), thus, reducing the mortality and morbidity related to this type of malignancy with a poor prognosis when diagnosed at an advanced stage.

The Canadian Association of Gastroenterology (CAG) has formed a special interest group (SIG) in AI to further develop and promote the use of AI. This CAG AI SIG core group comprises six gastroenterologists from five Canadian institutions across three provinces. They have started evaluating AI technologies using cohort studies and randomized controlled trials. They are in the process of establishing video and data biobanks to accrue raw data from which additional novel AI solutions can be created. Further activities of group members include developing and implementing AI curricula since the next generation of gastroenterologists needs to be trained to develop and implement AI solutions at institutions across Canada. The CAG AI SIG has an open model inviting new members, and AI researchers to maximize this novel technology's potential in improving endoscopy quality and patient outcomes.

Recently, a few AI-driven endoscopy products were approved in Canada. For instance, in November 2021, Medtronic Canada ULC, a subsidiary of Medtronic plc, announced that it had received a Health Canada license for the GI Genius intelligent endoscopy module. GI Genius is a computer-aided detection (CADe) system that uses artificial intelligence (AI) to highlight regions of the colon suspected to have visual characteristics consistent with different types of mucosal abnormalities. Hence, the use of artificial intelligence (AI) in gastroenterology is likely to propel the growth of endoscopy procedures, which will in turn increase the demand of disposable endoscope.

Disposable Endoscope Market Report Segmentation Analysis

Key segments that contributed to the derivation of the disposable endoscope market analysis are application and end user.

- Based on application, the disposable endoscope market is segmented into urologic endoscopy, gastrointestinal endoscopy, bronchoscopy, arthroscopy, proctoscopy, and others. The gastrointestinal endoscopy segment held the largest market share in 2023.

- By end user, the disposable endoscope market is segmented into hospitals, diagnostic centers, and clinics. The hospitals segment held the largest share of the market in 2023.

Disposable Endoscope Market Share Analysis by Geography

The geographic scope of the disposable endoscope market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the disposable endoscope market. Incresaing number of hospitals acquired infections in the United States and favourable regulatory scenario has led the growth of regional market. Asia Pacific region is anticipated to grow with the highest CAGR in the coming years.

Disposable Endoscope

Disposable Endoscope Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.38 Billion |

| Market Size by 2031 | US$ 7.89 Billion |

| Global CAGR (2024 - 2031) | 16.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Disposable Endoscope Market Players Density: Understanding Its Impact on Business Dynamics

The Disposable Endoscope Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Disposable Endoscope Market News and Recent Developments

The disposable endoscope market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the disposable endoscope market are listed below:

- Keio University and Air Water Inc. developed the ultra-fine rigid endoscope utilizing graded-index plastic optical fiber (GI-POF) technology. The endoscope has a GI-POF lens tip which can transmit images from inside the body to the outside of the body. GI-POF lenses can be fabricated with outer diameters as thin as 0.1mm to 0.5mm, allowing minimally invasive (less physically taxing for patients) observation of the inside of joints. Furthermore, the low cost of production allows for lenses to be single-use (disposable) like syringe needles. (Source: AIR WATER INC, News Releases, May 2023)

- PENTAX Medical Europe, one of the leading companies in the endoscopic field, obtained a CE mark for its new single-use bronchoscope named as PENTAX Medical ONE Pulmo. This product provides high quality care without compromise in pulmonary care. The PENTAX Medical ONE Pulmo is a single-use bronchoscope with superior suction power and HD image quality. (Source: PENTAX Medical Europe, Press Release, May 2021)

Disposable Endoscope Market Report Coverage and Deliverables

The “Disposable Endoscope Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Disposable endoscope market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Disposable endoscope market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Disposable endoscope market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the disposable endoscope market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For