Dust Control or Suppression Chemicals Market Analysis, Size, and Share by 2030

Dust Control or Suppression Chemicals Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Chemical Type (Lignin Sulfonate, Calcium Chloride, Magnesium Chloride, Asphalt Emulsions, Oil Emulsions, Polymeric Emulsions, and Others) and End-Use Industry (Mining, Construction, Oil & Gas, Food & Beverage, Textile, Glass & Ceramics, Pharmaceuticals, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPRE00005630

- Category : Chemicals and Materials

- No. of Pages : 185

- Available Report Formats :

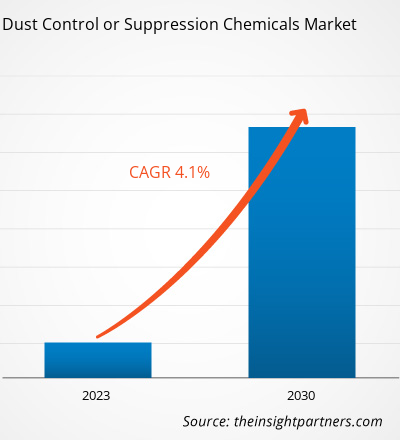

[Research Report] The dust control or suppression chemicals market size is expected to grow from US$ 1,212.12 million in 2022 to US$ 1,675.13 million by 2030; it is estimated to register a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

In heavy industries that generate large quantities of dust, such as fugitive dust to larger-sized dust particles, dust control and dust suppression are very important. Using dust control or dust suppression methods is very important as dust can cause extreme personal health and environmental issues If it is not controlled. It also poses an explosion threat. For effective dust suppression and dust control, there are various methods and equipment used. Different dust control or suppression chemicals are lignin sulfonate, calcium chloride, magnesium chloride, asphalt emulsions, oil emulsions, polymeric emulsions, sodium chloride, enzymes, acids, specialty products, and many others. Dust control or suppression chemicals find application in many industries, such as mining, construction, oil & gas, food & beverage, textile, glass & ceramics, pharmaceuticals, agriculture, metal processing, chemicals, woodworking, and power generation. Mining, oil & gas, and construction are among the major industries for dust control or suppression chemicals. In the mining industry, both surface and underground mining operations generate dust during the extraction and processing of minerals.

Growth Drivers and Challenges:

The major factor driving the global dust control or suppression chemicals market growth is the growing mining and oil & gas industry. According to the International Trade Administration, Brazil generated 62% higher revenue from the mining sector in 2021 compared to 2020. Brazil is among the top producers of iron ore, manganese, bauxite, and tantalite. The country's mining sector also includes reserves of gold, kaolin, nickel, coal, and phosphates. Further, Vale, a Rio de Janeiro-based mining company, is one of the largest iron ore producers and mining companies in Brazil.

The Middle East has many oil-producing countries, with the presence of the largest oil producers in Saudi Arabia, Iraq, and the UAE. Saudi Arabia possesses nearly 17% of the world's proven petroleum reserves, according to the Organization of the Petroleum Exporting Countries. The oil & gas sector of Saudi Arabia accounts for ~50% of gross domestic product and ~70% of export earnings. In the UAE, nearly 30% of the country's GDP is directly based on oil and gas output. A huge demand for dust control or suppression chemicals in these countries is due to the strong presence of the oil & gas industry. In addition, to meet rising energy demand due to the booming population, various oil-producing companies are spending more on increasing oil production, further creating demand for dust control or suppression chemicals.

The availability of alternatives in the market is constantly rising, which is further expected to restrain the dust control or suppression chemicals market growth. Several alternatives, such as water and vegetable oil, are available in the market. Water is the most effective and eco-friendly dust suppressant. However, the application of water as a dust suppressant can be challenging in areas with limited water resources. Several dust suppressant alternatives are more environmentally friendly than conventional dust control chemicals. There is also scope for internal substitution in the market. For instance, calcium magnesium acetate is used to attract moisture to the surface of soil, which helps to prevent dust generation. Calcium magnesium acetate is a cost-effective and less corrosive dust control solution compared to sodium chloride.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDust Control or Suppression Chemicals Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Dust Control or Suppression Chemicals Market" is segmented on the basis of chemical type, end-use industry, and geography. Based on chemical type, the market is segmented into lignin sulfonate, calcium chloride, magnesium chloride, asphalt emulsions, oil emulsions, polymeric emulsions, and others. By end-use industry, the market is segmented into mining, construction, oil & gas, food & beverage, textile, glass & ceramics, pharmaceuticals, and others. The market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on chemical type, the dust control or suppression chemicals market is segmented into lignin sulfonate, calcium chloride, magnesium chloride, asphalt emulsions, oil emulsions, polymeric emulsions, and others. The calcium chloride segment held a significant market share in 2022, and the market for the segment is expected to grow significantly from 2022 to 2030. Calcium chloride is extensively used to control dust on unpaved roads and construction sites. It can also be used to control dust in indoor environments such as warehouses and factories. Dry calcium chloride can be applied to surfaces using a spreader truck or manually. It is also applied in liquid form to the road surface using a water truck or spray bar. The calcium chloride solution penetrates the surface when sprayed on the road and binds the dust particles. Lignin sulfonate is also one of the major chemical types in the market. Lignin sulfonate is a natural polymer derived from wood pulp and is used as a dust suppression chemical. Lignin sulfonate is mixed with water and applied to dusty surfaces, such as unpaved roads and construction sites. It binds with fine particles and helps them weigh down, reducing suspended dust particles. Lignin sulfonate is an environment-friendly option compared to synthetic dust control agents. Lignin sulfonate is also cost-effective compared to other dust control alternatives, making it an economical choice for several industries. It helps to stabilize loose soils and gravel, enhancing the overall stability of surfaces.

Regional Analysis:

Based on geography, the dust control or suppression chemicals market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global market, and the regional market accounted for ~US$ 350 million in 2022. Asia Pacific is witnessing urbanization and the rising construction of commercial and residential projects. Additionally, the per capita income in the region has been increasing, coupled with the development of affordable residential buildings. The increasing expansion of foreign companies in Asia Pacific has created a demand for new offices, production houses, and buildings, thereby driving the construction sector in the region. Thus, the growing construction industry in the region boosts the demand for dust-suppressant chemicals. The Middle East & Africa is another major contributor, holding more than 20% of the global market share. The countries in the Middle East & Africa are rapidly developing their public infrastructure, including airports, hospitals, and administrative buildings. The construction of the commercial infrastructure sector in the region has upsurged due to the rising tourism industry and the growing immigrant population. Dust suppressant chemicals are used to minimize the air pollution caused in the construction industry.

Industry Developments and Future Opportunities:

The following initiatives are taken by the key players operating in the dust control or suppression chemicals market:

- In March 2021, Dow Inc. signed an agreement with the Zhanjiang Economic and Technological Development Zone Administrative Committee to establish the Dow South China Specialties Hub. This multi-year project will provide customers with local access to Dow's portfolio of high-value products and innovative technologies.

- In October 2023, Solenis LLC acquired CedarChem LLC. The acquisition is consistent with Solenis' direct go-to-market strategy of improving chemical and wastewater treatment product and service offerings for clients.

- In July 2023, Solenis LLC acquired Diversey Holdings Ltd. Solenis has expanded to a global corporation with 71 manufacturing facilities and over 15,000 people after the acquisition. Solenis is now a more diversified firm with a much-enhanced scale, a broader worldwide reach, and the capacity to offer a "one-stop shop" suite of solutions that match client demand while also addressing global water management, cleaning, and hygiene challenges.

- In 2020, Midwest Industrial Supply launched a synthetic fluid plus polymeric binder system to improve dust control in hard-rock underground mines.

- In 2021, BioBlend launched a high-performance, environmentally responsible product – EPIC EL Dust Suppressant. The product is a premier soy-based dust control product designed with their powerful proprietary Ester Link technology, providing superior fugitive particle (dust) control while also being friendly to the environment, including waterways, agriculture, wildlife, and humans.

COVID-19 Pandemic Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units of companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. The negative impact of the pandemic on the growth of industries such as construction, oil & gas, mining, food processing, and others reduced the demand for dust control or suppression chemicals.

Various industries are coming on track as supply constraints affecting these industries are resolving gradually. Moreover, the rising demand for dust control or suppression chemicals from various industries substantially promotes the dust control or suppression chemicals.

Dust Control or Suppression Chemicals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.21 Billion |

| Market Size by 2030 | US$ 1.68 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Chemical Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Dust Control or Suppression Chemicals Market Players Density: Understanding Its Impact on Business Dynamics

The Dust Control or Suppression Chemicals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

Beneficent Technology Inc., Veolia Environnement SA, Ecolab Inc., Quaker Chemical Corp, Dow Inc., BASF SE, Solenis LLC, Borregaard ASA, LignoStar, and Cargill Incorporated are a few players operating in the global dust control or suppression chemicals market. Players operating in the global market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansion, partnerships, and collaboration in order to stay competitive in the market.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For