Electronic Signature Software Market Share, Growth & Forecast 2025-2031

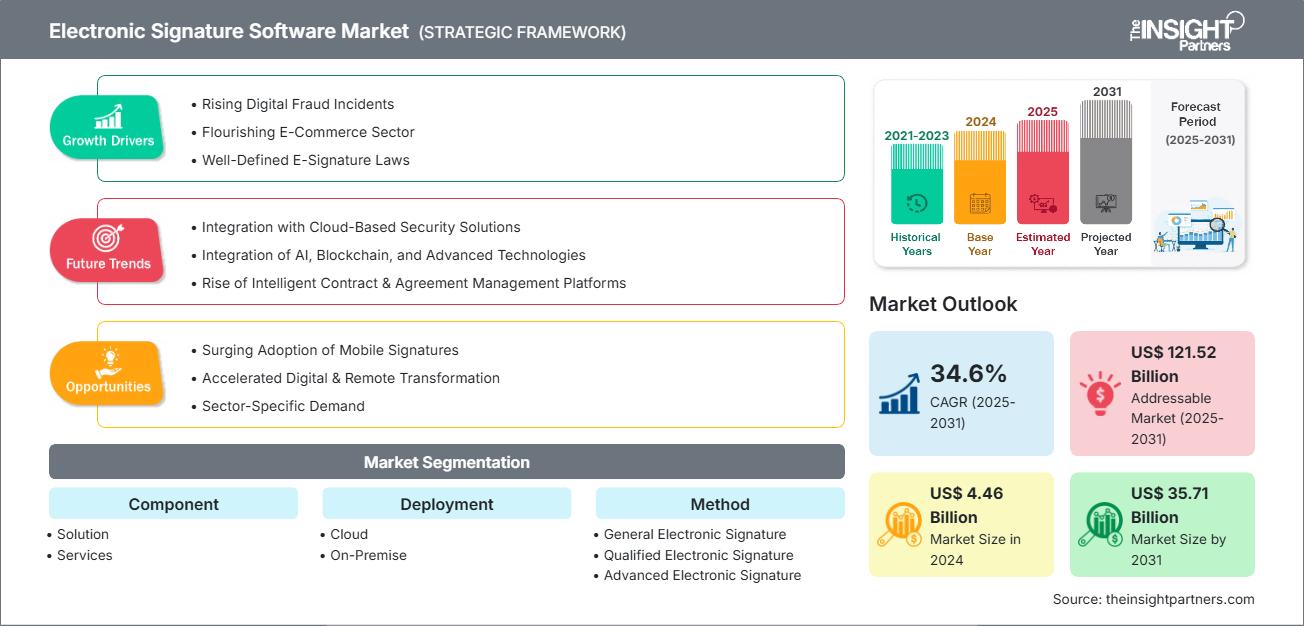

Electronic Signature Software Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Component (Solution and Services), Deployment (Cloud and On-Premise), Method (General Electronic Signature, Qualified Electronic Signature, and Advanced Electronic Signature), End User (Manufacturing, BFSI, Pharmaceuticals, Government Agencies, Legal, and Others), and Region (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Sep 2025

- Report Code : TIPTE100000939

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 249

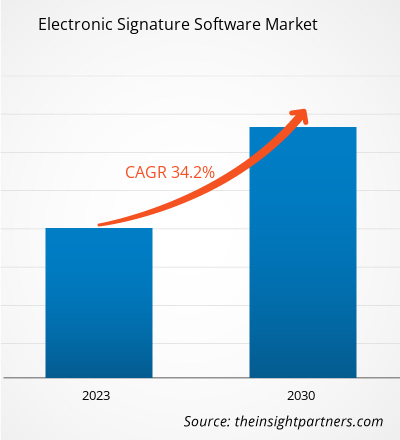

The electronic signature software market size was valued at US$ 4.46 billion in 2024 and is projected to reach US$ 35.71 billion by 2031. The market is expected to register a CAGR of 34.6% during 2025–2031.

Electronic Signature Software Market Analysis

Rising electronic fraud cases, the booming e-commerce industry, and the increased focus on e-signature legislation fuel the growth of the electronic signature software market. The market is likely to expand in the forecast period as a result of the passage of e-signature regulations and growing adoption of mobile signatures. Integration with cloud-based security platforms is becoming an important trend in the market. Nonetheless, restrictions on document and recipient settings inhibit the electronic signature software market development.

Electronic Signature Software Market Overview

An electronic signature is a digital signature governed by a legal standard that provides the greatest comfort when verifying identity and securely associating a signature to the signed document. It employs Public Key Infrastructure (PKI) standards to ensure the highest level of security, which is why it is widely used as a trusted technology for authenticating digital transactions. Electronic signatures are used in various industries including finance, software distribution, and contract management; thus preserving the authenticity of documents, preventing forgery or tampering.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONElectronic Signature Software Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electronic Signature Software Market Drivers and Opportunities

Market Drivers:

- Rising Digital Fraud Incidents: In North America, losses due to digital payment fraud surpassed US$12 billion in 2023, with credit card fraud being the most common fraud type. In all three reviewed time periods, credit-transfer and card-payment frauds were most prevalent with regards to payment frauds. The primary means of accomplishing these unlawful acts are through the use of social engineering techniques that trick individuals into giving their consent for these bogus payments to be made. Additionally, frauds where individuals divulge account information - compromised credentials fraud - is also increasing. While these are two relatively different fraud types, the increase in frauds overall is evidence of a shift in fraud typology, moving from fraud based on digital payment fraud, to now scams directed at trolling someone for their vulnerabilities and flaws, exploiting humans, rather than exploiting weaknesses in digital payment systems. As number of scams worldwide is increases in frequency and sophistication, financial institutions will increasingly face complexity.

- Flourishing E-Commerce Sector: There has been a steady increase in business to business (B2B) e-commerce all over the globe. The region’s continued digital transformation, with more and more firms incorporating e-commerce systems to increase operational efficiency, optimize supply chains, and enhance customer service, has been driving this momentum. According to the Census Bureau of the Department of Commerce, US retail e-commerce sales in the second quarter of 2025 was 304.2 billion USD. This figure will seasonally be adjusted, having a 1.4% (±0.9%) increase from the first quarter of 2025. The rapid growth of B2B e-commerce has changed the mode of transacting business, and most firms now prefer transacting through the internet because it is convenient, scalable, and inexpensive. Multinational organizations have laminated policies in regard to any threats posed by cyber attacks and fraud in the increasing torrent of online exchanges, even to the point of apprehending and committing resources for powerful electronic signatures to confirm the legitimacy of entrusted online contracts for agreement's integrity, authenticity and non-repudiation.

- Well-Defined E-Signature Laws: Legally defined and formulated policies shall promote and use the international network for electronic signatures to travel across borders. Moreover, electronic signature providers can position themselves with a focus on security, compliance, and cross border interoperability as leaders in digital transformation. The eIDAS – European Union Regulatory No. 910/2014 – provides a legal framework that allows for electronic identification and trust services throughout the European Union (EU). The eIDAS scope means ensuring that the qualified electronic signature (QES) - legally equivalent to a handwritten signature - meets strict security and authenticity standards.

Market Opportunities:

- Surging Adoption of Mobile Signatures: Mobile signatures are becoming increasingly popular worldwide as consumers are highly use mobile devices for transactions and communications. They are convenient by enabling users to sign documents while on the move without a computer desktop, or printing facilities. They also contribute to efficiency as electronic signatures take very little time to complete, eliminating the use of paperwork. Mobile signatures also enable accessibility, allowing people to sign anywhere at any time without physical meetings or stamps.

- Accelerated Digital & Remote Transformation: The digital transformation with remote working options has, and, remotely working systems have, strongly advanced the requirement pertaining to electronic signature software across verticals. To enhance organizational efficiency and ease of operations, companies pursue systems that provide uninterrupted workflow without regard to physical location. Increasingly, electronic signature platforms provide geo-agnostic legally binding electronic approvals without transactional documents which is a paradigm shift for many businesses.

- Sector-Specific Demand: Industry spesific demand has become a leading reason for growth for e-signature software and its usage across high volume documentation industries. Industries like banking, healthcare, and the legal and governmental sectors, have a need to transaction sensitive information in a secure and compliant way. These industries have a multifaceted compliance and regulatory environment set in place such as the ESIGN act, UETA, HIPAA, and GDPR that set the terms for the management of sensitive data and real-time identity verification, data authentication, and sustained identity verification for sensitive and complex documents.

Electronic Signature Software Market Report Segmentation Analysis

The electronic signature software market is divided into different segments to get information about its growth potential and the latest trends. Below is the standard segmentation approach used in industry reports:

By Deployment:

- On-Premise: On-premise deployments provide a significant advantage for electronic signature software industry by allowing organizations to retain their processes and current internal systems. The on-premise electronic signature software is licensed to the client with a single license and deployed on the client's local server. On-premise electronic signature software is preferred by organizations that have a strong dislike to share their data with any other organization.

- Cloud: In the cloud deployment model, the information is stored on the vendors' servers, as it helps clients to offload the cost of an IT infrastructure and lower the operational cost of the solution. All clients on cloud share the same pool of infrastructure, via security protections, flexible configuration, and access variability.

By Offerings:

- Solution: Communication is on the rise at a high speed, typically involving sensitive information that can easily be targeted by malicious groups. The electronic signature solution enables customers to handle communications electronically and orchestrate processes. This require electronics signatures for document approvals, contract signing, and deals. Growing digitalization increases the demand for digital or e-signatures signature solutions for completion of transactions is fueling the segment.

- Service: Digital signature service secures business requirements and guarantees privacy, security, and enforceability of the transaction. Various vendors offer end-to-end services and send the document to the individuals who need to sign it. The providers of the services also provide an automatic reminders feature, which can be sent to individuals to remind them to sign.

Method:

- General Electronic Signature

- Qualified Electronic Signature

- Advanced Electronic Signature

End User:

- Manufacturing

- BFSI

- Pharmaceuticals

- Government Agencies

- Legal

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The North America’s electronic signature software market is significantly growing due to ongoing technological innovation. Numerous service providers of electronic signature software reside in North America and the region has also witnessed several efforts in favor of the deployment of electronic signature technology. For instance. the USAID in Octobr 2021 initiated an elecronic signature sprocess which aims to stream line the signing and document management workflow for enhanced security.

Electronic Signature Software Market Regional InsightsThe regional trends and factors influencing the Electronic Signature Software Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Electronic Signature Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Electronic Signature Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 4.46 Billion |

| Market Size by 2031 | US$ 35.71 Billion |

| Global CAGR (2025 - 2031) | 34.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Electronic Signature Software Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Signature Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Electronic Signature Software Market top key players overview

Electronic Signature Software Market Share Analysis by Geography

The rapid growth in the electronic signature software market in Europe due to the presence of multiple big players throughout Europe. These players are working together to enhance capabilities and provide seamless integration. For instance, in in May 2023, DocuSign and ZealiD, an approved EU digital identity and electronic signature firm, furthered their partnership for a third year. This partnership supports the co-selling efforts of both companies and fulfills broad customer demand by allowing the resale of DocuSign’s ZealiD app to new and existing customers. The alliance has added functionalities and provided seamless integration of ZealiD's Qualified Electronic Signature (QES) into the DocuSign platform, providing an end-to-end and secure solution for remote signature and identity authentication.

The electronic signature software market growth differs in each region owing to digital transformation, technological advancements, and industrial expansion. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a major share of the electronic signature software market

-

Key Drivers:

- Investments in cybersecurity and authentication technologies are increasing

- Strong legal framework supporting electronic document usage

- Widespread cloud integration among enterprise users

- Trends: Growing demand for remote work and transactions

2. Europe

- Market Share: Substantial share

-

Key Drivers:

- Digital transformation initiatives by the government and businesses

- Cross-border transactions need secure signature solutions

- GDPR compliance enhances secure digital document handling

- Trends: Rising fintech and insurtech demand digital documentation

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Rapid smartphone and internet penetration across markets

- Government digital initiatives such as India's Digital India

- Expanding e-commerce requires efficient transaction systems

- Trends: Cloud-based solutions preferred due to scalability needs

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Increasing mobile usage for business and communication

- Emerging tech startups demand digital process solutions

- Push for paperless workflows in growing economies

- Trends: Regulatory support for digital signatures is expanding steadily

5. Middle East and Africa

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Digital government initiatives are driving tech market expansion

- Rising smartphone use facilitates digital signature platforms

- Cloud infrastructure development enables software growth

- Trends: Business modernization spurred by foreign tech investments

Electronic Signature Software Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Adobe Inc, Yousign SAS, DocuSign Inc., Sproof GmbH, and EDICOM. In addition, regional and specialized vendors such as Zoho Corp Pvt Ltd, SIGNABLE LTD, secrypt GmbH, D-Trust GmbH, and Aruba S.p.A. contribute to a dynamic and competitive landscape. This high level of competition urges companies to stand out by offering:

This high level of competition urges companies to stand out by offering:

- Advanced AI-driven document automation and fraud detection features

- Interoperability with widely used enterprise software platforms (CRM, ERP, cloud storage, and productivity tools)

- Compliance-centric features addressing regulations such as eIDAS, GDPR, HIPAA, and ESIGN/UETA

- Support for remote identity verification and secure multi-factor authentication

- Personalized user experiences through machine learning-based workflow optimization and smart template recommendations

Opportunities and Strategic Moves

- Strategic partnerships with legal tech providers, cloud service platforms, and compliance consultants are enhancing solution offerings and ensuring adherence to global e-signature regulations such as eIDAS (EU), ESIGN Act, and UETA (US).

- Adoption of e-signature platforms is accelerating across sectors such as finance, real estate, healthcare, and government, driven by remote work trends, demand for paperless workflows, and increased need for secure digital transaction management.

- Expansion into emerging markets (Asia Pacific, Middle East, Latin America) offers significant growth opportunities due to increasing digital transformation, mobile device adoption, and evolving regulatory frameworks favoring electronic documentation.

- Research and Development investments in biometric authentication, blockchain for audit trails, and AI for identity verification are advancing the security, trust, and compliance of e-signature platforms.

- Integration with Document Management Systems (DMS), Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), and cloud storage solutions enhances workflow automation, improves user experience, and streamlines document lifecycle management.

Major Companies operating in the electronic signature software market are:

- Adobe Inc (United States)

- Yousign SAS (France)

- Zoho Corp Pvt Ltd (India)

- DocuSign Inc. (United States)

- Sproof GmbH (Germany)

- EDICOM (Spain)

- SIGNABLE LTD (United Kingdom)

- secrypt GmbH (Germany)

- D-Trust GmbH (Germany)

- Aruba S.p.A. (Italy)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- PandaDoc

- SignNow (by airSlate)

- HelloSign (Dropbox Sign)

- SignRequest

- SignEasy

- SignWell

- Dropbox Sign

- Nintex eSign (formerly AssureSign)

- BoldSign

- ReadySign

Electronic Signature Software Market News and Recent Developments

- Zoho Sign New Features In February 2025, Zoho Corp Pvt Ltd updated the Zoho Sign. The newly updated Zoho Sign app for Android contains a wider interface and a range of menu options. It also supports multi-login and payment signer fields. Zoho Sign has now added support for the following providers and eID procedures in generating qualified electronic signatures (QES) and advanced electronic signatures (AES) via eID-based signer authentication - certME (Romania), Adacom One-Shot, Intesi (Finland) for qualified electronic signatures, and GSE Gestión de Seguridad Electrónica (Colombia), MSC TrustGate (Malaysia), SerproID (Brazil), and TrustAsia (China) for advanced electronic signatures. This service incurs additional costs based on the provider/eID procedure chosen. Both users of Zoho Sign and external signers can use this integration.

- Abode Introduced Acrobat Sign's Next-Generation e-sign Experience In December 2024, Abode launched Acrobat Sign's next-generation e-signing experience. Traditionally, e-signature platforms render agreements as images, which causes significant problems for users. In contrast, our new e-signing experience, built on Acrobat's trusted global standard PDF viewer, renders the agreement as a native PDF. This unlocks major improvements in two key areas of the e-signing experience: streamlining agreement completion across mobile and desktop, and improving accessibility.

- itAgile and Docusign Power Digital Signature: An Explosive Silver Partnership In July 2024, itAgile and Docusign consolidated their explosive partnership to advance the digital signature revolution. itAgile, an Italian excellence in agile paperless solutions, strengthened its ten-year relationship with DocuSign, the global digital signature giant. They improve integrated qualified digital signature solutions every day to transform the way companies manage their processes.

Electronic Signature Software Market Report Coverage and Deliverables

The "Electronic Signature Software Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Electronic signature software market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electronic signature software market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Electronic signature software market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electronic signature software market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For