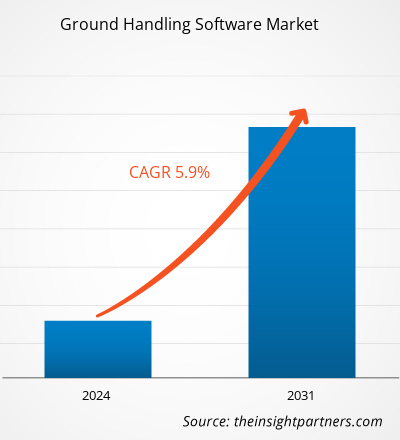

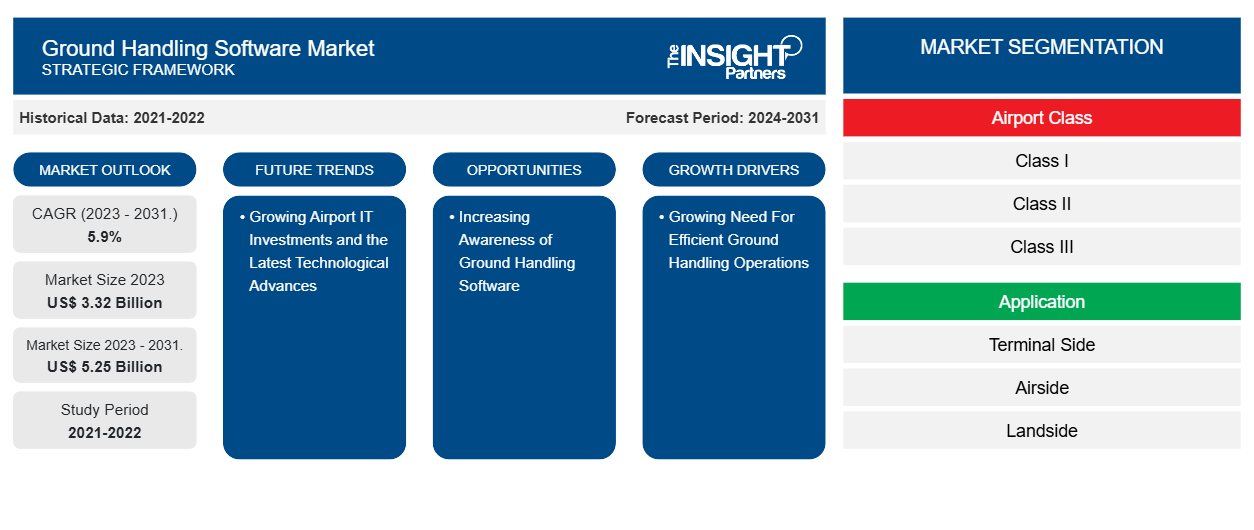

Si prevede che la dimensione del mercato del software di assistenza a terra raggiungerà i 5,25 miliardi di dollari entro il 2031, rispetto ai 3,32 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 5,9% nel periodo 2023-2031. I crescenti investimenti IT aeroportuali e gli ultimi progressi tecnologici rimarranno probabilmente una tendenza chiave nel mercato.

Analisi di mercato del software di assistenza a terra

La domanda di software per la gestione a terra è in continuo aumento a causa delle innovazioni tecnologiche e del desiderio di operazioni aeroportuali efficienti. L'implementazione di sistemi digitali che includono automazione, analisi dei dati e cloud computing per ottimizzare le procedure di gestione a terra è in aumento. Inoltre, la spinta verso l'iniezione di nuove tecnologie e sistemi operativi nel settore è sollecitata da un ambiente normativo di sicurezza rigoroso e da un'interazione self-service dei passeggeri accresciuta.

Panoramica del mercato del software di assistenza a terra

Il software di ground handling è un sistema che consente di fornire a terra tutti i servizi svolti sull'aereo in modo rapido e nel miglior modo possibile. Includono cose come rifornimento, catering, movimentazione bagagli e manutenzione dell'aeromobile. Il software di ground handling è la misura definitiva che ha fornito ai fornitori di servizi come carburante extra e velocità di crociera extra, che sono cruciali per ridurre i tempi di turnaround dell'aeromobile e quindi aumentare i ricavi.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato del software di assistenza a terra

Crescente necessità di operazioni di assistenza a terra efficienti

La crescente domanda di una gestione efficiente delle operazioni di terra negli aeroporti è guidata dalla necessità di ridurre i costi operativi e migliorare la soddisfazione del cliente. Con gli aeroporti che stanno vivendo un allarmante aumento della congestione, le compagnie aeree stanno attualmente cercando modi per ridurre i tempi di turnaround, migliorare l'accuratezza delle operazioni di movimentazione e ridurre i ritardi. Il software di movimentazione a terra è la soluzione che consente alle compagnie aeree di gestire le attività di terra con facilità, riducendo così i costi operativi e migliorando l'esperienza del cliente. La tecnologia semplifica le procedure coinvolte nella movimentazione e aiuta una compagnia aerea a prepararsi in anticipo per le avversità del crescente traffico aereo in un ambiente operativo altamente efficace e orientato al cliente.

Aumentare la consapevolezza del software di assistenza a terra

La consapevolezza in rapida crescita dei vantaggi che il software di assistenza a terra può portare all'adozione dell'automazione e della tecnologia nelle operazioni di assistenza a terra continua ad aumentare. Comprendendo la competitività di un settore, le compagnie aeree cercano modi per migliorare la produttività operativa riducendo al contempo i costi, essendo sensibili al prezzo. Il software di assistenza a terra fornisce alle compagnie aeree i mezzi per automatizzare la maggior parte delle loro operazioni di assistenza a terra; questo, quindi, riduce i costi generali e migliora l'efficienza operativa. La crescente consapevolezza di questi vantaggi alimenta effettivamente il tasso di adozione del software di assistenza a terra negli aeroporti.

Analisi della segmentazione del rapporto di mercato del software di assistenza a terra

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato del software di assistenza a terra sono la classe di aeroporto, l'applicazione e il tipo di software.

- In base alla classe aeroportuale, il mercato è segmentato in Classe I, Classe II, Classe III e Classe IV. Il segmento Classe I ha detenuto una quota di mercato significativa nel 2023.

- In termini di applicazione, il mercato è segmentato in terminal side, airside e landside. Il segmento terminal side ha detenuto una quota di mercato significativa nel 2023.airside, and landside. The terminal side segment held a significant market share in 2023.

- In base al tipo di software, il mercato è segmentato in controllo di imbarco e partenza passeggeri, gestione bagagli, controllo automatizzato di merci e carichi, tracciamento GSE (telemetria) e gestione rampa. Il segmento di gestione bagagli ha detenuto una quota di mercato significativa nel 2023.GSE tracking (telemetry), and ramp management. The baggage management segment held a significant market share in 2023.

Analisi della quota di mercato del software di assistenza a terra per area geografica

L'ambito geografico del rapporto sul mercato del software per l'assistenza a terra è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, e Sud e Centro America.

Il mercato del software di assistenza a terra del Nord America sta crescendo rapidamente a causa della crescente domanda di soluzioni di assistenza a terra efficienti e convenienti da parte di varie compagnie aeree e aeroporti. Questa regione ospita la maggior parte delle più grandi compagnie aeree e aeroporti del mondo, che stanno investendo molto in software di assistenza a terra per apportare miglioramenti nell'efficienza operativa e nella riduzione dei costi. I fornitori di software di assistenza a terra nella regione sono aumentati, motivando così la concorrenza e l'innovazione. Nel complesso, la crescita del mercato del software di assistenza a terra del Nord America è forte, sostenuta dalla crescente domanda da parte di compagnie aeree e aeroporti di soluzioni di assistenza a terra efficienti e convenienti, dall'aumento dei fornitori di software di assistenza a terra e dall'adozione di soluzioni basate su cloud.

Approfondimenti regionali sul mercato del software di assistenza a terra

Le tendenze regionali e i fattori che influenzano il mercato del software di assistenza a terra durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato del software di assistenza a terra in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato del software di assistenza a terra

Ambito del rapporto di mercato sul software di assistenza a terra

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 3,32 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 5,25 miliardi di dollari USA |

| CAGR globale (2023 - 2031.) | 5,9% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per classe di aeroporto

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei player del mercato del software di assistenza a terra: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del software di Ground Handling sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato del software per l'assistenza a terra sono:

- Società a responsabilità limitata

- Avtura limitata

- Damarel Systems International Ltd.

- INFORMA GmbH

- Soluzioni per l'aviazione quantistica

- Quonesto

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato del software di assistenza a terra

Notizie di mercato e sviluppi recenti del software di assistenza a terra

Il mercato del software di ground handling viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato del software di ground handling:

- Menzies Aviation, il principale partner di servizi per aeroporti e compagnie aeree di tutto il mondo, insieme alla società leader di servizi tecnologici e consulenza Wipro, ha annunciato il lancio con successo del suo nuovo sistema di gestione del carico Menzies Aviation Cargo Handling (MACH).

(Fonte: Menzies Aviation Limited, sito Web aziendale, dicembre 2023)

Copertura e risultati del rapporto di mercato del software di assistenza a terra

Il rapporto "Dimensioni e previsioni del mercato del software di assistenza a terra (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato del software di assistenza a terra a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Tendenze del mercato del software di assistenza a terra e dinamiche di mercato come conducenti, vincoli e opportunità chiave

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi di mercato del software di assistenza a terra che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato del software di assistenza a terra

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato del software di assistenza a terra

Ottieni un campione gratuito per - Mercato del software di assistenza a terra