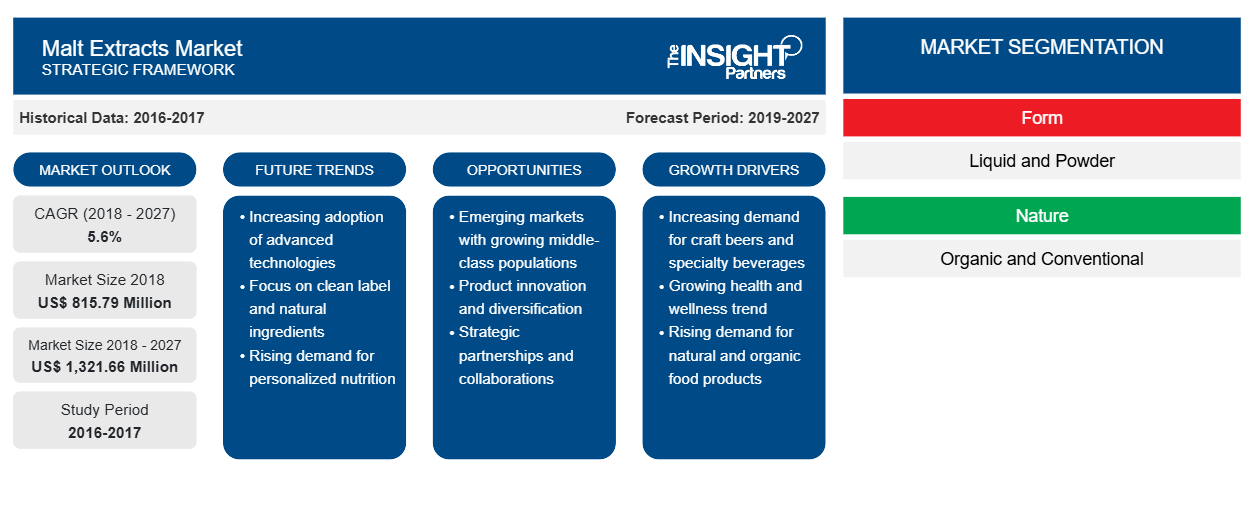

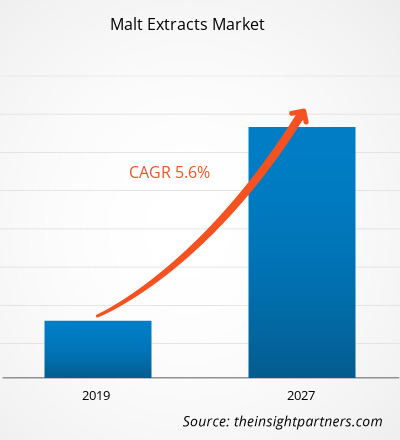

[Research Report] The malt extracts market was valued at US$ 815.79 million in 2018 and is projected to reach US$ 1,321.66 million by 2027; it is expected to grow at a CAGR of 5.6% from 2019 to 2027.

Malt extract is a sweet substance derived from malted grains, i.e., germinated cereal grains dried during malting process. The extract is extensively used in the brewing of beer. It is produced in two forms—dried and liquid malt extracts. The liquid malt extracts have high viscosity and are available in color shades ranging from light to dark. The dry malt extracts are prepared by spray drying liquid extracts. Malt extract has been in use in multiple products for its unique flavor characteristics; it also works as a sugar or honey substitute in baked food, bars, cereals, and cookies, among others. It helps in enhancing flavors, aromas, and colors. Apart from its application in baking and brewing, the extract is also consumed as dietary supplement. Brewers prefer liquid malt extracts since they require fewer processing steps and appeal to those the users looking for the purest form of the product. Thus, the increasing demand for craft beer as well as growing adoption of natural and organic food would boost the malt extracts market during 2019–2027.

The malt extracts market in North America is expected to grow at the highest CAGR of 6.0% during the forecast period. This region is also expected to gain a significant share in the global malt extracts market owing to the increasing demand for functional food and increasing health-consciousness among the consumers. Moreover, a prime shift among North American consumers toward healthy lifestyle provides huge growth opportunities for the key players in the market. However, low awareness among the consumer regarding the availability, usage, and consumption of malt extracts is restricts the growth of the malt extracts market in this region. The North American Free Trade Agreement was initiated, the U.S. agriculture and food industry has enhanced innovation and efficiency, and boosted its competitiveness in a quickly changing global economy. Food product manufacturers from the US are looking forward to entering the Canadian marketplace. Although Canadians continue to look for innovative and new products made in the US, the US exporters face multiple challenges while exporting their goods to Canada. A few of these challenges include customs procedures, exchange rate fluctuations, labeling requirements, and regulatory compliances.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Malt Extracts Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Malt Extracts Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Effect of COVID-19 upon Malt Extracts Market

COVID-19 outbreak first began in Wuhan (China) during December 2019 and since then it has spread at a fast pace across the globe. As of March 2020, US, Brazil, India, Russia, South Africa, Mexico and UK are among of the worst-affected countries in terms confirmed cases and reported deaths. According to the latest WHO figures, there are ~17,057,958 confirmed cases and ~666,532 deaths globally for the month of July. The COVID-19 outbreak has been affecting economies and industries in various countries through lockdowns, travel bans, and business shutdowns called up in these countries. Food & beverages is one of the major industries facing serious disruptions such as factories shutdowns, supply chain breaks, and technology event cancellations as a result of this outbreak.

Market Insights

Increasing Adoption of Malt Extracts in Beverages Industry

Rising consumer demand for healthier foodstuff is a major focus of all segments of the food and beverages sectors worldwide. Food processors and manufacturers worldwide are finding better ways to formulate their current products, along with creating more innovative and newer products, to meet this increasing demand. This has resulted in the propagation of new trends for extracts used in these products. In the milk drink and soft drink segment, there are presently two trends that are inevitable for manufacturers—beverage should contain no added sugar, and it should constitute 100% natural extracts and ingredients. However, it can be hard to source such Ingredients fitting into these two criteria, and as a result, beverage processors and manufacturers have already begun to exploring ways to create beverages in line with these trends. Rather than replacing the sugar component, leading manufacturers have instead ventured into looking for novel natural ingredients entirely, which they can integrate into their products for sweetness and functional benefits. As a natural ingredient or food additive with inherent sweetness, eradicating the need for sugar, malt extracts fits in both the parameters that consumers look for in beverages.

Application Insights

Based on application, the malt extracts market has been segmented into beverages, food, pharmaceuticals, and others. The beverages segment accounted for the largest share of the global malt extracts market in 2018, and it is expected to register the highest CAGR during the forecast period. Malt extract is prepared by brewing the whole grain in the same way beer is prepared but skipping the fermentation step; the extract is obtained in the form of a syrup or liquid or soluble powder upon the evaporation of varying volumes of water. In addition to the elevated interest in plant-based, multifunctional natural ingredients, malt extracts sweeteners provide specific benefits for the various range of beverage-industry items. Nearly a third of consumers worldwide have increased their consumption of nutritional or performance beverages, and many of them are seeking products with ingredients deemed simple, natural, or clean. Malt-based beverages offer unique flavor profiles as well as subtle sweetness; however, unlike cane sugar, high-fructose corn syrups, and artificial sweeteners, the extracts contain an abundance of antioxidants (five times the quantities present in the equal quantity of broccoli) along with essential amino acids, vitamins, minerals, and soluble fibers. Malt-based beverages are popular, along with non-alcoholic beer, among athletes. In the US, often unique flavors are added to malt-based beverages, for extra sweetness and fruity notes to prepare drinks such as as-Dark & light malt beverages, specialty beers; weizen, IPA, stout, etc., pilsner, radlers, ciders, and soft & energy drinks.

Form Insights

Based on form, the malt extracts market has been segmented into powder and liquid. The liquid segment accounted for a larger share of the global malt extracts market in 2018, and the powder segment is expected to register a higher CAGR during 2019–2027. Liquid malt extracts (LME) is concentrated, unfermented brewery wort, and a viscous syrup used mainly in brewing especially home brewing as well as in the food industry. LME is a common ingredient in baked goods, confectionery, breakfast cereals, dairy products, malt beverages, and condiments. Liquid malt extract, also known as barley malt syrup, is available as the purest malt extracts syrup. Barley malt syrups are convenient to use and further protected against oxidation. The malt extracts market players offer different products such as pilsner, pale, ultra-light, maris otter, munich, rye, bavarian wheat, porter and stout dark malt extracts, and sorghum syrups. Beer is mainly made with four ingredients, including malt, yeast, hops, and water. Malted barley is mainly mashed, and the resulting fermentable sugars are then extracted and concentrated into malt extracts. Malt extract syrups are less concentrated than dry malt extracts. A 4 pound of syrup or liquid malt extracts is equal to ~3 pound of dry malt extract. However, LME is a simple and convenient malt base for any extract beer recipe with a various range of colors and flavors, consistently high degree of fermentability along with a fresh malt flavor.

Nature Insights

Based on nature, the malt extracts market has been segmented into conventional and organic. The conventional segment accounted for a larger share in the global malt extracts market in 2018, and the organic segment is expected to register a higher CAGR during the forecast period. Both the liquid and powder malt extracts are produced from conventionally grown ingredients, i.e., while growing the crops such as barley, wheat, and sorghum, farmers use chemical fertilizers, pesticides, and other chemical components to increase the yield. The conventional malt extracts are more preferred type than the organic malt extracts due to the comparatively lower prices of conventional ingredients and easy availability in the market. Hence, most of the malt extract market players produce conventional malt extracts for the food & beverages, pharmaceuticals, and other industries.

Malt Extracts Market Regional Insights

The regional trends and factors influencing the Malt Extracts Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Malt Extracts Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Malt Extracts Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 815.79 Million |

| Market Size by 2027 | US$ 1,321.66 Million |

| Global CAGR (2018 - 2027) | 5.6% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Malt Extracts Market Players Density: Understanding Its Impact on Business Dynamics

The Malt Extracts Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Malt Extracts Market top key players overview

The players present in the global malt extracts market such as Ireks Gmbh, Malteurop Group, and Groupe Soufflet have been implementing these strategies to enlarge their respective customer base and gain significant share in the global market, which also allows them to maintain their brand name globally. For instance, Malteurop extended its Australian malt house in Geelong in 2018 and at the Albacete plant in Spain in 2019. For pursuing its international growth strategy, the company announced the construction of a new plant in Mexico in 2019, which will be commissioned in 2021. In 2019, Groupe Soufflet opened a new roaster in St Petersburg to mark the 20th anniversary of its malting plant. This facility would produce special malts (coloured and caramel) for the Russian market, along with Pilsen malts and wheat malts, and it would gradually increase its production capacity to 5,000 tonnes per year.

Global Malt Extracts Market– By Form

- Powder

- Liquid

Global Malt Extracts Market – By Application

- Beverages

- Food

- Pharmaceuticals

- Others

Global Malt Extracts Market– By Nature

- Conventional

- Organic

Company Profiles

- Maltexco S.A

- Malteurop Group

- Ireks Gmbh

- Malt Products Corporation

- United Malt Group

- Groupe Soufflet

- Muntons Plc

- Boortmalt N.V.

- Holland Malt

- Rahr Corporation

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Malt Extracts Market

- Maltexco S.A

- Malteurop Group

- Ireks Gmbh

- Malt Products Corporation

- United Malt Group

- Groupe Soufflet

- Muntons Plc

- Boortmalt N.V.

- Holland Malt

- Rahr Corporation

Get Free Sample For

Get Free Sample For