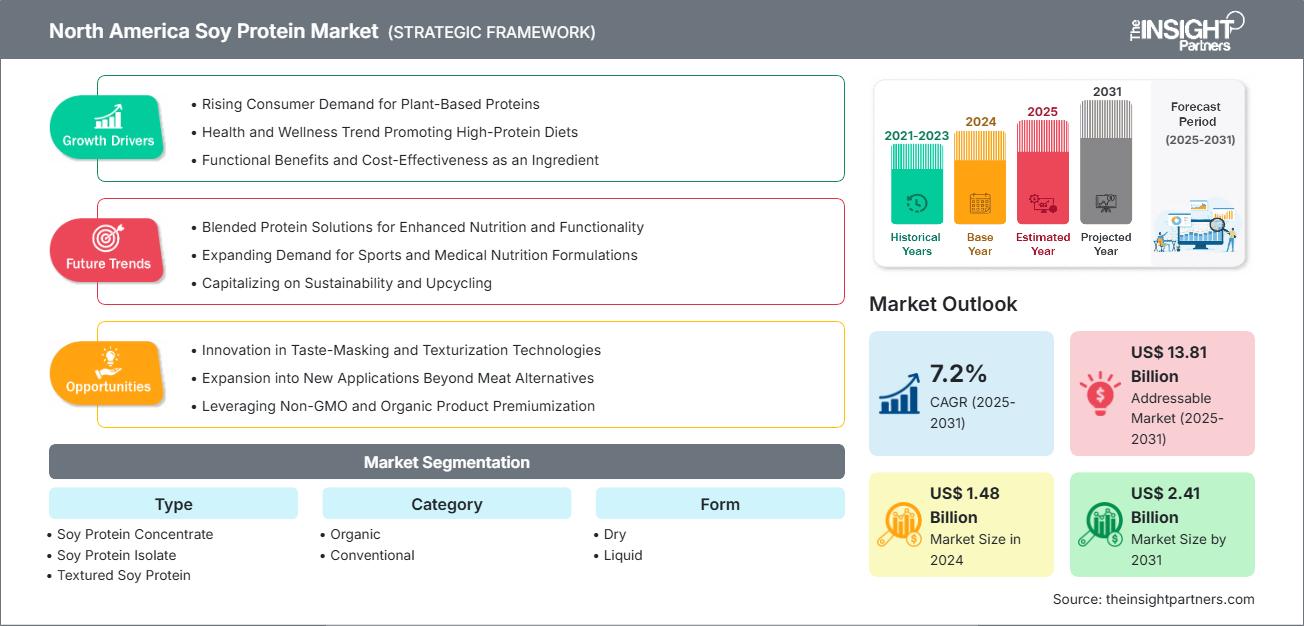

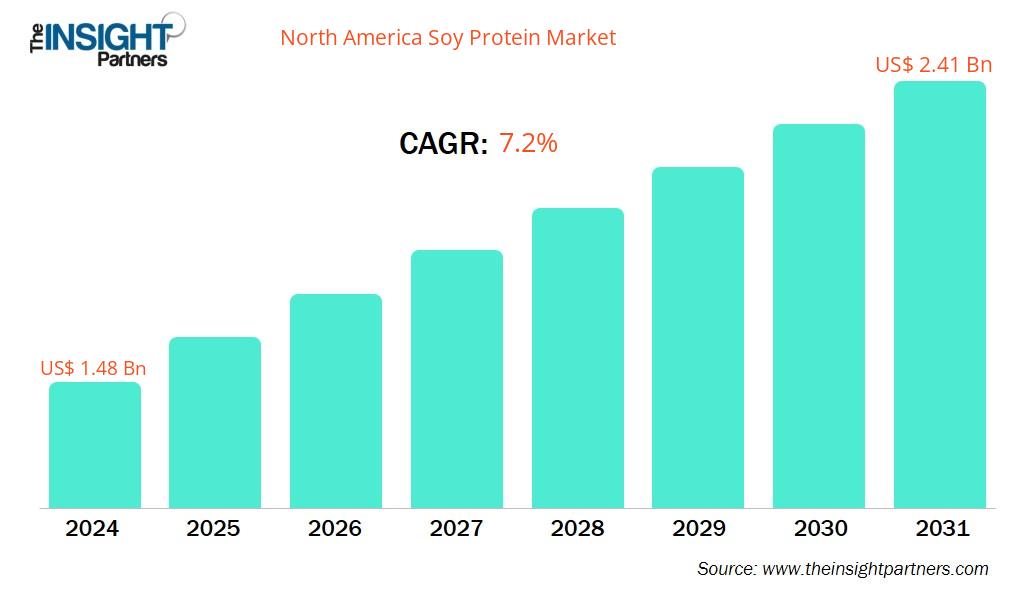

The North America soy protein market size is projected to grow from US$ 1.48 billion in 2024 to US$ 2.41 billion by 2031; the market is expected to register a CAGR of 7.2% during 2025–2031.

North America Soy Protein Market Analysis

The increasing demand for cost-effective and quality protein in the developed and emerging economies is driving the adoption of soy protein. Soy protein is becoming a vital ingredient that manufacturers of food products, drinks, and baked products incorporate into their products due to its functional attributes, including emulsion, moisture retention, and texture. The market is growing due to favorable government initiatives supporting its demand, such as government campaigns advocating the use of plant-based nutrition, the enhancement of supply chains, and the availability of products. Moreover, the growing demand for sports and medical nutrition formulations propels the market growth. The sports and medical nutrition markets are lucrative due to their demand for clinically-backed, high-performance ingredients and their relative insulation from price sensitivity compared to the general food market. Soy protein isolate (SPI), with its high purity (>90% protein), excellent digestibility, and complete amino acid profile, is well-suited for these applications. In sports nutrition, SPI's high leucine content—a key trigger for muscle protein synthesis—positions it as a proven plant-based alternative to whey protein, catering to the growing demographic of athletes and fitness enthusiasts seeking dairy-free options.

North America Soy Protein Market Overview

A plant-based protein, such as soy protein, is sourced from soybeans, which are commonly known to be a complete protein with all nine essential amino acids. It exists as soy protein isolate, concentrate, and textured soy protein and is applied in meat products, dairy products, snacks, and nutritional supplements. It is gaining popularity due to increasing consumer interest in plant-based diets, health and wellness, and sustainable food. Soy protein offers health benefits, such as muscle building, heart health, and weight management, and is therefore popular among athletes, vegetarians, and health-conscious consumers. Further, the bakery segment represents a vast potential market for using soy protein to boost the protein content of bread, pasta, and snacks without compromising sensory attributes. The sports and clinical nutrition markets offer high-margin opportunities for ultra-pure, rapidly digesting soy protein isolates tailored for performance shakes, medical nutrition products, and healthy aging supplements. By deploying R&D resources to solve application-specific formulation challenges, soy protein producers can unlock new revenue streams, diversify their customer base beyond plant-based meat companies, and reduce dependency on a single, cyclical end-market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Soy Protein Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Soy Protein Market Drivers and Opportunities

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Soy Protein Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Drivers:

- Growing Health Awareness: Consumers prefer nutritious alternatives, such as soy protein, for healthier diets and lifestyles.

- Rising Vegan/Vegetarian Trends: An increase in plant-based diets boosts the demand for soy protein across the region.

- Wide Application Scope: The growing demand for sports and clinical nutrition is owing to its high-protein content.

- Government Support: Favorable government initiatives supporting demand for plant-based products.

Market Opportunities:

- Expansion of QSR and Foodservice Applications: With the growing number of QSRs and the food service industry, the demand for soy protein is rising as a popular meat alternative.

- Development of Novel Soy-Based Ingredients: It enhances taste, texture, and nutritional profiles to meet evolving consumer preferences..

- Advanced Technology : Advancements in technology to improve the digestibility of soy protein and reduce allergenicity.

- Growing Product Visibility: Increasing product awareness and visibility through campaigns creates a growth opportunity for soy protein in the region.

North America Soy Protein Market Report Segmentation Analysis

The North America soy protein market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Soy Protein Concentrate: It is a high-protein product; most carbohydrates are eliminated to provide texture and nutrition to food products.

- Soy Protein Isolate: It is the purest type of soy protein, with more than 90% protein content, which is suitable in protein-enriched and specialty nutrition products.

- Textured Soy Protein: A meat-like soy product consisting of defatted soy flour may be used as a meat replacement in plant-based foods.

- Soy Flour and Grits: Soy beans are ground into a fine powder used in food and baking recipes to enhance protein and texture.

By Category:

- Organic: No synthetic pesticides, fertilizers, genetically modified organisms (GMOs), or irradiation are used to produce soybeans.

- Conventional: The conventional soybeans are grown traditionally and may use artificial pesticides, fertilizers, and other agricultural chemicals.

By Form:

- Dry: Powdered soy protein is used in food manufacturing for extended shelf life, easy storage, and versatile application.

- Liquid: It is used in beverage production and liquid food formulations.

By Application:

- Bakery and Confectionery: In the bakery and confectionery industry, soy protein enhances the product's moisture retention, protein content, and texture.

- Meat Alternatives: Holds the largest share in the market as soy protein is used to replicate meat textures and boost protein content in the products.

- Dairy Alternatives: In dairy alternatives, soy protein provides protein and structure in yogurts, non-dairy milks, and cheese.

- Infant Nutrition: Soy protein is added to infant nutrition as a lactose-free and plant-based protein source.

- Protein Supplements: Soy protein is added to protein bars, shakes, and powders for muscle strength.

- Animal Nutrition: Soy protein is used in aquaculture and livestock feed to improve digestibility and nutritional levels.

By Country:

- US

- Canada

- Mexico

The US recorded the largest share in the North America soy protein market, owing to the growing demand from the foodservice industry.

North America Soy Protein Market Report Scope

Report Attribute

Details

Market size in 2024

US$ 1.48 Billion

Market Size by 2031

US$ 2.41 Billion

Global CAGR (2025 - 2031)

7.2%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type - Soy Protein Concentrate

- Soy Protein Isolate

- Textured Soy Protein

- Soy Flour & Grits

By Category - Organic

- Conventional

By Form - Dry

- Liquid

By Application - Bakery and Confectionery

- Meat Alternatives

- Dairy Alternatives

- Infant Nutrition

- Protein Supplements

- Animal Nutrition

- Others

Regions and Countries Covered

North America - US

- Canada

- Mexico

Market leaders and key company profiles

- International Flavors and Fragrances Inc

- Cargill Inc

- Archer Daniels Midland Company

- Bunge Global SA

- SunOpta Inc.

- Farbest-Tallman Foods Corp

- The Scoular Co.

- Sun Nutrafoods

- Associated British Foods Plc

- American International Foods Inc

North America Soy Protein Market Players Density: Understanding Its Impact on Business Dynamics

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.48 Billion |

| Market Size by 2031 | US$ 2.41 Billion |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The North America Soy Protein Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Soy Protein Market top key players overview

High Market Density and Competition

Competition is intense due to established players such as International Flavors & Fragrances Inc., Cargill Inc., Archer Daniels Midland Company, Bunge Global SA, SunOpta Inc., Farbest-Tallman Foods Corp, and The Scoular Co.

The high level of competition urges companies to stand out by offering:

- Innovative product offering

- Sustainable and ethical sourcing

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- Focusing on research and development activities to distinguish themselves in the market

- Expanding global footprint and capabilities through acquisitions of food manufacturing companies

- Expanding product portfolio with the launch of plant-based meal kits

Major Companies operating in the North America soy protein market are:

- International Flavors & Fragrances Inc.

- Cargill Inc.

- Archer Daniels Midland Company

- Bunge Global SA

- SunOpta Inc.

- Farbest-Tallman Foods Corp

- The Scoular Co

- Sun Nutrafoods

- Associated British Foods Plc

- American International Foods Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Sojaprotein

- Wilmar International

- IMCOPA

- Gushen Biological Technology Group

- Henan Fiber Source Biological Engineering

- Benson Hill

- New Protein Global Inc.

- Devansoy Inc

- Northland Organic Foods Corporation

- Puris Proteins LLC

North America Soy Protein Market News and Recent Developments

- Bunge Global SA – Mergers and Acquisitions Bunge Global SA announced an agreement with Solae to acquire virtually all assets related to lecithin, soy protein concentrate production, and the crushing operations of International Flavors and Fragrances, Inc. (IFF). According to Bunge, the agreement, which was announced on August 5, is subject to specific adjustments and closing conditions and is expected to close by the end of 2025.

- Cargill, Inc – Mergers and Acquisitions In June 2025, Cargill announced the acquisition of the soybean crushing unit, refinery, and oil bottling facility in Barreiras, Bahia, ending a lease contract that had been in place since 1998.

North America Soy Protein Market Report Coverage and Deliverables

The "North America Soy Protein Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- North America soy protein market size and forecast at the regional and country levels for all the key market segments covered under the scope

- North America soy protein market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's five forces and SWOT analysis

- North America soy protein market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America soy protein market

- Detailed company profiles

Frequently Asked Questions

What are the driving factors for the North America soy protein market?

What is the estimated value of the North America soy protein market by 2031?

Which are the leading players operating in the North America soy protein market?

Which country dominated the North America soy protein market in 2024?

What will the future trends be in the North America soy protein market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For