Spinal Fusion Devices Market Growth Drivers and Forecast by 2030

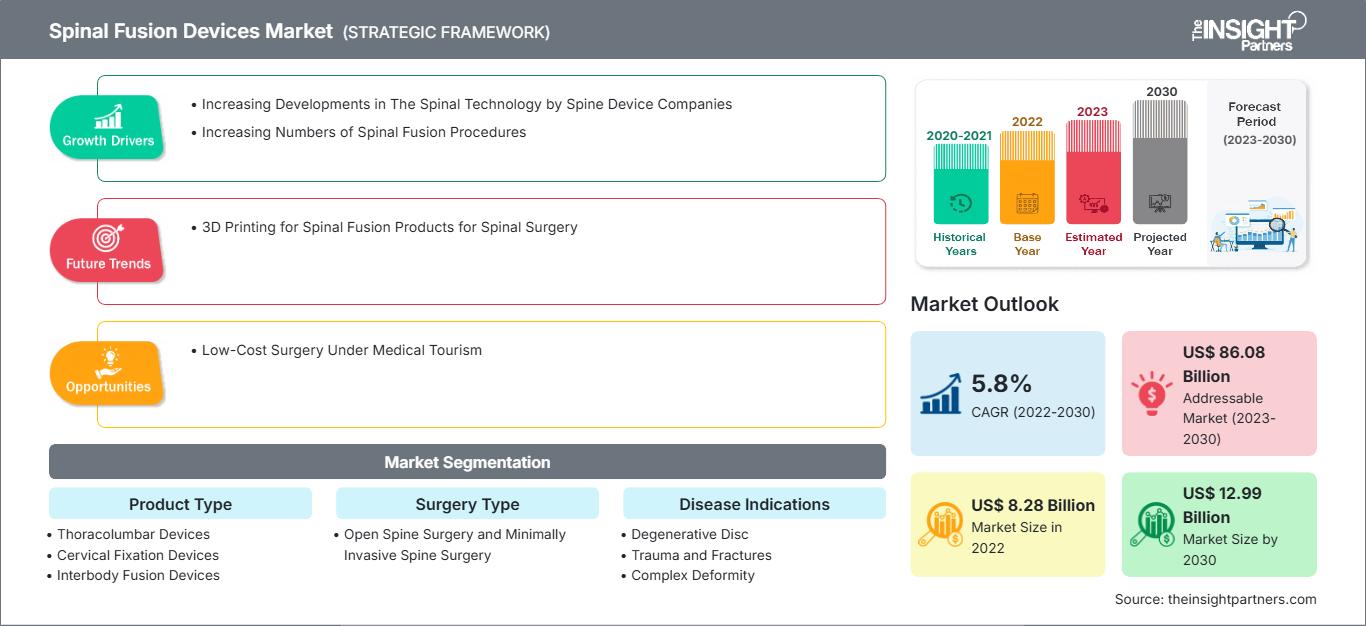

Spinal Fusion Devices Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Thoracolumbar Devices, Cervical Fixation Devices, and Interbody Fusion Devices), Surgery Type (Open Spine Surgery and Minimally Invasive Spine Surgery), Disease Indications (Degenerative Disc, Trauma and Fractures, Complex Deformity, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPMD00002296

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 208

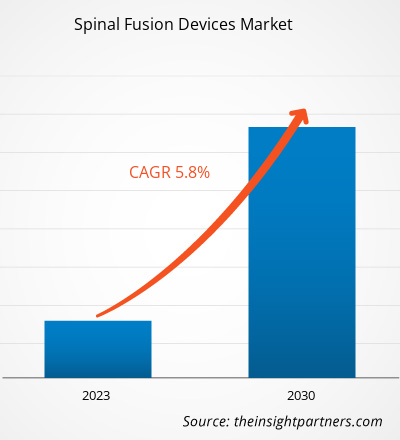

[Research Report] The spinal fusion devices market size is expected to grow from US$ 8,276.31 million in 2022 and to reach a value of US$ 12,993.25 million by 2030, it is anticipated to record a CAGR of 5.8% from 2022 to 2030.

Market Insights and Analyst View:

The spinal fusion devices market size is growing rapidly due to the increase in number of spinal fusion devices cases due to increase in cases of gallstones. Also, increase in cases of diabetes fuel the growth of the market.

In addition, strategic initiatives by companies for the market development are fueling the growth of the market. In September 2022, GE Healthcare announced US FDA 510(k) clearance of its breakthrough AIR Recon DL for 3D and PROPELLER imaging sequences. The advantages of AIR Recon DL are extended by these new features to almost all Magnetic Resonance Imaging (MRI) clinical procedures, covering all anatomies and enabling better image quality, shorter scan times, and enhanced patient experience. Thus, a significant rise in revolutionary technologies to address customer needs is likely to bring new trends in the market during the forecast period.

Opportunities and Challenges:

Spinal fusion surgeries are much costlier; many patients slide back from the decision to undergo spinal surgeries. Also, in many cases, the cost of spinal implants is not covered under health insurance plans, limiting the number of surgeries. For instance, a country like the US is expensive; according to the Healthcare Bluebook data published in February 2022, the top 5 cities are listed with the cost of lumbar spinal fusion: Denver: US$ 86,182, San Jose, California: US$ 78,809 San Francisco: US$ 78,809, Indianapolis: US$ 77,269, and Seattle: US$ 74,499. At the same time, the least cost for lumbar spinal fusion is ~ US$ 48,000 in cities such as Memphis, Tenn, and San Antonio.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSpinal Fusion Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

On the other hand, medical tourism has enabled to offer spinal fusion surgeries at cheaper costs. Countries in developing regions have significantly developed medical tourism and have advanced technologies that provide world-class medical services at cheaper rates. Lyfboat Technologies Pvt. data published on July 2023 stated that countries such as India, Thailand, Turkey, the UAE, and Egypt are considered best for offering scoliosis surgery between US$ 8,000 and US$ 16,000. The data published by Lyfboat Technologies Pvt also reveals the cost of spinal fusion surgery in Egypt is US$ 10,897, and in the UAE, it is ~ US$ 8,200. Similarly, in Turkey, the cost of spinal fusion surgery is US$ 15,000 and in India is nearly between US$ 8000 and US$ 12,000. Also, the cost of thoracoplasty in India is between US$ 2,500 and US$ 4,000.

Offering critical surgeries at cheaper costs increases patient flow to these countries for their medical treatments. Also, the availability of advanced medical techniques and increasing government funding to increase medical tourism are leading to the increasing demand for advanced surgical implants. Further, the advancing healthcare infrastructure in developing countries will likely continue the demand for advanced medical devices, enhancing growth opportunities for the spinal fusion devices market.

Regulatory requirements for spinal fusion devices are different from the other implantable devices. The regulations for spinal fusion devices are regularly updated to maintain the quality of products to offer enhanced quality of life to patients. In March 2023, the Food and Drug Administration (FDA) updated medical devices, orthopedic devices, classification of spinal spheres for use in intervertebral fusion procedures (final rule) final regulatory impact analysis. According to the FDA’s analysis, spinal devices are classified as Class III. The devices will require separate filing for pre-market approval applications. Moreover, the FDA found that general and special controls are insufficient to assure the devices' effectiveness and safety. Therefore, it is expected that companies must provide complete product descriptions and analyses for product efficiency and safety to avoid confusion concerning the product’s material and specifications for sizes and intentions of clinical condition.

Similarly, the regulations in developing countries are updating regulatory requirements for spinal fusion devices. In November 2021, the Australian government's Department of Health and Aged Care Therapeutic Goods Administration (TGA) revised the regulatory framework for spinal implantable medical devices. TGA aims to support sponsors and manufacturers with new regulatory requirements to understand and comply with the updated requirements. TGA has proposed four major requirements for the manufacturers, which include the need for specific information in the ARTG entry about Class IIb spinal fusion devices; TGA’s mandatory audit assessment for device inclusion applications, including assessment of clinical evidence; conformity assessment documents that demonstrate appropriate procedures for device classification, and manufacturer’s exhaustive assessment for the quality management systems and technical documentation related to each device. Thus, the strictness of the regulations for manufacturers will lead to more economic investments, and the risk of recalls may lead to losses. Therefore, the stringent regulations for spinal fusion devices are among the factors hindering the market growth.

Report Segmentation and Scope:

The spinal fusion devices market share is divided on the basis of product type, surgery type, disease indication, and end user. The spinal fusion devices market, by product type, is segmented into thoracolumbar devices, cervical fixation devices, and interbody fusion devices. The spinal fusion devices market, by surgery type, is bifurcated into open spine surgery and minimally invasive spine surgery. The spinal fusion devices market, by disease indications, is segmented into degenerative disc, trauma and fractures, complex deformity, and others. The spinal fusion devices market, by end user, is segment into hospitals, specialty clinics, others. Based on geography, the market is divided into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on surgery type, the Spinal Fusion Devices Market is bifurcated into open spine surgery and minimally invasive spine surgery. In 2022, the open spine surgery segment held a larger share of the market by surgery. The minimally invasive spine surgery segment is estimated to grow at a higher CAGR during 2022–2030 due to increasing adoption of minimally invasive spine surgery approach. Open surgeries are considered standard surgeries as they offer complete exposure to the anatomy. Open spine surgery is recommended to treat conditions such as scoliosis, severe degeneration of the discs, spine instability, or a combination of these problems. Open surgery is widely preferred if the condition is severe and complex; it provides a larger exposure to anatomy, offering ease for the procedure and greater visibility of surrounding structures. However, there are several risks associated with open spine surgery type. The risk includes excessive blood loss and longer recovery time.

In many cases, open spine surgery type may reverse the symptoms of spinal disorders. Complications may also lead to infection, poor wound healing, blood clots, and damage to surrounding veins or nerves.

Minimally invasive spine surgery type (MISS) has gained notable attention over traditional open spine surgery type. MISS requires smaller incisions; therefore, convincing patients to undergo MISS is easier. Other advantages such as avoiding damage to the surrounding muscles, less bleeding, less pain, faster recovery, and shorter hospital stays have increased the adoption of MISS. At present, MISS is considered a common procedure for spinal fusion. The higher adoption of MISS includes treating spinal problems in older and critically sick people by limiting the risks and changing reimbursement patterns and patient preferences. In addition, transformations in MISS have introduced new intraoperative imaging techniques by combining powerful software. The combination of imaging techniques and software allows real-time navigation for surgeons to supplement their understanding of the spine's 3-dimensional (3D) anatomy. Thus, the transformation in MISS is leading to the segment's fastest growth, eventually driving market growth. According to an article titled “Minimally Invasive Spine Surgery Type: An Overview,” published in July 2022, ~75% of 1.2 million spine procedures in the US are performed annually by MISS techniques. Similarly, an article, “Spinal Endoscopy: Evidence, Techniques, Global Trends, and Future Projections,” published in January 2022, stated that 96.7% of Asian surgeons perform MISS. Thus, considering the increasing number of MISS procedures, the market is anticipated to grow notably in the coming years.

The spinal fusion devices market, by product type, is segmented into thoracolumbar devices, cervical fixation devices, and interbody fusion devices. In 2022, the thoracolumbar devices segment held the largest share of the market by product type. The interbody fusion devices segment is estimated to grow at a significant CAGR during 2022–2030 due to growing developments for the interbody fusion devices. The spinal fusion devices market, by disease indication, is categorized into degenerative disc, trauma and fractures, complex deformity, and others. In 2022, the degenerative disc segment held the largest share of the market by disease indications and is estimated to grow at a significant CAGR during 2022–2030 due to growing geriatric population that are more prone to degenerative diseases. The spinal fusion devices market, by end user, is segment into hospitals, specialty clinics, others. In 2022, the hospitals segment held the largest share of the market and is expected to grow at the fastest rate during the coming years.

Regional Analysis:

Based on geography, the spinal fusion devices market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is the largest contributor to the growth of the market, and Asia Pacific is the fastest-growing region. The spinal fusion devices market in North America is segmented into the US, Canada, and Mexico. In 2022, the US held the largest market share in this region and is expected to continue its dominance during the forecast period. DePuy Synthes, Stryker, Aurora Spine, and Alevio Spine are among the major players operating in the spinal fusion devices market in the US. Product developments and launches driven by these players favor the market growth. Technologically advanced spinal fusion devices approved by the Food and Drug Administration (FDA) are widely adopted in the US. Following is the list of spinal fusion devices recently approved by the FDA:

- In May 2023, CTL Amedica received FDA 510(k) clearance for the commercialization of the NITRO Interbody Fusion Cage System, which is exclusively made by the fusion of biomaterial silicon nitride. Silicon nitride material is compatible with all imaging modalities; it exhibits unique bacteriostatic properties and provides artifact-free imaging.

- In January 2023, Alevio Spine received 510 (K) clearance of additional indications for the SI-Cure SI Joint Fusion System. The expanded indication includes sacroiliac fusion for skeletally mature patients undergoing sacropelvic fixation as part of a lumbar or thoracolumbar fusion.

- In June 2022, the US FDA granted 510K clearance for Aurora Spine’s DEXA SOLO-L anterior lumbar interbody fusion device (ALIF). Based on DEXA Technology Platform, a 3D printed standalone device was designed for anterior and lateral lumbar interbody fusion (ALIF & LLIF) procedures.

Age-related wear-and-tear triggers the prevalence of lower back pain (LBP) among the geriatric population in the US, in turn, fuels the demand for spinal fusion devices. According to National Health Services in 2022, lifetime incidence of LBP in the US is reported to be 60–90%, with annual incidence of 5%. The source also states that 14.3% of new patients visit physicians each year because of LBP, and ~13 million people visit physician due to chronic LBP.

Spinal Fusion Devices Market Regional InsightsThe regional trends and factors influencing the Spinal Fusion Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Spinal Fusion Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Spinal Fusion Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8.28 Billion |

| Market Size by 2030 | US$ 12.99 Billion |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Spinal Fusion Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Spinal Fusion Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Spinal Fusion Devices Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the Spinal Fusion Devices Market are listed below:

- In February 2023, Globus Medical Inc, a prominent musculoskeletal solutions provider, and NUVASIVE, a pioneer in spine technology innovation, agreed to merge in an all-stock transaction. The transaction brings together two well-known musculoskeletal technology companies with a common vision of innovation in the relentless pursuit of unmet clinical requirements to improve patient care.

- In November 2022, Centinel Spine LLC announced the first implantation of its prodisc C SK Cervical Total Disc Replacement (TDR) product. The prodisc C SK system is the second of the three new products to be released.

- In March 2022, DePuy Synthes Inc acquired CUPTIMIZE Hip-Spine Analysis, providing surgeons with an easy-to-use tool for better understanding and addressing the impact of aberrant mobility between the spine and pelvis in some patients requiring total hip arthroplasty (THA). CUPTIMIZE Hip-Spine Analysis improves the surgical planning capabilities of VELYS Hip Navigation, one of DePuy Synthes' VELYS Digital Surgery platforms of connected technologies.

Competitive Landscape and Key Companies:

A few prominent players operating in the spinal fusion devices market are Medtronic PLC, Johnson & Johnson Services Inc, B.Braun SE, Stryker Corp, ATEC Spine Inc, Globus Medical Inc, NuVasive Inc, ZimVie Inc, Centinel Spine LLC, and Orthofix Medical Inc. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For