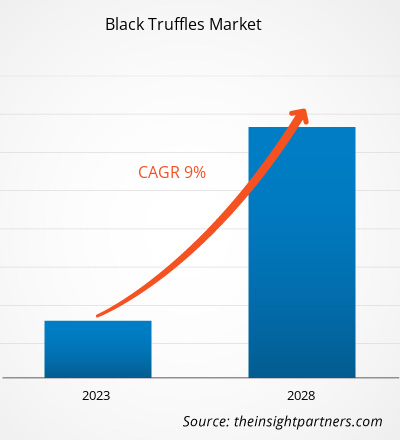

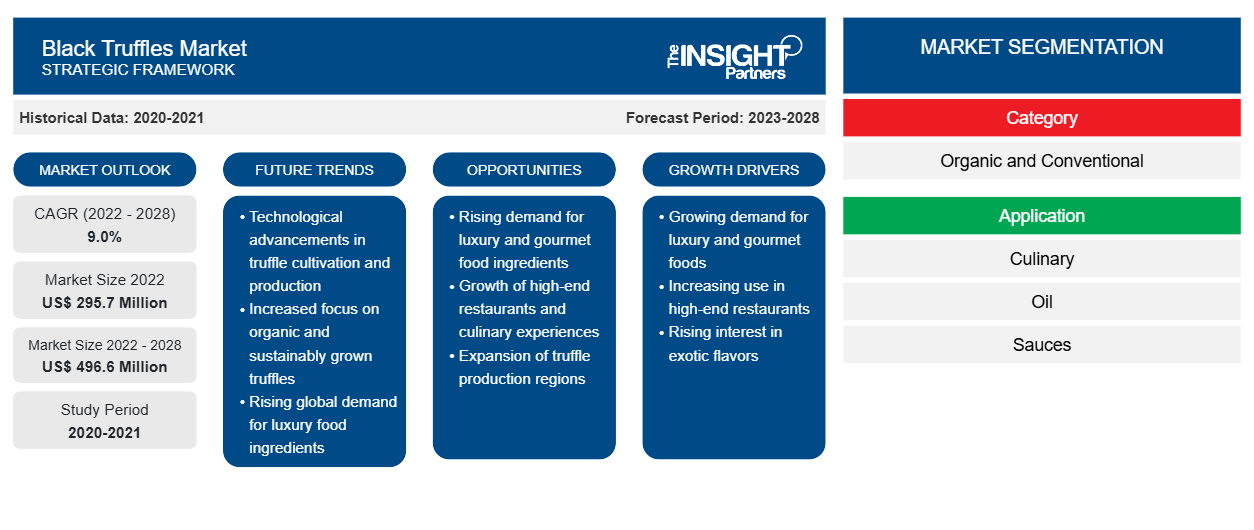

La taille du marché des truffes noires devrait passer de 295,7 millions de dollars américains en 2022 à 496,6 millions de dollars américains d'ici 2028 ; elle devrait croître à un TCAC de 9,0 % de 2022 à 2028.

La truffe noire (Tuber melanosporum), également connue sous le nom de truffe du Périgord ou truffe noire d’hiver, est présente à l’état sauvage dans toute l’Europe de novembre à février, bien que la saison puisse varier légèrement. Récemment, la truffe noire d’hiver a été cultivée avec succès en Australie et en Nouvelle-Zélande. La truffe noire est un champignon ectomycorhizien, on la trouve donc généralement en étroite association avec les racines des arbres. La truffe noire est principalement utilisée dans la cuisine italienne et française. La truffe noire a des saveurs et des arômes uniques. Le goût de la truffe noire a des notes terreuses avec une pointe de menthe, de poivre et de noisette. La truffe noire est préférée par de nombreux gourmets en raison de son profil de saveur unique. Souvent, les chefs appellent la truffe noire le « diamant de la cuisine ».

Impact de la pandémie de COVID-19 sur le marché des truffes noires

En 2020, diverses industries ont dû ralentir leurs opérations en raison des perturbations des chaînes de valeur et d'approvisionnement causées par la fermeture des frontières nationales et internationales. La pandémie de COVID-19 a eu des répercussions négatives sur les économies et les industries en raison des confinements, des interdictions de voyager et des fermetures d'entreprises. Les perturbations des chaînes d'approvisionnement des principales matières premières et les irrégularités dans les processus de fabrication dues aux restrictions imposées par les autorités gouvernementales ont eu un impact direct sur l'industrie des aliments et des boissons. Ces facteurs ont eu un impact négatif sur le marché des truffes noires pendant la pandémie de COVID-19. Cependant, en 2021, le marché a connu une reprise positive lorsque les gouvernements ont annoncé l'assouplissement des restrictions précédemment imposées. Les fabricants ont été autorisés à travailler à pleine capacité, exploitant ainsi leur rentabilité. Ce facteur devrait stimuler le marché dans les années à venir.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Informations sur le marché

Initiatives d'innovation de produits par les utilisateurs finaux

Les fabricants de truffes noires investissent massivement dans la recherche et le développement, les partenariats et les collaborations pour lancer des produits innovants afin d'attirer une large base de consommateurs. Les fournisseurs de produits alimentaires et de boissons lancent de nouveaux produits à base de truffes, tels que des sauces et des huiles, qui conduisent à la consommation de truffes noires sur le marché mondial. En 2018, deRosario, le fabricant basé aux États-Unis, a lancé une gamme de condiments à base de truffes, notamment de l'huile de truffe noire et de l'huile d'olive extra vierge. En 2020, PS Gourmet Pe a lancé son huile de truffe noire à Singapour. En novembre 2022, TRUFF, un fabricant basé en Australie, est entré dans le secteur des assaisonnements avec le « TRUFF Black Truffle Salt ». L'option condiment comprend un mélange de sel de mer fin et grossier avec une quantité ciblée de truffes noires. De tels lancements de produits aident les entreprises à établir des relations à long terme avec les consommateurs finaux.

Informations sur les types

En fonction de la catégorie, le marché des truffes noires est segmenté en truffes biologiques et conventionnelles. Le segment biologique devrait enregistrer un TCAC plus élevé au cours de la période de prévision. La truffe noire biologique est cultivée dans un sol exempt d'engrais chimiques (tels que l'azote synthétique, le phosphate et la potasse) et d'ingrédients génétiquement modifiés. Les herbicides et les pesticides synthétiques sont également évités dans la culture de truffes noires biologiques. Au lieu de cela, les producteurs utilisent des stimulateurs de croissance biologiques pour cultiver des truffes noires biologiques. En général, les truffes noires biologiques sont plus chères que les truffes conventionnelles en raison de leur qualité supérieure. Les entreprises se concentrent sur l'obtention de certifications biologiques pour répondre à la demande croissante de truffes noires biologiques sur le marché.

Informations sur les applications

En fonction de l'application, le marché des truffes noires est segmenté en culinaire ; huile ; sauces, tartinades et beurre ; et autres. Le segment culinaire détenait la plus grande part du marché en 2021. Les truffes noires sont râpées dans des sauces à base de vin ou de crème ou râpées sur des pâtes cuites, des œufs brouillés ou des plats de pommes de terre. Les truffes noires sont ajoutées comme garniture à divers produits alimentaires pour améliorer leur saveur et leur donner une apparence plus opulente. De plus, les truffes noires sont ajoutées comme ingrédients de garniture aux plats de viande et pour donner une saveur prononcée aux aliments. Elles sont également utilisées pour produire du sel à la truffe et du miel à la truffe. Certains types de fromages de spécialité contiennent également des truffes noires. Ces facteurs alimentent la demande de truffes noires dans les applications culinaires.

Les principaux acteurs du marché des truffes noires sont Trufo, TRUFFUS SAS, L'Aragonais Food Supplies SL, SABATINO NA LLC, LAUMONT TRUFFLES SLU, Arotz SA, Les Freres Jaumard SaRL, Perigord Truffles of Tasmania Pty Ltd, Great Southern Truffles Pty Ltd et Old World Truffles. Ces acteurs se concentrent sur la fourniture de produits de haute qualité pour répondre aux demandes des clients. Ils se concentrent également sur des stratégies telles que les investissements dans les activités de recherche et développement et le lancement de nouveaux produits.

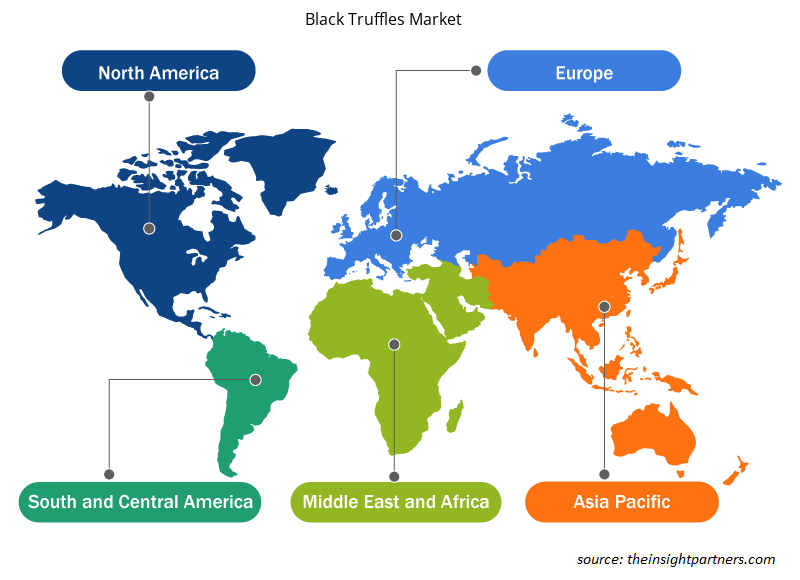

Aperçu régional du marché de la truffe noire

Les tendances régionales et les facteurs influençant le marché des truffes noires tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des truffes noires en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des truffes noires

Portée du rapport sur le marché des truffes noires

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2022 | 295,7 millions de dollars américains |

| Taille du marché d'ici 2028 | 496,6 millions de dollars américains |

| Taux de croissance annuel composé mondial (2022-2028) | 9,0% |

| Données historiques | 2020-2021 |

| Période de prévision | 2023-2028 |

| Segments couverts |

Par catégorie

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché de la truffe noire : comprendre son impact sur la dynamique commerciale

Le marché des truffes noires connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des truffes noires sont :

- Trufo, Truffus SAS

- L'aragonais Food Supplies SL

- Sabatino Na LLC

- Truffes Laumont SLU

- Arotz SA

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de la truffe noire

Rapports en vedette

- Tendances progressistes de l'industrie sur le marché des truffes noires pour aider les acteurs à développer des stratégies efficaces à long terme

- Stratégies de croissance commerciale adoptées par les entreprises pour assurer leur croissance sur les marchés développés et en développement

- Analyse quantitative du marché de la truffe noire de 2019 à 2028

- Estimation de la demande mondiale en truffes noires

- Analyse des cinq forces de Porter pour illustrer l'efficacité des acheteurs et des fournisseurs de truffes noires

- Développements récents pour comprendre le scénario concurrentiel du marché

- Tendances et perspectives du marché, ainsi que facteurs qui stimulent et freinent la croissance du marché des truffes noires

- Aide à la prise de décision en mettant en évidence les stratégies de marché qui sous-tendent l'intérêt commercial

- La taille du marché de la truffe noire à différents points névralgiques

- Aperçu détaillé et segmentation du marché, ainsi que de la dynamique du secteur des aliments et des boissons

- Taille du marché de la truffe noire dans différentes régions avec des opportunités de croissance prometteuses

Profils d'entreprise

- Truffe

- TRUFFUS SAS

- L'Aragonais Food Supplies SL

- SABATINO NA LLC

- TRUFFES LAUMONT SLU

- Arotz SA

- Les Frères Jaumard SaRL

- Truffes du Périgord de Tasmanie Pty Ltd

- Truffles du Grand Sud Pty Ltd

- Truffes du Vieux Monde

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché aux truffes noires

Obtenez un échantillon gratuit pour - Marché aux truffes noires