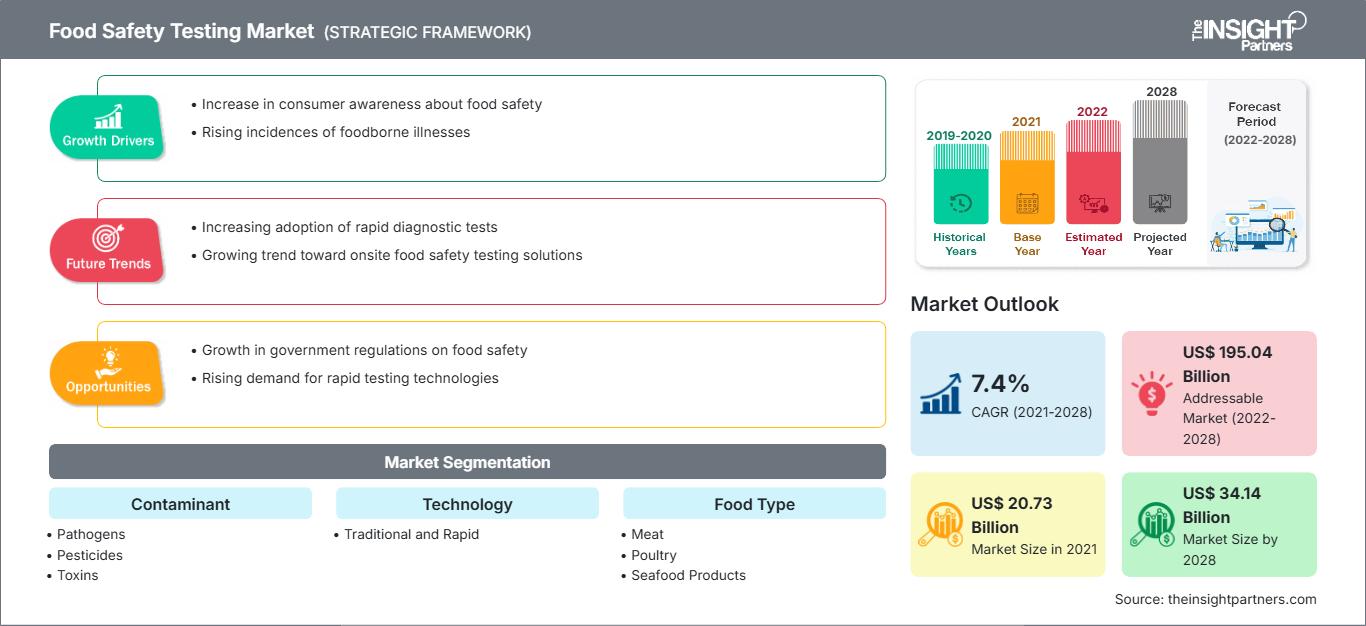

Food Safety Testing Market Dynamics and Developments by 2028

Food Safety Testing Market Forecast to 2028 - Analysis By Contaminant (Pathogens, Pesticides, Toxins, GMOs, and Others), Technology (Traditional and Rapid), and Food Type (Meat, Poultry, and Seafood Products; Dairy Products; Cereals and Grains; Processed Food; Fruits and Vegetables; and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Oct 2021

- Report Code : TIPRE00003964

- Category : Consumer Goods

- Status : Published

- Available Report Formats :

- No. of Pages : 148

The food safety testing market was valued at US$ 20,733.4 million in 2021 and is projected to reach US$ 34,142.5 million by 2028; it is expected to grow at a CAGR of 7.4% from 2021 to 2028.

Food safety testing is a scientific analysis of a food product and its contents to find information about various characteristics such as physiochemical properties, composition, and structure. The information is used to determine the safety of the product for consumption. The rising prevalence of foodborne illnesses demands food safety testing for all food and beverage products to prevent health hazards, which boosts the growth of the food safety testing market.

As per the data published by the World Health Organization (WHO), the consumption of unsafe food causes 420,000 deaths and 600 million cases of foodborne diseases worldwide each year. Foodborne diseases are preventable; hence, numerous organizations and governments lead coordinated actions to build resilient and robust food safety systems across multiple industries. Moreover, a 2018 World Bank report estimated that the economic burden through a total loss of productivity faced due to foodborne illnesses was estimated to be US$ 95.2 billion per year. Therefore, the food safety testing market is witnessing growth due to consumer awareness regarding food safety and government efforts to prevent foodborne illnesses.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFood Safety Testing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Food Safety Testing Market

Consumer awareness is one of the major drivers of the food safety testing market across the world. The COVID-19 outbreak positively impacted the market as consumers and governments are focused on the safety and hygiene of products meant for consumption. All food & beverages sectors face challenges amid the outbreak as the SARS-CoV-2 is highly infectious and could possibly travel through food surfaces. Meat and poultry processing facilities faced distinctive challenges with respect to virus transmission as workers in several facilities across the world were infected. For instance, U.S. Department of Health & Human Services reported in July 2020 that 239 facilities in 23 states fell subject to COVID-19 infection. The total reported cases were 16,233, with 86 related deaths. Moreover, in November 2020, China reported that a frozen pork knuckle sample imported in China had triggered a new COVID-19 case in the country. Such cases of COVID-19 infections in the food industry have created apprehensions among consumers and governments, which propelled the demand for food safety testing to mitigate health risks.

Market Insights

Emergence of Foodborne Illness Outbreaks

Foodborne illnesses are toxic or infectious. They can be caused by the chemical substances, parasites, viruses entering the body through contaminated water or food. Foodborne pathogens can cause debilitating infections, such as meningitis or severe diarrhea. In some cases chemical contamination can cause long-term diseases, such as cancer, or short-term illness, such as acute poisoning. A few examples of unsafe food are raw shellfish containing marine biotoxins, vegetables and fruits contaminated with feces, and uncooked foods of animal origin. E. Coli, campylobacter, and salmonella are among the most common foodborne pathogens that affect millions of people worldwide annually and result in fatal or severe outcomes. A few symptoms of foodborne illnesses are diarrhea, abdominal pain, vomiting, nausea, headache, and fever. Moreover, listeria infection leads to death of newborn babies or miscarriages in pregnant women. Although the chances of this disease are relatively low, the fatality of listeria makes it one of the most serious foodborne infections. Vibrio cholera infects people through contaminated food or water. Its symptoms may include severe dehydration, profuse watery diarrhea, vomiting, abdominal pain, and could possibly result in death. Various types of seafood, millet gruel, vegetables, and rice have been implicated in cholera outbreaks. Therefore, the demand for food safety testing is increasing to prevent the incidence of foodborne illnesses.

Contaminant Insights

Based on contaminant, the food safety testing market is segmented into pathogens, pesticides, toxins, GMOs, and others. The pathogens segment accounted for the largest market share in 2020, and the GMOs segment is expected to register the highest CAGR in the market during the forecast period. Pathogen testing is done to eliminate or reduce the incidence of foodborne illnesses. The elimination is considered so essential that the testing process is implemented in the very step of food production to ensure food safety and sanitation. A few most common pathogens that can cause foodborne illnesses are E. coli, listeria, and salmonella. Pathogen testing can be done using traditional techniques or newer ones. The traditional techniques use conventional cell culture standards, whereas the newer techniques include laser-based or spectrometric diagnostics. Since pathogens are one of the most common reasons for foodborne illnesses, the pathogen segment holds the largest market share in the food safety testing market. Also, the market for this segment is expected to grow during the forecast period due to the growth of the food & beverages industry.

Technology Insights

Based on technology, the food safety testing market is bifurcated into traditional and rapid. The rapid segment accounted for a larger market share in 2020, and the same segment is expected to register a higher CAGR in the market during the forecast period. Major market players are introducing innovative products in the rapid testing owing to the high demand for the service. For instance, in 2009, bioMérieux, Inc. introduced TEMPO, an automated system for the enumeration of microorganisms in food. The automated system eliminates the tedious manual steps involved in most probable number (MPN) method using a miniature card. Therefore, the automated test offers simple traceability and high throughput, and it is also a cost-effective alternative to manual testing. Moreover, the company has also introduced recombinant bacteriophage technology that is used for food-borne pathogen detection, which has reduced the time to grow bacteria at a detectable level. Such rapid tests prove to be useful in terms of cost saving for food manufacturers as the waiting period for batches in inventory is significantly reduced. Thus, the multiple benefits of rapid testing is expected to fuel the market growth for this segment during the forecast period.

Food Type Insights

Based on food type, the food safety testing market is segmented into meat, poultry, and seafood products; dairy products; cereals and grains; processed food; fruits and vegetables; and others. The meat, poultry, and seafood products segment accounted for the largest market share in 2020, and the fruits and vegetables segment is expected to register the highest CAGR in the market during the forecast period. The meat, poultry, and seafood products testing includes testing for contaminants as well as for food adulteration wherein one meat type is adulterated with other meat types. The products may be tested for ash, fat, moisture, protein/nitrogen, heavy metals, pesticides, antibiotics and drugs, salt, chloride, and nitrates and nitrites. Meat products are most likely to get contaminated or defected considering the shelf life and nature of these products. Therefore, the testing for these products is mandatory in all countries. The market for this segment is expected to grow due to the rising consumption of meat, poultry, and seafood products across the world.

A few players operating in the food safety testing market are SGS SA, Eurofins Scientific, Intertek Group Plc, TÜV SÜD, AES Laboratories Pvt. Ltd., TÜV NORD GROUP., Bureau Veritas, ALS Limited, NEOGEN Corporation, and AsureQuality. These companies provide a wide range of product portfolio for the market. The companies have their presence in the developing regions, which provides lucrative opportunities for the food safety testing market growth. The market players are developing high-quality and innovative products to fulfil the customer’s requirements.

Report Spotlights

- Progressive industry trends in the food safety testing market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the food safety testing market from 2019 to 2028

- Estimation of global demand for food safety testing

- Porter’s five forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the Food safety testing market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the food safety testing market size at various nodes

- Detailed overview and segmentation of the market, as well as the food safety testing industry dynamics

- Size of the food safety testing market in various regions with promising growth opportunities

The regional trends and factors influencing the Food Safety Testing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Food Safety Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Food Safety Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 20.73 Billion |

| Market Size by 2028 | US$ 34.14 Billion |

| Global CAGR (2021 - 2028) | 7.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Contaminant

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Food Safety Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Food Safety Testing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Food Safety Testing Market top key players overview

Food Safety Testing Market – by Contaminant

- Pathogens

- Salmonella

- E.coli

- Listeria

- Others

- Pesticides

- Toxins

- GMOs

- Others

Food Safety Testing Market – by Technology

- Traditional

- Rapid

- PCR-based Testing

- Immunoassay-based Testing

- Others

Food Safety Testing Market – by Food Type

- Meat, Poultry, and Seafood Products

- Dairy Products

- Cereals and Grains

- Processed Food

- Fruits and Vegetables

- Others

Company Profiles

- SGS SA

- Eurofins Scientific

- Intertek Group Plc

- TÜV SÜD

- AES Laboratories Pvt. Ltd.

- TÜV NORD GROUP.

- Bureau Veritas

- ALS Limited

- NEOGEN Corporation

- AsureQuality

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For