Anti-obesity Drugs Market Dynamics, Recent Developments, and Strategic Insights by 2031

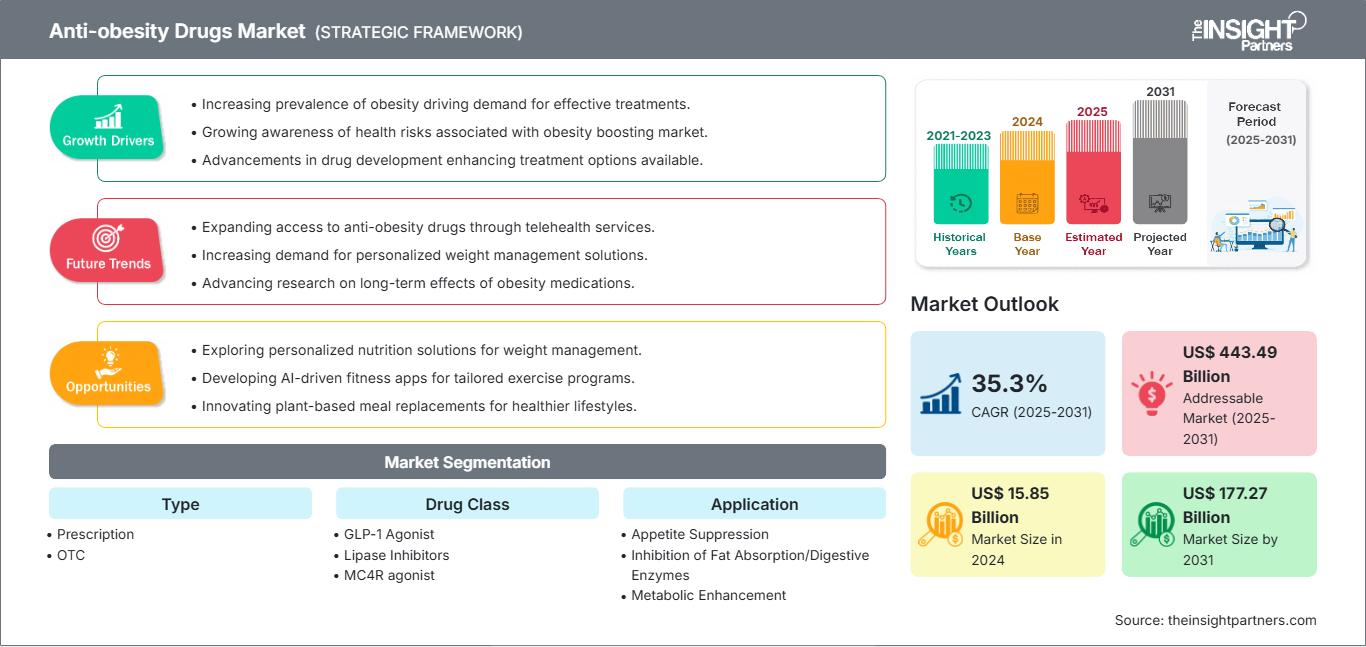

Anti-obesity Drugs Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Prescription and OTC ), Drug Class (GLP-1 Agonist, Lipase Inhibitors, MC4R agonist, and  others), Application (Appetite Suppression, Inhibition of Fat Absorption/Digestive Enzymes, Metabolic Enhancement, and Combination), Route of Administration (Oral and Parenteral), and Distribution Channel (Hospital Pharmacies, Online Channel, and Retail Pharmacies), and GeographyÂ

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jun 2025

- Report Code : TIPRE00006850

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 310

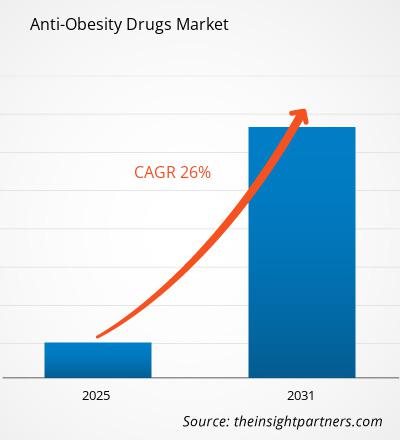

The anti-obesity drugs market size is projected to reach US$ 177.27 billion by 2031 from US$ 15.85 billion in 2024. The market is expected to register a CAGR of 35.3% during 2025–2031. Precision medicine and personalized anti-obesity drug regimens are likely to bring in new market trends during the forecast period.

Anti-obesity Drugs Market Analysis

According to the World Health Organization (WHO), the global prevalence of obesity more than doubled between 1990 and 2022. In 2022, 2.5 billion adults aged 18 and older were overweight, with over 890 million classified as obese: this equates to 43% of adults (43% of men and 44% of women), up from 25% in 1990. Overweight prevalence varied by region, with rates as low as 31% in the WHO South-East Asia and African Regions and reaching up to 67% in the Region of the Americas. Reducing obesity rates could alleviate the economic burden associated with the disease. According to the World Obesity Atlas, the total costs related to obesity—including healthcare and economic productivity losses—are expected to exceed US$ 4 trillion by 2035, accounting for approximately 3% of global GDP from US$1.96 trillion in 2020. Thus, the rising obesity rates and awareness of associated health risks, such as diabetes, cardiovascular diseases, and certain types of cancer, fuel demand for anti-obesity drugs.

Anti-obesity Drugs Market Overview

The anti-obesity drugs market is expanding due to the mounting prevalence of obesity and increased awareness and demand for weight management solutions. Prominent players operating in the market are focusing on innovations and collaborative efforts for enhanced product availability and reach. However, the side effects and safety concerns hinder market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAnti-obesity Drugs Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Anti-obesity Drugs Market Drivers and Opportunities

Increased Awareness and Demand for Weight Management Solutions Fuels Market Growth

In 2013, the American Medical Association officially recognized obesity as a disease with various biological factors that require multiple interventions for effective treatment and prevention. Obesity increases the risk of type 2 diabetes, cardiovascular disease, hypertension, and certain cancers. The heightened awareness among the public about these serious health risks has fuelled the demand for weight management solutions. This shift is reflected in public health initiatives and changes in consumer behavior, leading to a demand for weight loss services, products, and pharmaceuticals.

Governments and pharmaceutical companies are increasing their efforts to educate the public about the dangers of obesity, particularly its links to diabetes, cardiovascular disease, and other chronic conditions. In March 2024, Eli Lilly and Company launched the next phase of its "Get Better" corporate branding campaign, focusing on obesity. Earlier that year, Lilly had introduced "Get Better" to emphasize its commitment to discovering and producing medicines that would help people achieve better health. As part of this ongoing campaign, Lilly released two films titled "Shame" and "Big Night." These films presented the company's perspective on obesity, highlighting the seriousness of the condition and the appropriate use of anti-obesity medications. In December 2022, Novo Nordisk launched the "Break the Partnership" campaign to educate individuals with diabetes, their caregivers, and healthcare professionals about the impact of weight on type 2 diabetes management. Officially launched by former cricketer Kapil Dev, the campaign encouraged discussions with clinicians about new treatment options that addressed blood glucose levels and weight. Over the following six months, the Novo Nordisk team engaged healthcare professionals through awareness events and scientific meetings in various cities.

The awareness of obesity drugs is surging worldwide. According to a cross-sectional study, ' Longitudinal Analysis of Obesity Drug Use and Public Awareness' published in JAMA Network in 2025, between July 2017 to February 2024, a total of 69,213,936 obesity management drug (OMD) prescriptions were dispensed in the US. From July 2017 to June 2018, the number of prescriptions increased from 0.76 to 0.80 million, while from March 2023 to February 2024, they rose from 1.29 to 1.51 million. The mean annual growth rate was 5.3%. In February 2024, OMD prescriptions reached 1.5 million, making up 0.41% of all prescriptions. The most prescribed medications included phentermine, semaglutide (Wegovy), liraglutide (Saxenda), and tirzepatide (Zepbound).

Expansion in Emerging Economies to Create Lucrative Opportunities in Market

According to a Lancet study published in July 2023, approximately 450 million adults in India are expected to be overweight or obese by 2050. In 2021, more than half of the world's adults who were classified as overweight or obese lived in India, with 180 million affected individuals; China, with 402 million; Brazil, with 88 million; Russia, with 71 million; Mexico, with 58 million; Indonesia, with 52 million; and Egypt, with 41 million.

According to the World Obesity Federation, Vietnam, Indonesia, and Bangladesh are experiencing rising obesity prevalence, with a rate of 6–9% in recent decades. The mounting prevalence of obesity in emerging countries due to urbanization, sedentary lifestyles, and dietary changes has increased the demand for anti-obesity drugs. A large segment of the population remains undiagnosed or untreated, offering an underpenetrated market for pharmaceutical companies to introduce new therapies and expand their reach. Eli Lilly is preparing to launch its weight-loss and diabetes drug, tirzepatide (marketed as Mounjaro for diabetes and Zepbound for obesity), in India, Brazil, and Mexico by 2026.

Brazil is enhancing healthcare infrastructure and obesity management programs, fostering a supportive environment for the introduction and reimbursement of new anti-obesity medications. In April 2024, Brazil opened a laboratory in Hortolândia, São Paulo State, dedicated to producing medications for diabetes and obesity, including liraglutide, an active ingredient found in Ozempic. The EMS-operated plant will also produce semaglutide, a key ingredient in Ozempic, which has a patent valid until March 2026 and is already under review by Agência Nacional de Vigilância Sanitária (ANVISA). With an investment of R$60 million (~US$ 10.93 million), this facility is the first of its kind in Brazil and supports the federal government's Health Economic-Industrial Complex initiatives.

According to the World Economic Forum, initial access to anti-obesity medications may be limited to private markets and out-of-pocket payments. Still, future insurance coverage and generic versions in middle-income countries could improve the accessibility of these medications. Thus, the rising obesity rates, supportive government initiatives, and product innovations are expected to create future growth opportunities for the market in emerging countries.

Anti-obesity Drugs Market Report Segmentation Analysis

Key segments that contributed to the derivation of the anti-obesity drugs market analysis are type, drug class, route of administration, application, and distribution channel.

- Based on type, the anti-obesity drugs market is bifurcated into prescription and OTC. The prescription segment held a larger share of the market in 2024.

- By drug class, the anti-obesity drugs market is segmented into GLP-1 agonists, lipase inhibitors, MC4R agonists, and others. The GLP-1 Agonist segment held the largest share of the market in 2024. GLP-1 agonists segment further subsegmented into Semaglutide, Liraglutide, Tirzepatide.

- Based on application, the anti-obesity drugs market is categorized into appetite suppression, inhibition of fat absorption/digestive enzymes, metabolic enhancement, and combination. The appetite suppression segment held a largest share of the market in 2024.

- In terms of route of administration, the anti-obesity drugs market is bifurcated into oral and parenteral. The oral segment dominated the market in 2024.

- Per distribution channel, the anti-obesity drugs market is categorized into hospital pharmacies, online channel, and retail pharmacies. The hospital pharmacies segment dominated the market in 2024.

Anti-obesity Drugs Market Share Analysis by Geography

The geographic scope of the anti-obesity drugs market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the global market in 2024 and is expected to continue its dominance during the forecast period. The US is the largest market for anti-obesity drugs in the world. According to the data from the National Health and Nutrition Examination Survey, the prevalence of obesity in adults was 40.3% in the country from August 2021–August 2023. Obesity occurrence was higher in adults aged 40–59 (46.4%) than in people aged 20–39 (35.5%) and 60 and older (38.9%). This surge in obesity rates has led to an increase in related comorbidities such as type 2 diabetes, hypertension, and cardiovascular diseases, escalating healthcare costs. Thus, the demand for effective anti-obesity medications to mitigate these health risks is rising.

Key pharmaceutical companies have introduced innovative treatments that have reshaped the market landscape. Novo Nordisk's semaglutide-based drugs, Ozempic and Wegovy, have become widely prescribed for type 2 diabetes and obesity management, respectively. Per the Drug Usage Statistics, United States, 2013 – 2022, provided by the ClinCalc DrugStats Database, semaglutide was the 48th most commonly prescribed medication in the US in 2022, with more than 13 million prescriptions. These medications aid in weight reduction and improve the management of obesity-related comorbidities, thereby enhancing their appeal among healthcare providers and patients. Eli Lilly has also made strides with its GLP-1 receptor agonist, tirzepatide, marketed as Mounjaro for diabetes and Zepbound for weight loss. In 2024, Eli Lilly's stock soared 16% following promising results from a Phase 3 trial of its new oral weight-loss drug, orforglipron, which demonstrated an average weight loss of 16 pounds over 40 weeks.

Anti-obesity Drugs Market Regional InsightsThe regional trends and factors influencing the Anti-obesity Drugs Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Anti-obesity Drugs Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Anti-obesity Drugs Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 15.85 Billion |

| Market Size by 2031 | US$ 177.27 Billion |

| Global CAGR (2025 - 2031) | 35.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Anti-obesity Drugs Market Players Density: Understanding Its Impact on Business Dynamics

The Anti-obesity Drugs Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Anti-obesity Drugs Market top key players overview

Anti-obesity Drugs Market News and Recent Developments

The anti-obesity drugs market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Below are key developments witnessed in the anti-obesity drugs market:

- Danish drugmaker Novo Nordisk bought global rights to China-based United Laboratories International's ) "triple-G" weight-loss drug candidate in a deal worth up to $2 billion. (Source: Novo Nordisk, March 2025)

- AbbVie and Gubra A/S, a company specializing in preclinical contract research services and peptide-based drug discovery within metabolic and fibrotic diseases, announced a license agreement to develop GUB014295, a long-acting amylin analog for the treatment of obesity. (Source: AbbVie., Press Release, March 2025)

Anti-obesity Drugs Market Report Coverage and Deliverables

The "Anti-obesity Drugs Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Anti-obesity drugs market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Anti-obesity drugs market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Anti-obesity drugs market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the anti-obesity drugs market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For