Point-of-Care Molecular Diagnostics Market Outlook and Strategic Insights by 2028

Point-of-Care Molecular Diagnostics Market Forecast to 2028 - Analysis By Product & Services (Assays and Kits, Instruments, and Services and Software), Technology [PCR, Isothermal Nucleic Acid Amplification Technology (INAAT), and Other Technologies], Application (Infectious Diseases, Oncology, Hematology, Prenatal Testing, Endocrinology, and Other Applications), and End User (Hospitals and Clinics, Diagnostic Laboratories, Research and Academic Institutes, and Others) Geography

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Oct 2021

- Report Code : TIPRE00003144

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 208

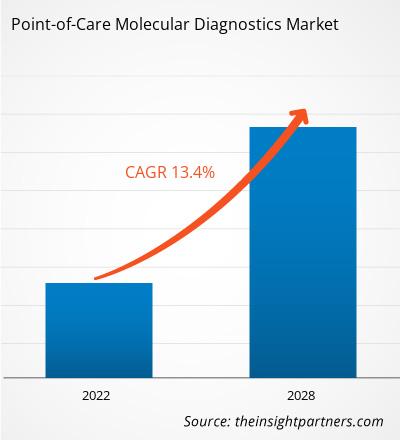

[Research Report] The point-of-care molecular diagnostics market is projected to reach US$ 5,381.18 million by 2028 from US$ 2,230.94 million in 2021; it is expected to grow at a CAGR of 13.4% from 2021 to 2028.

Market Insights and Analyst View:

Point-of-Care Molecular Diagnostics include portable devices, and assays & kits used to detect and diagnose diseases in human samples, such as throat swab, blood, serum, and stool. Molecular diagnostics are shifting from centralized laboratories to decentralized point-of-care molecular testing, due to its simplicity, convenience, rapid turnaround time, and potential to improve patient outcomes. Owing to these advantages, it can be applied for diagnosis in low-resource or remote areas. Growing incidence of infectious diseases has considerably driven the demand for effective diagnosis. Increasing demand for diagnostic tools to control and eliminate infectious diseases, timely detection of causative agent, allowing effective treatment and disease control will fuel the market during the forecast period. Additionally, modern techniques are enabling a remarkable makeover in the field of molecular diagnostics. The global point-of-care molecular diagnostics market size is expected to reach US$ 5,381.18 million in 2028 from US$ 2,230.94 million in 2021. The market is estimated to grow with a CAGR of 13.4% from 2021-2028.

Growth Drivers and Challenges:

Rising Incidences of Infectious Diseases

The rising spread of infectious diseases increases the level and rate of testing. Moving molecular diagnostic testing for infectious diseases from laboratories to the point-of-care settings has the potential to revolutionize the rate and amount of testing to be performed. Molecular diagnostics is a more sensitive product and services that allows the detection of smaller concentrations of infectious pathogens, allowing diseases detection earlier than previously allowed. Point-of-care molecular diagnostics offers the potential to minimize the time required to get an actionable result and promote early infection detection, appropriate infection control measures, and enrollment into therapy clinical trials. The rising prevalence of influenza A/B, respiratory syncytial virus (RSV), and hospital-acquired infections (HAIs) boosts the demand for point-of-care molecular testing. Influenza and respiratory syncytial virus (RSV) point-of-care testing can improve patient treatment and infection control. Recently, point-of-care molecular diagnostics played a crucial role in detecting the COVID-19 infection. For COVID-19 infection detection, RT-PCR-based diagnostic tests are time-consuming, expensive, and require advanced equipment and specialized personnel. The high cost of diagnosis and the scarcity of test kits made it difficult to monitor the community transmission. As a result, rapid, affordable, and effective approaches for detecting COVID-19 viral infection in people were needed urgently. The easy and effective point-of-care molecular diagnostic devices allow on-site testing, which aids in the prevention of infection and control of its spread. Therefore, the rising demand for rapid and effective point-of-care molecular kits to detect infectious diseases drives the market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPoint-of-Care Molecular Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Restraints

Pricing Pressures owing to Reimbursement Cuts

The healthcare diagnostic market is currently suffering from a lack of reimbursements for different methods, which are crucial to patient diagnosis. The absence of reimbursements negatively impacts the market, with large marketplaces in major economies experiencing flat growth. Point-of-care molecular diagnostic tests face similar under-reimbursements issues across various countries worldwide. The reimbursement system is usually hostile to diagnostic tests. As the diagnostic tests are under-reimbursed, the prices of the tests are set too low, which eventually decreases the industry’s profitability and market size. Moreover, inefficient reimbursement structures constitute a barrier to the development of better diagnostic tests. Furthermore, reimbursement cuts may have a negative impact on clinical practice, as it is confronted with both a reluctance to employ diagnostics and a lack of improved tests in the future. Additionally, countries have their own reimbursement structures and policies when it comes to specific treatments. For instance, authorities in the US and Germany compensate hospitals for the total cost of treating a disease. Therefore, the hospitals bear the expense if the patient stays in the hospital longer than expected. This scenario can hinder the use of diagnostic tools if hospitals and healthcare centers believe that additional testing would result in a loss of profit or a financial loss per patient. Therefore, original equipment manufacturers (OEMs) of point-of-care molecular diagnostic devices face numerous bureaucratic and pricing challenges due to rigid reimbursement structures. Thus, reimbursement issues are creating pricing pressures on the manufacturers of point-of-care molecular diagnostic devices, which acts as a major restraint for the overall growth of the point-of-care molecular diagnostics market.

Report Segmentation and Scope:

The “Global Point-of-Care Molecular Diagnostics” is segmented based on product & services, technology, application, end user, and geography. Based on product and services, the global point of care molecular diagnostics market is segmented into assays and kits, instruments, and services and software. Point-of-care molecular diagnostics market based on the technology is segmented into PCR, isothermal nucleic acid amplification technology (INAAT), and other technologies. Point-of-care molecular diagnostics market based on the application is segmented into infectious diseases, oncology, haematology, prenatal testing, endocrinology, and other applications. Point-of-care molecular diagnostics market based on the end user is segmented into hospitals and clinics, diagnostic laboratories, research and academic institutes, and others.

The point of care molecular diagnostics in health markets commercial based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on technology, the molecular diagnostics point of care market is segmented into PCR, isothermal nucleic acid amplification technology (INAAT), and other technologies. In 2021, the PCR segment is likely to hold the largest share of the market, however the INAAT segment is expected to grow at the fastest rate during the forecast period. Isothermal amplification of nucleic acid rapidly and efficiently accumulates nucleic acid sequences at a constant temperature. The amplification techniques are developed as an alternative to PCR and are used for biosensing targets, such as DNA, RNA, small molecules, proteins, cells, and ions. Amplicons, produced by the isothermal amplification methods, are utilized to construct versatile nucleic acid nanomaterials having various applications in biomedicine, bioimaging, and biosensing. The complex biochemical nature of clinical samples, low abundance of nucleic acid targets presents in clinical samples, and existing biosensor technology indicate that some form of nucleic acid amplification will be required to obtain clinically relevant sensitivities from the small samples used in point-of-care testing.

Based on product and services, the point of care molecular diagnostics market is segmented into assays and kits, instruments, and services and software. In 2021, the assays and kits segment is likely to hold the largest share of the market and is expected to grow at the fastest rate during the forecast period. Point-of-care molecular diagnostic assays and kits are specifically designed for physician offices, hospital critical care units, outpatient clinics, and community health posts. The assays and kits help in the early diagnosis of respiratory tract infections and women’s health and sexual health conditions. The assay kits are mostly used in life science research, environmental monitoring, and drug discovery and development. They are also used in various applications such as studying disease pathways, screening for potential drug candidates, and evaluating biopharmaceutical production processes. The POC ELISA (enzyme-linked immunosorbent assay) kits are widely used for detecting and quantifying proteins and antigens from samples. Target-specific ELISA kits are used to streamline immunodetection experiments.

Point-of-care molecular diagnostics market based on the application is segmented into infectious diseases, oncology, haematology, prenatal testing, endocrinology, and other applications. In 2021, the infectious diseases segment is likely to hold the largest share of the market however, oncology is expected to grow at the fastest rate during the coming years. Around 50 million people worldwide have epilepsy, making it one of the most common neurological diseases globally. The age-adjusted incidence of epilepsy in North America ranges between 16 out of 100,000 and 51 out of 100,000 person-years. The age-adjusted prevalence ranges from 2.2 of 1000 to 41 of 1000, depending on the reporting country. Partial epilepsy may constitute up to two-thirds of incident epilepsies. Incidence increases in lower socioeconomic populations. About 25% to 30% of new-onset seizures are thought to be provoked or secondary to another cause. Epilepsy incidence is highest in younger and older age groups and increases steadily after 50 years of age. The most common cause of seizures and epilepsy in older people is cerebrovascular disease.

Benzodiazepines such as diazepam, midazolam, or lorazepam are acceptable as the first-line medications for continuing seizure. The best second-line medication is unclear even after completing a highly anticipated randomized trial of benzodiazepine refractory status epilepticus- the established status epilepticus treatment trial (ESETT). Second-line medications include fosphenytoin, valproate, levetiracetam, and others.

Point of Care Molecular Diagnostics Market Analysis, Regional Analysis:

Based on geography, the global point-of-care molecular diagnostics market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In North America, the U.S. is the largest market for point-of-care molecular diagnostics market. The demand for point-of-care molecular diagnostic devices in the US market is being driven by the introduction of wearable medical devices, lab-on-a-chip technologies, and increased smartphone usage. Over the next few years, the industry will be transformed by the increasing availability of quick tests for identifying infectious diseases such as HIV, tuberculosis, and malaria, allowing clinicians and patients to visualize the results on a smartphone and make appropriate therapeutic decisions. The latest diagnostics industry advancements are driving the US point-of-care molecular diagnostics market, aiming to give an expedited diagnosis for quick clinical decision-making to assist treatment regimens.

Furthermore, the US was one of the worst-hit nations by the COVID-19 pandemic. Rapid testing and detection of the virus was needed for timely treatment. Point-of-care (POC) detection technologies that enable decentralized, quick, sensitive, and low-cost COVID-19 infection diagnostics are urgently required worldwide, including in the US. Thus, the COVID-19 pandemic opened lucrative growth opportunities for the US point-of-care molecular diagnostics market. Moreover, the rapidly increasing incidence of chronic diseases in the country is primarily driving the market. For instance, according to the American Cancer Society, an estimated 1.8 million new cancer cases were diagnosed in the US in 2020. Breast cancer, lung and bronchus cancer, prostate cancer, colon and rectum cancer, melanoma, and liver cancer are frequent cancers.

Furthermore, according to research published by the Centers for Disease Control and Prevention in 2020, roughly 34.2 million Americans had diabetes. As per the same study, American youth has a greater incidence of diabetes. The prevalence of such diseases would drive demand for point-of-care molecular diagnostics in the country. Furthermore, there has been a notable increase in innovative and enhanced medical technologies in recent years. As a result of this expansion, sophisticated medical equipment was developed, and discoveries and breakthroughs in the healthcare business were stimulated. Furthermore, the US is home to several companies working on cutting-edge point-of-care molecular diagnostics. This factor is further expected to drive the US point-of-care molecular diagnostics market.

The introduction of real-time PCR (qPCR) extended the scope of molecular diagnostics in the medical field. In recent years, breakthrough tests in the US market have resulted from molecular diagnostic tests performed in a POC context or near patients. Molecular testing can improve the specificity and sensitivity of conventional near-patient and quick diagnostic tests, boosting the POC molecular diagnostic market in the US to new heights. The growing use of this diagnostic testing in laboratory settings is expected to increase its demand. The increased demand for early and precise diagnosis of a specific condition to provide appropriate treatment will lead to new technologies, thereby driving the US POC molecular diagnostics market.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global point-of-care molecular diagnostics market are listed below:

- In February 2021, Roche announces the filing for FDA Emergency Use Authorization for SARS-CoV-2 Rapid Antigen Test, allowing healthcare professionals to make fast decisions at the point-of-care.

- In March 2021, bioMérieux, announced BioFire Diagnostics, its subsidiary specialized in molecular syndromic infectious disease testing, has received U.S. Food and Drug Administration (FDA) De Novo authorization for the BIOFIRE® RP2.1 Panel.

- In November 2020, Enzo Biochem announced results of an analysis showing that tests processed on the Company’s proprietary GENFLEX™ molecular diagnostic platform are successfully able to detect the presence of currently known variants of COVID-19. While the Company’s PCR testing does not distinguish between different variants, positive samples can be further analyzed for variant identification. Rapid antigen tests currently available in the marketplace do not have this capability.

- In May 2021, Biocartis Group NV announced to have signed a new agreement with AstraZeneca, a global science-led biopharmaceutical company (LSE/STO/Nasdaq: AZN), aimed at providing access to rapid and easy-to-use Idylla™ EGFR testing products at selected hospital sites in Biocartis’ European and global distributor markets to support the identification of patients with EGFR mutations.

Point of Care Molecular Diagnostics

Point-of-Care Molecular Diagnostics Market Regional InsightsThe regional trends influencing the Point-of-Care Molecular Diagnostics Market have been analyzed across key geographies.

Point-of-Care Molecular Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.23 Billion |

| Market Size by 2028 | US$ 5.38 Billion |

| Global CAGR (2021 - 2028) | 13.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product & Services

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Point-of-Care Molecular Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Point-of-Care Molecular Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Covid-19 Impact:

The US has the highest number of COVID-19 cases of all countries in North America. This has negatively impacted various industries, and supply and distribution chains in the region. During the pandemic, life science companies shifted their focus in the development of novel drugs for the treatment of life-threatening diseases. In addition, the demand for rapid testing equipment has also increased, which is playing a prominent role in the growth of the North America point-of-care molecular diagnostics market. Moreover, continuous spread of COVID-19 is bolstering the demand for point-of-care molecular diagnostic kits. The adoption of these kits is boosting new product developments and launches. In March 2021, Eurofins' Clinical Enterprise, Inc. obtained an Emergency Use Authorization (EUA) from the US Food and Drug Administration (FDA) for a direct-to-consumer (DTC) version of its EmpowerDX COVID-19 Home Collection Kit. Similarly, in July 2020, Clinical Diagnostics of Eurofins USA announced the availability of its pooled PCR test to detect SARS-CoV-2, which would substantially lower the cost per PCR test for clients.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global point-of-care molecular diagnostics market include bioMérieux SA, F. Hoffmann-La Roche Ltd., Danaher Corporation, Enzo Biochem, Inc., Abbott, binx health, Inc., Meridian BioScience, Inc., Biocartis, Quidel Corporation, Bio-Rad Laboratories, Inc. among others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For