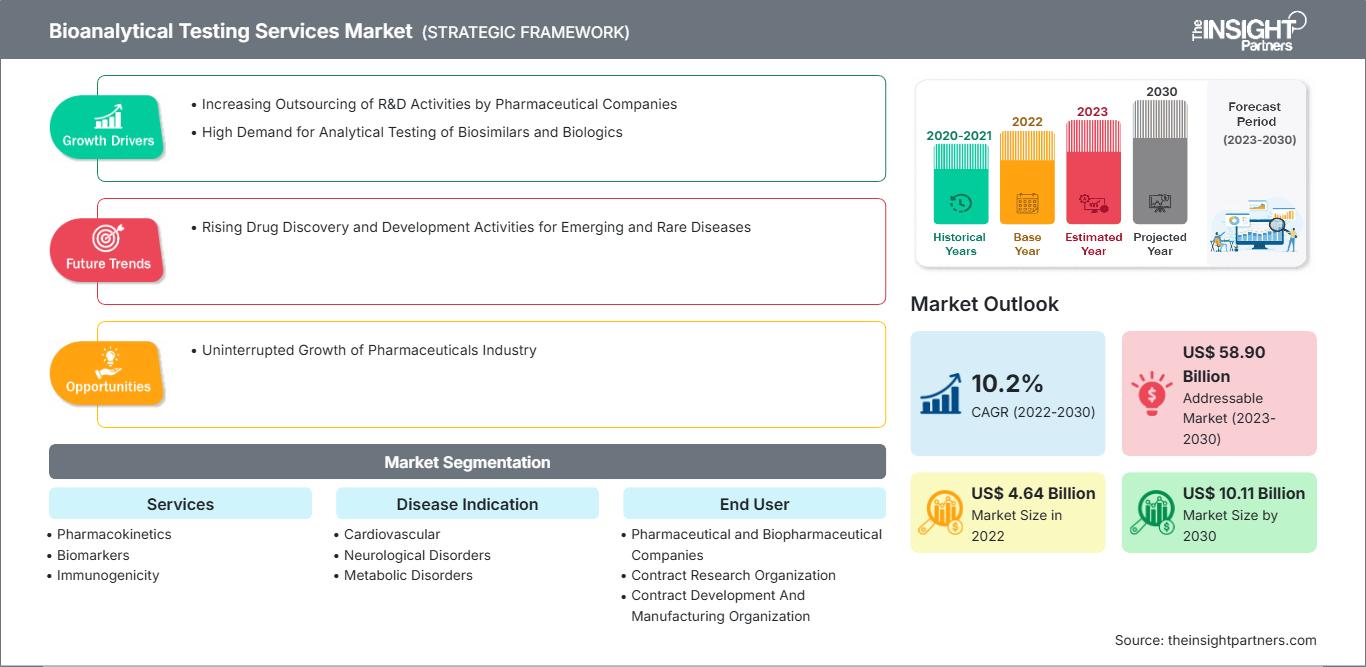

Bioanalytical Testing Services Market Segments and Growth by 2030

Bioanalytical Testing Services Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Services (Pharmacokinetics, Biomarkers, Immunogenicity, Virology Testing, Cell-based assays, and Others); Disease Indication (Cardiovascular, Neurological Disorders, Metabolic Disorders, Autoimmune Disorders, Respiratory Diseases, Oncology, Sexual Health, Bone Disease, and Others); End User [Pharmaceutical and Biopharmaceutical Companies, Contract Research Organization (CRO), Contract Development And Manufacturing Organization (CDMO), and Others], and Geography  (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPRE00007336

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 202

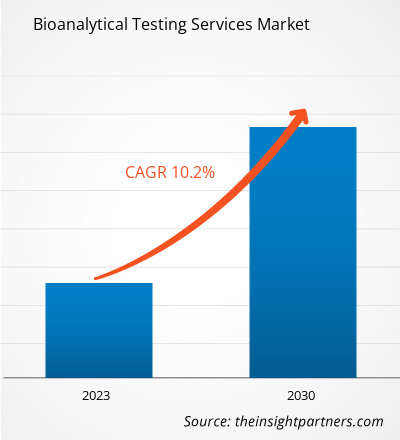

[Research Report] The bioanalytical testing services market is expected to grow from US$ 4,641.13 million in 2022 to US$ 10,108.82 million by 2030; it is anticipated to record a CAGR of 10.2% from 2022 to 2030.

Market Insights and Analyst View:

Bioanalytical testing refers to the quantitative assessment of the concentration of drugs and their metabolites or biomarkers in biological fluids such as blood, plasma, serum, urine, and saliva, or tissue extracts. These testing services are provided by various contract research organizations (CROs) and are used by various pharmaceutical companies in the drug development process. The increasing outsourcing of R&D activities by pharmaceutical companies, and the high demand for analytical testing of biosimilars and biologics boost the bioanalytical testing services market size.

Growth Drivers:

Pharmaceutical companies outsource research & development activities that are not core to their internal structure. Outsourcing miscellaneous activities allows them to efficiently focus on their internal core competencies for making the drug development process better and more cost-effective. Moreover, outsourcing manufacturing activities, along with R&D, benefits them by lowering the turnaround period, adding to their expertise, and eliminating the need for large capital investments. According to the Survey of Biopharmaceutical Manufacturing Capacity and Production by BioPlan Associates, analytical testing/bioassay was the most outsourced service in 2022, followed by toxicity testing, validation services, product characterization, and others. While developing nations are the largest contributors to the demand for bioanalytical testing services through contract manufacturing, the US remains a potential outsourcing destination. 39.6% of non-US respondents in the survey preferred outsourcing these tests to US-based facilities. Among developing nations, China and India account for a large share of biotechnology and biopharmaceutical companies preferring US-based facilities for outsourcing bioanalytical testing. Germany, the UK, Singapore, and Japan were reported to be important outsourcing destinations. Thus, the practice of outsourcing is gaining popularity worldwide, especially in developing countries, thereby favoring the growth of the bioanalytical testing services market.

Pharmaceutical businesses are widely implementing the quality-by-design (QbD) concept. This is further propelling the adoption of outsourcing services by pharmaceutical companies to increase the robustness of their production processes. This also ensures optimal product quality and manufacturing productivity. QbD is supported by regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The concept has gained traction in the pharmaceutical industry over the years with the publication of ICH Q9 (Quality Risk Management), ICH Q8 (R2, Pharmaceutical Development), and ICH Q10 (Pharmaceutical Quality System). According to the ICH Q10 guidelines, analytical methods are essential to the pharmaceutical quality system. Analytical QbD (AQbD) implementation in manufacturing ensures product quality and performance.

Outsourcing bioanalytical testing services helps pharmaceutical businesses reduce business risks by avoiding major investments in analytical equipment and skilled professionals, especially while the product is in the early phase of development. In the past few decades, the emergence of CROs has significantly contributed to the growth of the bioanalytical testing services market. Globally, more than 1,000 CROs support pharmaceutical companies by providing various bioanalytical testing platforms. CROs are highly specialized infrastructures for carrying out different drug discovery processes, due to which pharmaceutical companies prefer outsourcing their R&D operations to them.

Due to the availability of specialized analytical testing service providers with crucial competencies to quickly provide excellent results, pharmaceutical companies are increasingly considering outsourcing bioanalytical testing services to third-party service providers, which fuels the bioanalytical testing services market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBioanalytical Testing Services Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Bioanalytical Testing Services Market” is segmented on the basis of the services, disease indication, and end user. Based on service, the market is segregated into pharmacokinetics, biomarkers, immunogenicity, virology testing, cell-based assays, and others. In terms of disease indication, the bioanalytical testing services market is segmented into cardiovascular, neurological disorders, metabolic disorders, autoimmune disorders, respiratory diseases, oncology, sexual health, bone disease, and others. Based on end user, the market is segmented into pharmaceutical and biopharmaceutical companies, contract research organizations (CRO), contract development and manufacturing organizations (CDMO), and others. The bioanalytical testing services market, based on geography, is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

The bioanalytical testing services market, by service, is segmented into pharmacokinetics, biomarkers, immunogenicity, virology testing, cell-based assays, and others. The cell-based assays segment held the largest market share in 2022. It is further anticipated to register the highest CAGR during the forecast period. All tests performed on living cells are considered cell-based tests. Cell-based assays measure the quantitative effects of therapeutic drugs, DNA, RNA, protein, small molecules, and nanoparticles. The assays are based on disease states, proliferation, cytotoxicity, signaling pathways, and gene expression. In the regulatory environment, cell-based assays are commonly used to determine the biological activity (potency) of the drug product or drug substance, and discover the mechanism of action (MOA). On the other hand, in immunogenicity studies, these assays help determine the drug-neutralization effect of antibodies produced in the patient body.

Based on disease indication, the bioanalytical testing services market is segmented into cardiovascular, neurological disorders, metabolic disorders, autoimmune disorders, respiratory diseases, oncology, sexual health, bone disease, and others. The oncology segment held the largest market share in 2022. Further, it is anticipated to register the highest CAGR during the forecast period. Over the past decade, advances in oncology for pain relief, chemotherapy, and other therapies have dramatically changed how cancer is diagnosed and treated. Carboplatin and cisplatin are chemotherapy drugs used to treat various types of cancer. These compounds contain platinum, which can be analyzed by inductively coupled plasma mass spectrometry (ICP-MS). This instrument analyzes natural elements such as iron, sodium, platinum, lithium, and potassium. The diluted sample extracts are introduced into an argon plasma torch for nebulization. Then the ions are passed through a lens set to the quadrupole filter of the mass spectrometry detector. These methods are validated according to the latest regulatory guidelines for examining bioanalytical methods.

Based on end user, the bioanalytical testing services market is segmented into pharmaceutical and biopharmaceutical companies, contract research organizations (CRO), contract development and manufacturing organizations (CDMO), and others. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2022. It is further anticipated to register the highest CAGR during the forecast period. Pharmaceutical industries use bioanalytical testing services for sample analysis, toxicokinetics (TK), biomarker assays, and dosage analysis. These companies adopt these services to align their drug manufacturing procedures with good laboratory practices (GLP) and good clinical practices (GCP) guidelines. The bioanalytical test services aim to eliminate the risks involved in pharmaceutical production from the beginning to the final product release. Thus, the cruciality of bioanalytical testing services in drug discovery and development drives the bioanalytical testing services market for the pharmaceutical and biopharmaceutical companies segment.

Regional Analysis:

Based on geography, the global bioanalytical testing services market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America contributed the largest share of the global bioanalytical testing services market size. Asia Pacific is estimated to register the highest CAGR during the forecast period.

The US holds a significant share of the bioanalytical testing services market in North America. The bioanalytical testing services market growth in this country is mainly ascribed to the rising government spending on healthcare and a surging demand for novel drugs to treat infectious diseases more efficiently. According to the US Centers for Medicare & Medicaid Services, the national healthcare expenditure in the country increased by 2.7% in 2021, reaching US$ 4.3 trillion or US$ 12,914 per person. Health spending accounted for 18.3% of the nation's GDP. As per the US Department of Health & Human Services, national health spending is expected to grow at an annual rate of 5.4% from 2019–2028, reaching US$ 6.2 trillion by 2028. The rising health expenditure may increase funds allocation to the research and development of drugs, thus fueling the demand for bioanalytical testing services.

According to new findings derived from the Global Burden of Disease study published in July 2020, there is a large and increasing burden of noncommunicable neurological disorders in the US. As per Johns Hopkins University, the cases of diseases such as HIV infections, SARS, Lyme disease, dengue fever, West Nile virus, and Zika virus infection have increased rapidly in the last two decades in the US. Also, the same source affirmed an upsurge in the incidence of re-emerging diseases such as malaria, tuberculosis, cholera, pertussis, influenza, pneumococcal disease, and gonorrhea. Thus, a rise in the incidences of various infections and re-emerging diseases boosts companies’ efforts in drug development, thereby fueling the bioanalytical testing service market growth in the US.

The US government strives to create a conducive environment for the development and commercialization of pharmaceutical and healthcare products in the country. The country has various potential pharmaceutical and medical device market players, including Pfizer, Novartis, Boston Scientific, Integra LifeSciences, Amgen, and Abbott, which hold various patents for their innovations in the pharmaceutical and medical device industry. Drug discovery and development procedures have to comply with good laboratory practices (GLP) and good clinical practices (GCP), which require additional resources during the manufacturing and trial stages. As a result, companies prefer outsourcing these operations. Thus, an increase in drug development activities by various pharmaceutical giants bolsters the bioanalytical testing services market in the US.

Bioanalytical Testing Services Market Regional InsightsThe regional trends and factors influencing the Bioanalytical Testing Services Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Bioanalytical Testing Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Bioanalytical Testing Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.64 Billion |

| Market Size by 2030 | US$ 10.11 Billion |

| Global CAGR (2022 - 2030) | 10.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Services

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Bioanalytical Testing Services Market Players Density: Understanding Its Impact on Business Dynamics

The Bioanalytical Testing Services Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Bioanalytical Testing Services Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global bioanalytical testing services market are listed below:

- In May 2023, Labcorp announced its plans for enhancing its central laboratory presence and drug development capabilities in Japan through the expansion of CB Trial Laboratory, the central laboratory comanaged by Labcorp Drug Development and BML, a leading Japanese provider of clinical laboratory testing services.

- In September 2022, KCAS Bioanalytical and Biomarker Services (KCAS) finalized the purchase of Active Biomarkers, located in Lyon, France. Active Biomarkers is a renowned assay development and specialty bioanalytical laboratory with expertise in oncology, infectious disease, inflammation, and neurodegenerative disorders. This acquisition adds to the world-class bioanalytical expertise of KCAS, along with expanding the reach of its large molecule and cell/gene therapy bioassay services in Europe.

- In July 2022, Eurofins Scientific announced the completion of the acquisition of WESSLING Hungary. WESSLING Hungary is one of the leading environmental, food and BioPharma product testing laboratories in Hungary. WESSLING generated ~€15 million in revenue in 2021 with ~300 employees in their staff. The acquisition of WESSLING Hungary further expands Eurofins’ presence in Central and Eastern Europe, and extends its position in BioPharma Product Testing.

- In July 2022, SGS announced the acquisition of Proderm. Proderm is the leading provider of advanced clinical testing solutions for cosmetics, personal care, and medical products in Germany. Proderm serves clients in the global consumer care and pharmaceutical industries, as a CRO conducting clinical studies from initial consultation to final report.

- In May 2021, Labcorp expanded its drug development offering in Asia Pacific with the addition of bioanalytical services to its line-up available for its customers in Singapore.

- In March 2023, Pharmaron Beijing Co., Limited announced that its Gene Therapy CDMO based in Liverpool, UK, received a prestigious grant from the Life Sciences Innovation Manufacturing Fund (LSMIF) of the UK Government to expand its viral vector and DNA manufacturing facilities.

- In September 2022, KCAS Bioanalytical and Biomarker Services (KCAS) finalized the purchase of Active Biomarkers, located in Lyon, France. Active Biomarkers is a renowned assay development and specialty bioanalytical laboratory with expertise in oncology, infectious disease, inflammation, and neurodegenerative disorders. This acquisition adds to the world-class bioanalytical expertise of KCAS, along with expanding the reach of its large molecule and cell/gene therapy bioassay services in Europe.

Competitive Landscape and Key Companies:

SGS SA, Pharmaron Beijing Co Ltd, Element Materials Technology Group Ltd, CD BioSciences Inc, Charles River Laboratories International Inc, Eurofins Scientific SE, Labcorp Drug Development Inc, Syneos Health Inc, KCAS Bioanalytical and Biomarker Services LLC, ICON Plc, and Intertek Group Plc are the prominent bioanalytical testing services market companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For